You can listen to or watch this article here:

When looking at CoinMarketCap, there are more than 2000 cryptocurrencies listed. This situation shows that the blockchain industry is still in its early stages. This is because it is very likely that the future landscape in crypto will be much narrower due to three forces that will shape the marketplace: the format war, layering, and systemic risk.

The Format War

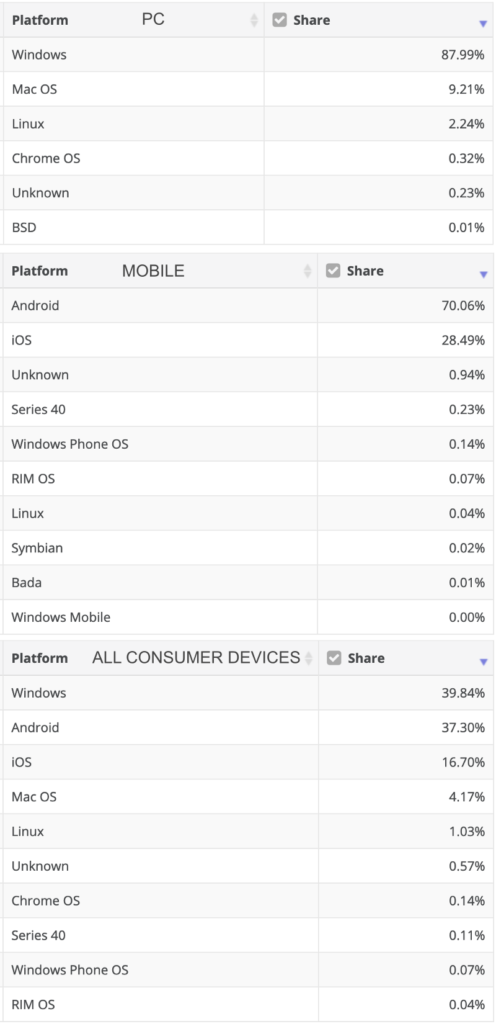

The current situation in the blockchain industry is very similar to classic format wars. These happen in industries with products or platforms with strong network effects, which need to set standards to help all industry players and users to cooperate and interact around them. In the case of the blockchain industry, the most similar historic example are the PC and mobile operating systems wars:

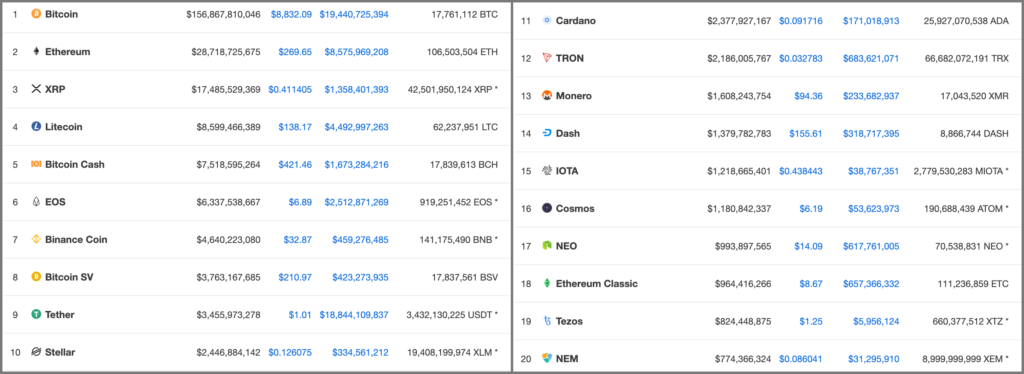

As it may be seen in the tables above, very few standards at the top of the rankings hold large market shares due to network effects. Usually, the first three or four own the ample majority of the market, and the rest of the players have negligible participation. That pattern is already observable in the first image of this article, with Bitcoin occupying 57% of market capitalization share.

The above means that, in the future, consumers, businesses, and other entities globally will not use a large or unlimited number of systems and currencies to manage their affairs. They will all converge to a few winning standards to minimize transactional costs and increase coordination, which has consistently been the long term trend in human history.

