You can listen to or watch this article here:

As the blockchain industry consolidates in the future, the prevailing systems will naturally organize themselves in what are called “layers”.

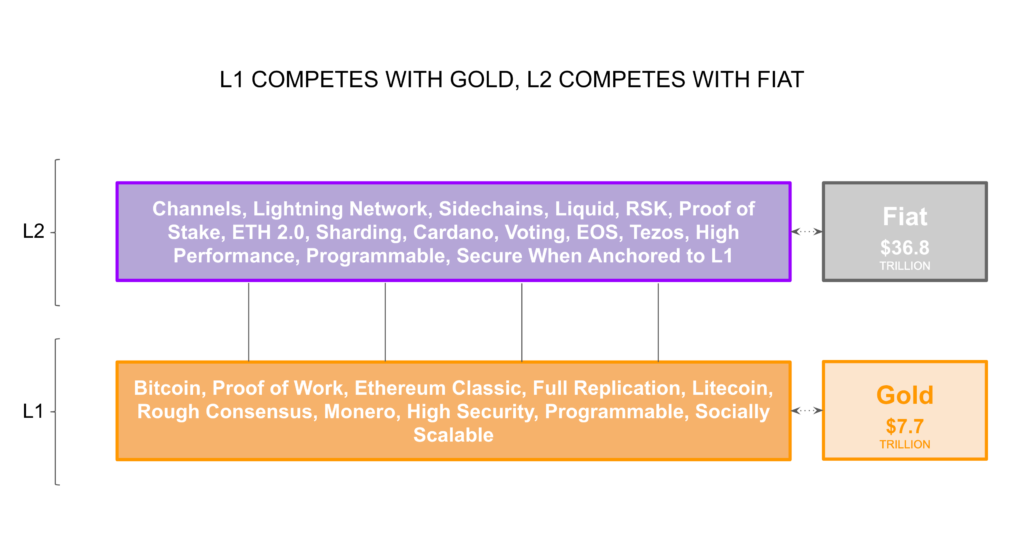

In that model, the “base layer”, or “layer 1”, or “L1”, will be the strongest and most secure, but less scalable blockchains, and the faster and most scalable, but not as secure systems will work on top as “layer 2” or “L2” components of the stack.

L1 Competes With Gold, but Is Programmable and Socially Scalable on a Planetary Level

In that context, it has been analogized and discussed frequently that “Bitcoin is digital gold“. This is a sound analogy, in my opinion, and is perfectly extensible to all base layer systems, including Ethereum Classic (ETC).

The design choices ETC has made are aligned and consistent with Bitcoin’s philosophy of prioritizing security over any other consideration. These choices, in general terms, include using proof-of-work as the consensus mechanism, having a fixed monetary policy, and having it’s database fully replicated throughout all nodes in the network.

With the above in mind, it is logical to consider that the base layer or L1 in the blockchain industry competes with gold as a proxy for its valuation and success metrics, but with the addition that the systems in that sub-sector of the industry are programmable and much more socially scalable on a planetary scale.

The total market value of all above-ground gold is estimated to be $7.7 trillion* at the time of this writing. With a total market capitalization of the crypto industry of $270 billion at the time of this writing, which includes systems that are L2, it is easy to see the potential trajectory and value creation the industry still has.

L2 Competes With Fiat Money, but Is Programmable and Highly Secure When Anchored to L1

If L2 systems are not “digital gold”, but will likely be the environment where high volumes will occur, and where the majority of innovation and useful features will be deployed, what do they compete against?

If high frequency retail payments, consumer and business applications, and moving value in high volumes, but low values per transaction, will occur in this sub-sector, then it is logical to compare and to consider it competing with traditional fiat systems.

However, the great advantage that L2 systems will have over fiat money globally is that they will be totally programmable and will have similar security guarantees, albeit not identical, as the base layer blockchains when anchored to L1.

At the time of this writing, the total market value of all fiat coins and bank notes in the world is estimated to be $7.6 trillion*. The total value of “narrow money” which includes coins, bank notes, and demand deposits globally is estimated to be $36.8 trillion*. The same comparison as with the total market capitalization of the base layer can be done here; the potential value creation of L2 systems is very substantial.

Conclusion

As the blockchain industry consolidates, the prevailing systems will redistribute themselves into L1 and L2. As L1 generally has the characteristics of hard money it is useful and reasonable to compare it and, in fact, does compete with gold.

As L2 systems seek to command higher volumes with lower value per transaction to compete with global retail systems, they can perfectly be compared and, in fact, do compete with fiat systems.

However, in both cases, L1 and L2, are programmable and much more secure than the systems they compete against. This means the blockchain industry, with its current valuation, has significant appreciation potential going forward.

*The source for estimates of gold and fiat monetary base is Visual Capitalist: http://money.visualcapitalist.com/worlds-money-markets-one-visualization-2017/

Code Is Law