You can listen to or watch this article here:

When Bitcoin was released it was the result of twenty years of Libertarian and Cypherpunk work to build a form of money that would be sound, transferable over communications channels, private, and trust minimized.

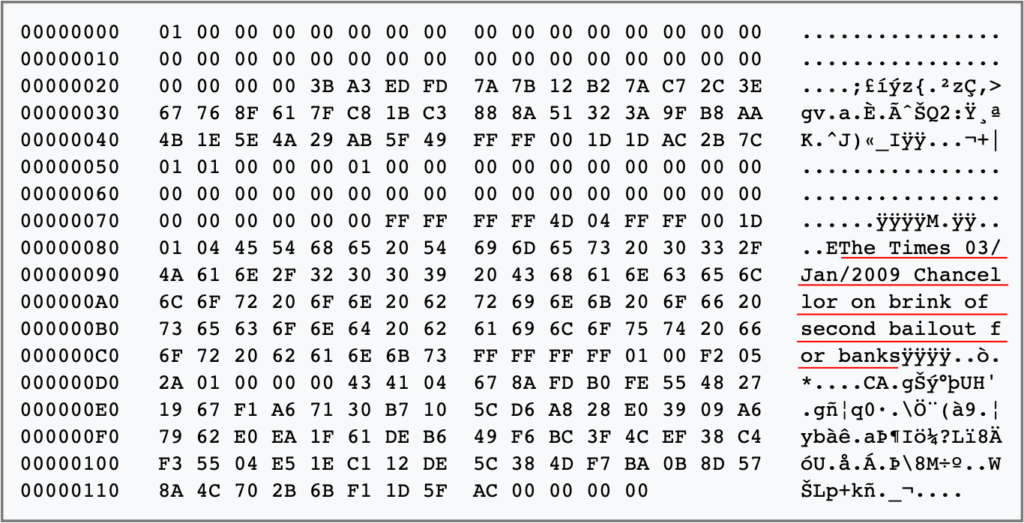

The principle of sound money was evident in Satoshi Nakamoto’s protest message, The Times 03/Jan/2009 Chancellor on brink of second bailout for banks, in the genesis block of the newly launched network, which was the headline of the day on the newspaper The Times.