Layering

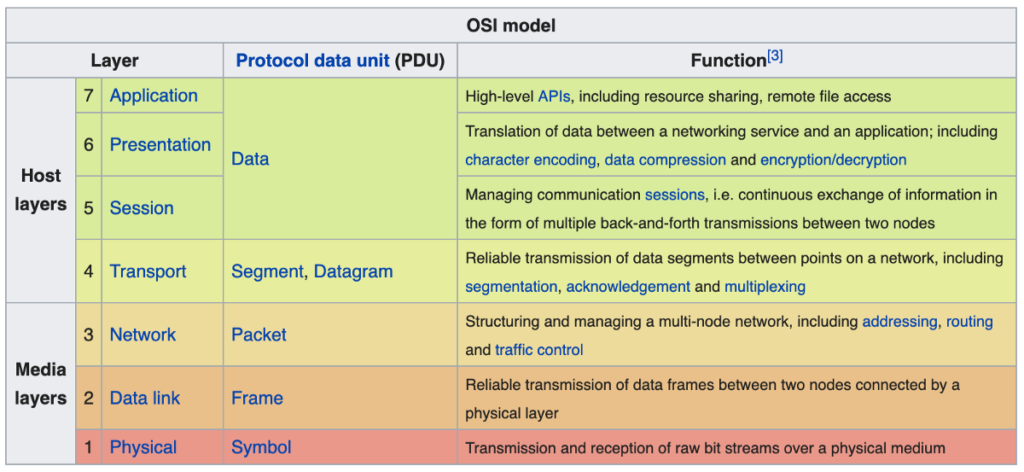

Computing systems, as many other types of organizational structures, tend to be constructed into layers to adapt them to physical constraints and user requirements.

The OSI model for networking is an example of layering in computer science:

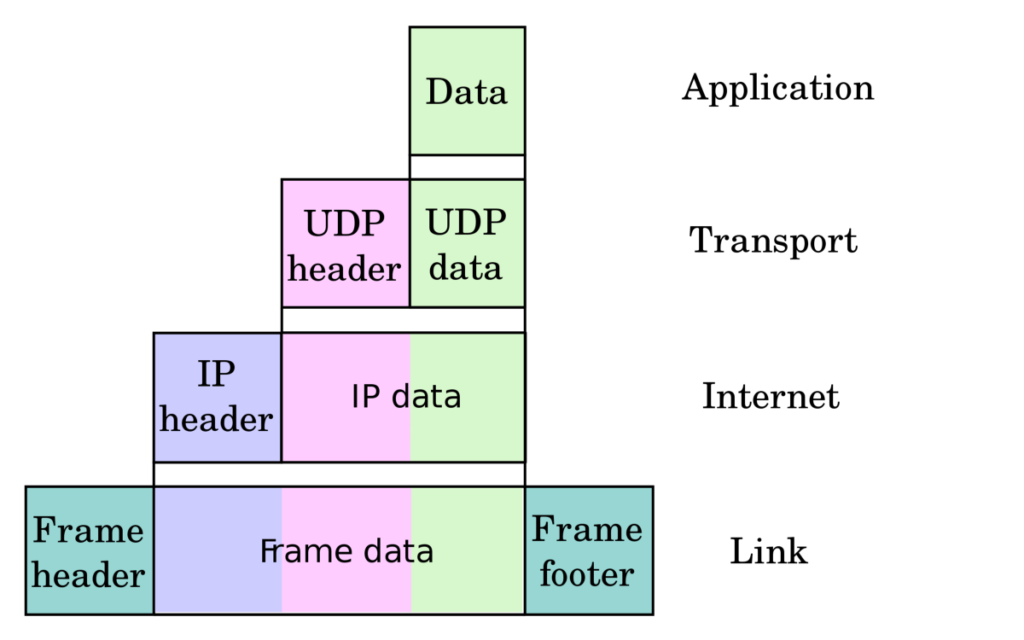

The TCP/IP protocol layering of the Internet is analogous to the OSI model:

