As the processes of technology and price discovery develop in the blockchain industry, users, investors, and developers ask: What is the function of blockchain X?; what is the value of token Y?; and who is going to adopt project Z and for what?

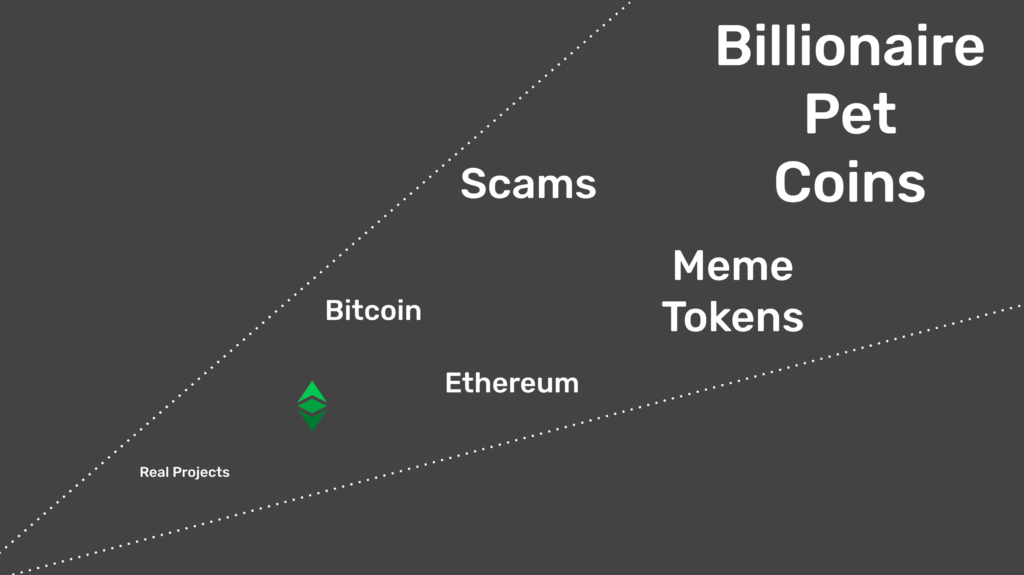

The problem is that; in a market with more than 9000 crypto tokens, where we have the core blockchains, such as Bitcoin and Ethereum, and several valuable real projects, but also many scams, worthless meme tokens, and billionaire sponsored pet coins; it is very difficult, both for the supply and demand, to overcome the noise and communicate useful information or find true value and potential.

This problem is not alien to Ethereum Classic (ETC). This is why it is very important for the various players in the ETC ecosystem to find a way to convey a compelling and concise story as to the network’s past, present, and future.

As to the general story, we can provide information about the past and present status, metrics, events, and projects, or do and communicate forward looking projections and hypotheses.

The asset management firm, Grayscale, produced the “Drop Gold” thesis and communications campaign for Bitcoin. That was very good because it implicitly gave the market a forward looking path for BTC: “It will be as valuable as gold and be used as digital gold”.

Granted, Bitcoin is an easier story to tell because it is simple and straightforward, whereas generalized programmable blockchains mean a much more complex set of options and alternatives for the world.

However, when thinking about projects like ETH 2.0, Cardano, Polkadot, Dfinity, EOS, Tezos, TRON, BNB, and others, it is clear (at least for me) that they are all after the same market segment, role, or function. If I had to define it, I would say they are all looking to be the preeminent cloud computing and money platforms of the future, but global and decentralized.

I am sure when trying to identify the total addressable market (TAM), serviceable addressable market (SAM) and share of market (SOM) of that business model it becomes a simpler task as we could research the global cloud computing industry and the global fiat money stock and then derive from there what position (thus value) each chain or project may achieve in the future based on their specialty or positioning.

I think ETC may be more difficult to define and quantify because it is not Bitcoin and it is not even competitive by performance (e.g. transactions per second) with the smart contracts proof of stake group of projects mentioned above.

However, Ethereum Classic is similar to Bitcoin in some ways and similar to the smart contracts platforms in others.

We may define ETC as a low performance cloud computing system, but with high security and its monetary supply may resemble more to gold or digital gold than the global decentralized cloud computing group.

Fortunately, the banking, financial markets, settlements, payments, and even cloud computing industries are layered. These layers are also graded by security and performance, e.g. Visa works on top of the banking industry, which works on top of the central banking system, which delegates some functions to large value settlement operators.

To look for analogies, and get some quantitative data for a market analysis and perhaps project what level of usage ETC may have in the future, one could examine, for example, the banking settlements industry (DTCC, Fedwire, etc.) in different regions and continents.

In terms of cloud computing, my imagination takes me to ETC functioning as a base layer of other blockchains and dapps.

For example, all the complex smart contracts platforms mentioned above are, themselves, internally layered. They usually have a layer of channels or rollups, then sidechains or shards, and then a central chain that unifies all the satellite networks of the system.

Examples of this are the ETH 2.0 shards and the beacon chain, the Cosmos Hub and the interconnected blockchains, and the Polkadot parachains with the relay chain.

I think all the central chains in all these systems (Ethereum beacon chain, Cosmos hub, and Polkadot relay chain) will not prove secure enough as they are proof of stake (regular byzantine fault tolerance, not 51% as Nakamoto consensus) and managed by naive “democratic” governance systems where groups of identifiable entities, people, and experts basically decide everything in each system, many times based on their token ownership.

It is only a matter of time until reality and political pressure dissolve this security model as it is essentially identical to traditional governments and fiat monetary systems.

Additionally, individual dapps in each of these systems may perfectly bypass their centrally managed security provider chains and anchor to the security of Bitcoin or ETC, which are proof of work based Nakamoto consensus systems.

Because ETC is, indeed, programmable, and because I am sure the whole world will not anchor all the systems to Bitcoin only, I believe Ethereum Classic has the opportunity of being a true provider of security services (both anchoring and settlements) to either the proof of stake chains, their dapps independently, or both.

This means ETC can also serve, together with Bitcoin, as a settlement layer of the banking industry in general and to sufficiently large entities like multinational corporations, governments, and supranational organizations, amongst others.

All of the above means that, if a TAM, SAM, and SOM for Bitcoin and ETH 2.0, Cardano, Polkadot, Dfinity, EOS, Tezos, TRON, BNB, and others may be estimated, then working a little further, from those quantities, a TAM, SAM, and SOM for ETC may also be deduced and projected.

And, from there, its business model, strategy, and future value.

Code Is Law