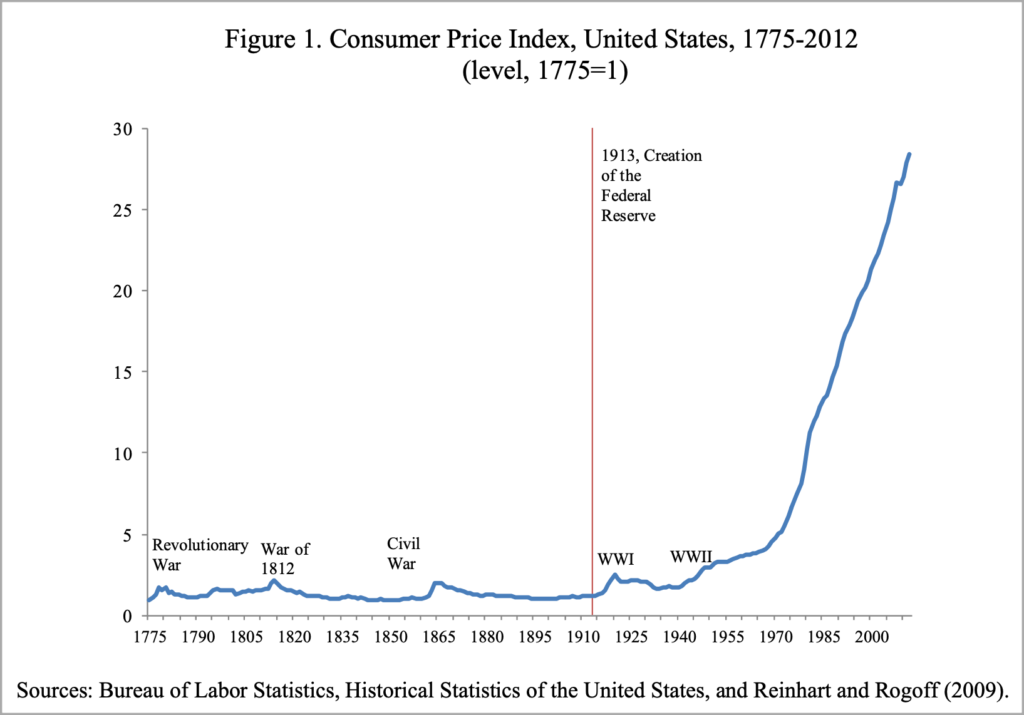

It also responded, as may be seen in the figure below, to a long history of inflationary monetary policy of government issued money since the creation of the Federal Reserve, which, together with the abandonment of the gold standard in 1933, and the creation of pure fiat money in 1971, undermined property rights and significantly diluted the value of money, incomes, and agreements denominated in that currency.

Carmen M. Reinhart and Kenneth S. Rogoff.

The same pattern actually repeats itself across nearly all countries.