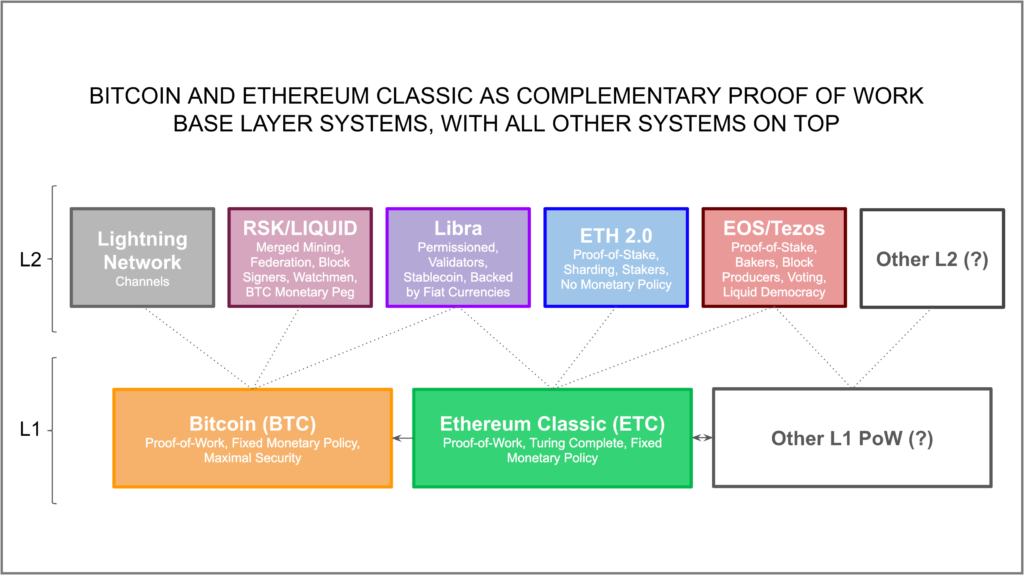

This natural tendency for layering systems will likely reorganize the winning blockchains of the current standards war into levels according to their security and performance models. Because security vs performance is a typical tradeoff in computing systems, especially in technology that manages value, these levels will be separated into a highly secure, but very inefficient and expensive base layer, or layer one (L1), and a high performance, but less secure and cheaper layer two (L2) on top.

As proof of work based Nakamoto consensus is a much more secure consensus mechanism for blockchains, but less performant, and proof of stake is less secure, but much more performant, proof of work blockchain networks, such as Bitcoin and Ethereum Classic, together with one or two others, will likely reside at the base layer. Proof of stake distributed ledgers, such as ETH 2.0, EOS, Cardano, Polkadot, and Tezos, will be naturally induced to work on top of L1 chains, as L2 systems, similar to sidechains and channels, to procure security and sound monetary policy services.

Systemic Risk

Many Bitcoin Maximalists think that Bitcoin will be the only blockchain and currency in the future, but as Bitcoin is a computer network, it naturally has IT risks. These risks can range from software bugs and sybil attacks to possibly breaking cryptography, routing attacks, network partitions and delay attacks, amongst many others.

Since Bitcoin is, in practice, an automated financial system, albeit limited to accounts and balances, these IT risks constitute important operational risks because great unsurmountable losses may be inflicted to consumers, enterprises, and governments if the system fails.

These IT and operational risks are systemic risks because all external systems that are built and connected on top of Bitcoin would be negatively affected in a generalized way when important or catastrophic events happen in the network.

Other systemic risks in Bitcoin, however minimized, are that the monetary policy could be modified to create more currency, miners could collude to attempt to disrupt the network, and developers could create controversial changes and convince other constituents, such as full node operators and exchanges, to deploy them.

Due to these systemic risks, it will be absolutely natural for pegged sidechains, connected channels, L2 systems, consumers, investors, businesses, governments, and other entities globally to want to diversify such risks.

In other words, it is very unlikely that 7.7 billion people, in 190 countries, with ~$80 trillion in global GDP, and ~$220 trillion in wealth will use only one blockchain at the base layer.

Conclusion

Due to network effects and format war dynamics, from the more than 2000 cryptocurrencies today, there will be a considerable narrowing of the market. However, that does not mean that only one highly secure blockchain will prevail at the base layer.

Because of Bitcoin’s inherent systemic risks, even if greatly minimized, users around the world will want to diversify such risks. Therefore, there will likely be at least three or four chains operating and actively used in a highly secure base layer.

As these processes evolve, the prevailing public blockchains and distributed ledgers will be reorganized in L1 and L2 where proof of work, highly secure blockchains will reside on L1 and proof of stake, high performance distributed ledgers, together with other complementary systems, will reside on L2.

Code Is Law