Today, crypto lists like CoinMarketCap and CoinGecko show the blockchain, dapp, stablecoin, and token markets as a single list with no differentiation. This leads many to treat all blockchains and ancillary projects as analogous and the same.

However, the truth is that the crypto stack has very different kinds of projects, and all fit in different niches in blockchain industry.

One of the main distinctions among blockchains specifically is the proof-of-work (PoW) vs proof-of-stake (PoS) dichotomy.

For several reasons, the future of the blockchain industry will be layered, and one of the tradeoffs made in this layered organization will be security vs performance.

In this scenario, different projects in the industry have made distinct design choices to compete in the various niches.

The Ethereum 2.0 and Ethereum Classic Choices

In the case of Ethereum 2.0 (ETH 2.0), which is the next version of the Ethereum blockchain, that ecosystem has decided to pursue a high performance strategy to scale in transactions per second. In doing so, it has a roadmap that will take it to have a PoS consensus mechanism, fragmentation of the database through sharding, it will continue to have no defined monetary policy, and will continue to power smart contracts, which was the project’s major contribution to the industry.

On the other hand Ethereum Classic (ETC), made the conscious choice of following a high security strategy, which is less scalable in terms of transactions per second, but which provides higher guarantees in terms of immutability and monetary soundness.

Ethereum Classic as a Base Layer System

Although the Ethereum community does not admit it yet, the system’s design choices makes it less secure. This means that, to really power high volumes of transactions for valuable dapps and systems globally and permissionlessly, it will inexorably seek sources of security to anchor its tech ecosystem and currency value.

These anchors will be Bitcoin and Ethereum Classic, and possibly a few other proof-of-work system.

The reason ETH 2.0 (and other systems such as Cardano, Polkadot, Dfinity, Tezos, Cosmos, etc.) will seek security from base layer systems is that its own components are layered.

Ethereum 2.0 will have a top layer with channels or rollups, an intermediate layer with dapp specific satellite networks or shards, and a central relay and monetary blockchain called the beacon chain.

The problem is that, as a PoS chain, the beacon chain will not provide the security guarantees, that PoW based Nakamoto consensus chains provide.

This means that the ETH 2.0’s shards, the beacon chain, or even specific independent dapps will seek security services (anchoring and monetary) from base layer system.

Why Is ETH 2.0’s Success ETC’s Success?

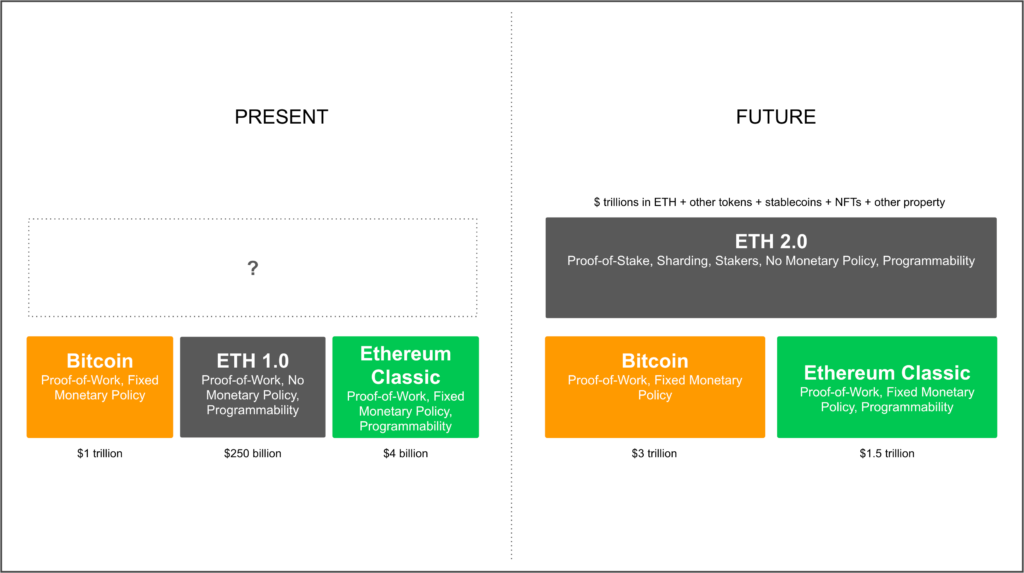

Ethereum 1.0 (ETH 1.0) is currently the second largest blockchain in the world with a value of approximately $250 billion. But, it has not yet migrated to ETH 2.0. This means it is still a PoW blockchain, identical to ETC.

Ironically, this state of affairs has kept both blockchains extremely undervalued.

With its advanced smart contracts functionality, ETH 1.0 should, indeed, be worth the same or more than Bitcoin if it were fully scalable and had lower fees per transaction, and ETC should be worth multiple times its current market capitalization.

As ETC is deemed to replace ETH 1.0’s position in the market, and operate as a base layer system together with Bitcoin, Ethereum’s successful migration to ETH 2.0 is critical to ETC’s success.

In other words, if Ethereum 2.0 is successful, then Ethereum Classic will accomplish all of its potential.

The risk is that, however unlikely, ETH 1.0 remains operational in some reduced but significant form and undercuts ETC’s potential. However, that would be seen as a failure, and is not the goal, of the Ethereum Foundation and the Ethereum ecosystem at large.

The Future Landscape of the Blockchain Industry

If the underlying drivers that this author envisions for the industry work as expected, it is very probable that Bitcoin will be worth at least $3 trillion.

In the case of Ethereum 2.0, as its ecosystem evolves and competes with high performance payments and fiat financial systems, and its rich functionality enables dapps, tokens, NFTs, stablecoins, and other forms of applications and property, all of its parts, including ether, will likely command a combined valuation of several trillions of dollars.

As ETC will provide complementary services to PoS systems and is programmable, it is likely that it will have a prominent position with Bitcoin at the base layer, and its’ value will hover around 50% of that system, at around $1.5 trillion.

Code Is Law