The Bitcoin Monetary Policy

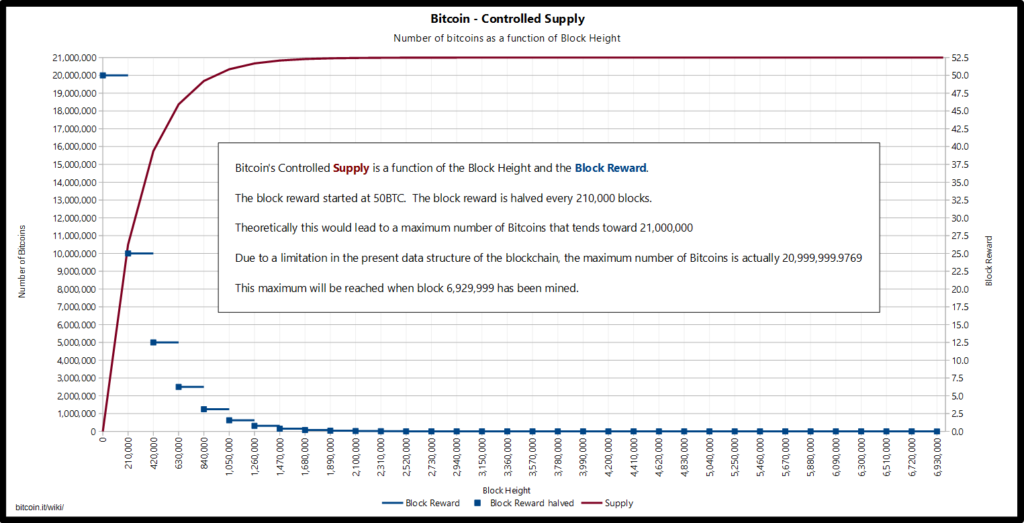

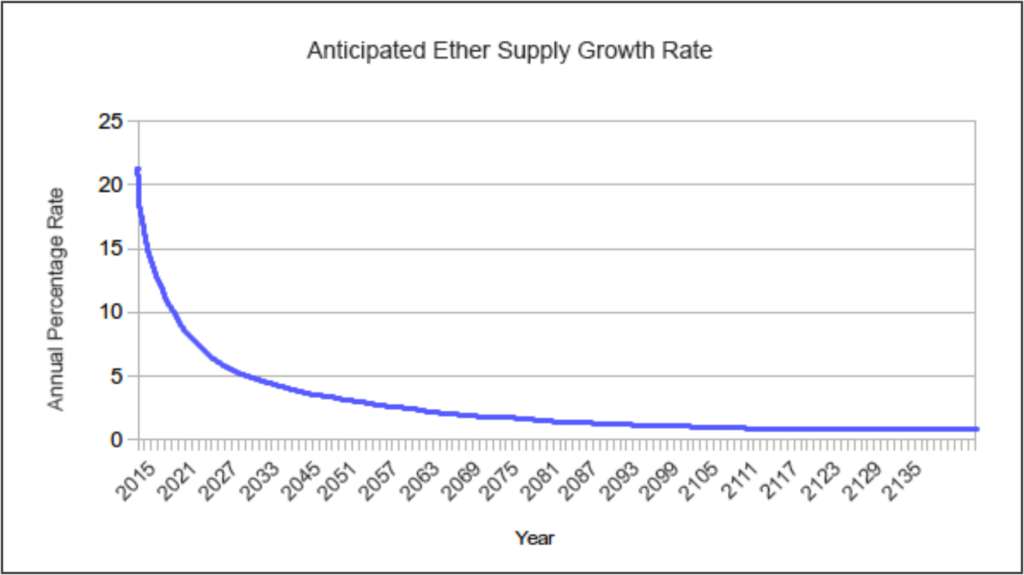

As a result, Satoshi Nakamoto established a very simple, mechanical, algorithmic, and capped monetary policy for $BTC. It consists of tranches of 210,000 blocks, which are produced every 10 minutes, where the miner rewards per block are halved at the beginning of each tranche, starting with 50 bitcoins per block at block 1 right after the genesis block. Then, halving to 25 on block 210,001, to 12.5 on block 420,001, 6.25 on block 630,001, and so on.

The end effects of such policy, which is programmed in the protocol, therefore not dependent on human subjectivity, is that Bitcoin has a sound, mechanical, capped, and trust minimized supply curve that will produce a maximum of 21,000,000 bitcoins by block 6,929,999 which will happen in more or less 120 years from now, with significant decelerating inflation.

The Ethereum Classic Monetary Policy

The current Ethereum Classic (ETC) monetary policy seeks the same goals as Bitcoin of being mechanical, algorithmic, and capped, thus sound and trust minimized. However, ETC’s model is not as simple because the network’s structure includes Bitcoin’s base ledger and cryptocurrency with a proof of work consensus mechanism, but adds smart contract capabilities on top. This means it includes an EVM, a programming language, a gas system, and faster blocks as they are created every 15 seconds, rather than 10 minutes.

Components

As a result of the above the Ethereum Classic monetary policy has more parts to solve as it has a few more quirks in the system.

The ETC issuance schedule may be best explained as 8 components:

1. The Pre-Mine

A difference about ETC is that, in order to launch it, its founders did a pre-sale of around 60 million $ETC (called $ETH at the time) to finance about a year and a half of the development and launch stages between 2014 and 2015. Developers also issued a number of around 12 million ETC as a reward to the founders, other collaborators within the team, and some outsiders.

All in all, the sum of issuance at the genesis block, which occurred on July 30th of 2015, before any mining ever took place, was a total of 72,009,990 ETC. This total is commonly called the pre-mine.

2. Eras

At the beginning of this section I wrote the “current” monetary policy and in the previous point I mentioned that $ETC was originally called “$ETH”. This is because it was a unified network at the time, but on block 1,920,000, which happened on July 20th of 2016, the Ethereum Foundation and the developer team, together with several ecosystem participants, decided to fork away from the legacy blockchain to bailout the investors of an application called theDAO.

Ever since, the legacy chain has been called “Ethereum Classic” and it’s currency “ETC”.

The above clarification is important because the original unified chain had an infinite monetary policy with no cap, however that was changed in a network upgrade on block 5,000,000 by the Ethereum Classic ecosystem on December 11th of 2017.

This established a new and definitive monetary policy with a cap and an “era”system, similar to Bitcoin tranches, every 5 million blocks. At 15 seconds per block, these eras have a duration of more or less 2.38 years.

The eras are described as follows:

Era 1:

The first 5,000,000 blocks were under the original monetary policy, which included block rewards for winning miners of 5 ETC per block, block rewards for uncle blocks of 4.375 ETC, and an incentive for block miners to include up to 2 uncle blocks of 0.15625 ETC.

In this regime, single blocks would get 5 ETC, and, if a limit of 2 uncle blocks were included, then an additional (0.15625 + 4.375) x 2 = 9.0625 ETC would be paid out, for a total of 14.0625 ETC.

This first era ended on December 11th of 2017, with a total ETC issuance of 98,491,770, composed of the 72,009,990 from the pre-mine, 25,000,000 from block rewards, and 1,481,780 from uncle block rewards.

The average annualized inflation in this period was 14.08%.

Era 2:

The second 5,000,000 blocks will end on block 10,000,000 approximately on March 16th of 2020. This second era made an arbitrary change of the block reward from 5 to 4 ETC, and the uncle block incentive and the uncle block miner reward were set at the same level of 0.125 ETC each.

The above means that single mined blocks are earning 4 ETC, and when a limit of 2 uncle blocks are added, that increases rewards by (0.125 + o.125) x 2 = 0.50 ETC, for a total of 4.50 ETC.

When this era ends, including a projected 5.4% average uncle block rate, there will be an estimated stock of 118,559,270 ETC, composed of the 98,491,770 ETC stock at the end of the previous era, plus 20,000,000 ETC in block rewards, plus 67,500 ETC in uncle block rewards.

The average annualized inflation rate in this era is estimated to be around 8.12%.

Era 3 and subsequent eras:

The policy of the rest of the eras starting on era 3 will consist of a discount in all the reward types of 20%. For example, on block 10,000,001, the new block reward will be 3.20 ETC, in the next era starting on block 15,000,001 it will be 2.56 ETC, and so on.

The same discount will be applied to the incentive to include uncle blocks and uncle block rewards themselves, always with a maximum limit of 2 uncles per block.

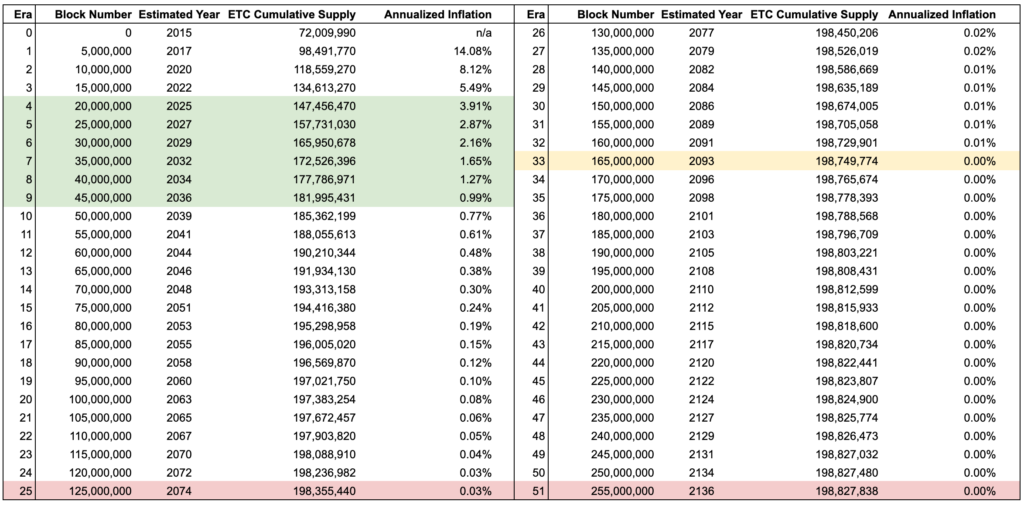

The following table shows the issuance since the ETC genesis block 0, in 2015, and projections of the first 51 eras, spanning 121 years, all the way to block 255,000,000, which will occur in 2136:

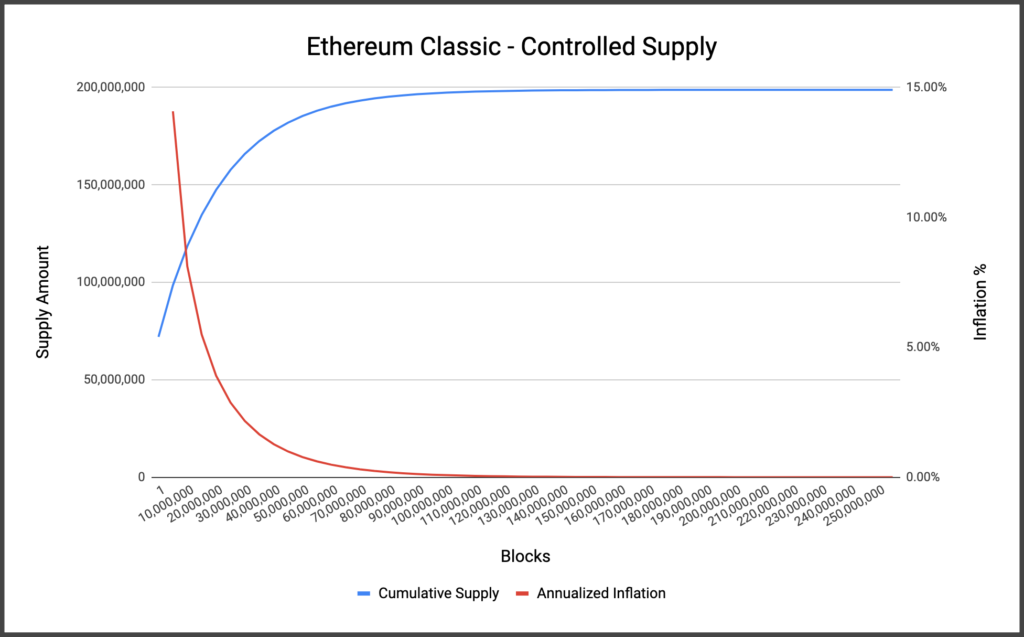

As may be seen in the table, similar to Bitcoin, the annualized inflation rate significantly decelerates from the outset, and between eras 4 and 9, which will occur between the years 2025 and 2036, it falls from around 4% to less than 1%, which is a low implied stock to flow ratio as compared to gold.

From then on, annualized inflation continues to drop until it reaches practically 0% by era 33, which will occur in the year 2093.

It is worth noting that in terms of total stock, by era 25, which occurs in the year 2074, ETC will have reached 198,355,440, which is very close to its cap, estimated to be around 199,000,000.

By era 51 on block 255,000,000, which is estimated to occur in 2136, the stock will be 198,827,838, a small increase in 62 years.

As a “hard cap”, if the extreme and unlikely situation happens where Ethereum Classic miners were to include 2 uncles for all blocks, the maximum supply would be around 211,000,000. This design choice sought to be an analogy of Bitcoin’s 21 million BTC hard cap, but multiplied by 10.

3. Block Rewards

The understanding about block rewards in proof of work (PoW) blockchains is that the miner who discovers a hash that meets the difficulty level set by the protocol gets the reward for that block. However, in Bitcoin, sometimes more than one block is discovered at the same time and is distributed across the network. When that happens, network nodes and miners continue to build on both blocks until one or the other is superseded first and becomes the “longest” or “heaviest” PoW chain. In Bitcoin in particular, the rule when that happens is that the “losing” block becomes “stale” and does not receive any rewards.

In Ethereum Classic, because blocks are created at a higher frequency, the probability of generating more than one valid block at the same time is higher. As this phenomenon may lead to mining pool centralization, because individual miners may become aware faster if their block is stale in a pool than by themselves, the rule in ETC is to actually reward stale blocks. These blocks are called “uncle blocks”.

In the case of the non-stale or regular blocks in ETC, the ones that “win” and actually become part of the main chain, are rewarded in the schedule described in the eras above: That is, 5 ETC in era 1, 4 ETC in era 2, and then rewards are discounted by 20% in each and all subsequent eras starting on era 3.

4. Incentive to add Uncle Blocks

For uncle blocks to be included in the network and actually paid their corresponding reward, the winning block producers have to voluntarily include them when they propagate their blocks. To incentivize propagation of stale blocks they are paid a small fee.

The incentive fee to include uncle blocks in ETC is also determined by the eras described above: The fee was 0.15625 ETC in era 1, 0.125 ETC in era 2, and then they are discounted by 20% in each and all subsequent eras starting on era 3.

5. Maximum Uncle Blocks per Block

To limit issuance, the Ethereum Classic monetary policy not only has a descending fee schedule for uncle blocks, but also limits stale block inclusion in the main chain to up to 2 uncles per winning block.

6. Uncle Block Rewards

As to the specific rewards for uncle blocks, the levels per era were 4.375 ETC in era 1, 0.125 ETC in era 2, and then they are discounted by 20% in each and all subsequent eras starting on era 3.

7. Uncle Block Rate

The uncle block rate is the ratio of uncle blocks in the network at any given time. For example, if in the first 100 blocks of ETC in era 1, there were 6 uncle blocks included and rewarded, that means the uncle block rate was 6%.

The above also means that ETC issuance was higher because not only were regular block miners rewarded 5 x 100 = 500 ETC, but they were rewarded an additional 0.15625 x 6 = 0.9375 ETC for including 6 uncle blocks, and uncle block producers were rewarded 4.375 x 6 = 26.25 ETC. The result was that the total issuance in this example increased from 500 to 527.1875 ETC due to uncle block inclusion.

The actual uncle block rate estimate used in this article is 5.4% which is the projection used by Matthew Mazur, the author of ECIP-1017, which was the specification used to change Ethereum Classic’s monetary policy on block 5,000,000.

8. Discount of Rewards per Block

As was described in this article, the original monetary policy of ETC was adjusted to mimic closely the goals of Bitcoin’s supply schedule. To accomplish this, not only the block rewards, uncle block rewards, and uncle block inclusion incentive fees were adjusted downward in era 2, but on era 3 and after, they will be discounted by 20% on an era by era basis until they will eventually diminish completely.

The above has the effect of establishing a cap of approximately 199,000,000 ETC if the uncle rate stays around 5.4%, or a hard cap of approximately 211,000,000 ETC if the extreme and unlikely case of full uncle block allocation were to occur, which is already not the case at the time of this writing.

Resulting Supply and Inflation

The resulting supply and annualized inflation rate evolution of the eight components described in this article of Ethereum Classic’s monetary policy may be seen in the chart below:

As can be seen in the chart, the ETC issuance and stock to flow patterns are very similar to Bitcoin’s mechanical, algorithmic, and capped, thus sound and trust minimized monetary policy.

If Ethereum Classic is About “Immutability” and “Code Is Law”, why was the Monetary Policy Changed in the First Place?

The above is an excellent question, and the short answer is that the Ethereum Classic monetary policy should have never been changed because the original Ethereum $ETH supply schedule was sound, even if it was not technically capped, therefore ETC violated the ethos of “immutability” and “Code Is Law”.

Does the above mean that ETC is permanently tainted?

The opinion of this author is that ETC suffered a significant setback by changing its monetary policy. However, because the new supply schedule is sound and effectively mimics Bitcoin’s schedule, including an effective cap, with accelerated disinflation, and Ethereum Classic’s culture is still very conservative, if ETC’s current monetary policy eventually ossifies, which is very likely to happen, then it can, and very likely will, recover it’s Lindy effect as time passes by, thus regaining full credibility in the market.

Conclusion

The overall purpose of blockchains is trust minimization, therefore a key component of this goal, given a generally unsatisfactory history of modern money, especially when managed by central banks and governments, is to make monetary policies the least dependent on human subjectivity as possible to protect people’s property rights and prevent dilution.

Following this premise, which was first hard coded in Bitcoin, the Ethereum Classic supply schedule is mechanical, algorithmic, and capped to ensure monetary soundness on a fully programmable and highly secure network at the base layer of the blockchain industry stack.

Code Is Law