You can listen to or watch this article here:

For a while I have been insisting that the current state in the blockchain industry, where there are so many competing platforms and systems, will not last very long, and that, in the end, very few blockchains will “win the race” at the base layer.

Below I transcribed two segments of recent articles I have written that refer to the reasons why I believe there will only be 3 or 4 surviving chains in the future.

Security, Exchange, and Coordination Costs

This is a segment of my critique of Paul Sztorc’s essay “Security Budget in the Long Run”. In it, I explain some of the transactional costs that will induce the market to select a few platforms and coins in the future.

The segment starts with Paul’s quote followed by my response:

But it is the reverse when we consider transaction fees and “btc-block-bytes”: Altcoin-blockspace is a pretty good substitute for Bitcoin-blockspace.

I disagree that block space is a generic commodity, therefore a transaction in Bitcoin is totally replaceable by a transaction in any altcoin or L2 system for that matter.

Up to a certain extent, and in different proportions, users will tend to tradeoff low transaction fees for standards and safety. This is because there are several types of costs that will induce the world to select very few chains in the future: Security costs, exchange costs, and coordination costs.

Security Costs

It is not the same to move value using the Bitcoin network or using any altcoin or L2 solution. This will create a market for high value, highly secure transfers in Bitcoin, e.g. central banks, governments, interbank, corporate, and other large value payment users, who will gladly pay very high fees.

For those who don’t need such security or for low value transfers there will be of course cheaper alternatives in other chains or in L2 solutions as mentioned above.

Exchange Costs

When senders and receivers want to store value in Bitcoin, but need to transfer them, it will not be frictionless to move from BTC to an altcoin, send it for a lower fee, and then pass it back to Bitcoin on the other side.

Between exchange commissions and spreads there will be an indifference point beyond which it will be better to pay for Bitcoin fees. Not only that, but the security dynamics mentioned above also change substantially. If Bitcoin is a very good store of value, transfers will occur within Bitcoin precisely for the same reason it is a good store of value.

Coordination Costs

Just because you can create N altcoins does not mean they are all going to survive. Because they are all not going to survive, there will be a limited competing block space market in the world. This is because our minds are limited and we will not think about 250 cryptocurrency names, transfer fees, the subsequent 250 prices, and go selecting the cheapest one each time we move value.

Our brains will only support understanding the value of 3 to 5 coins at most, and we will be comfortable using them interchangeably up to a certain point. If this is correct, then, together with the security and exchange costs considerations above, there will be a limited amount of coins in the future, with a limited amount of block space and transaction capacity. This means that the cost of sending value will be distributed between the surviving chains in proportion to value and safety requirements.

The Comparison to the Operating System Industry

This segment is from an article where I explained how a rational collaboration between Ethereum and Ethereum Classic should be in the context of a standards war, where very few chains will survive.

The segment starts with my quote on Twitter followed by my expanded explanation below:

For several reasons I think the base layer blockchain space will end up in the long run with 3 or 4 leading global chains. The share will be distributed something like this:

1st chain: 50%

2nd: 25%

3rd: 12.50%

4th: 6.25%The balance may be an “all the rest” niche residual list.

The reason I stated the above is because blockchains have network effects and, when those externalities kick in, usually it is a “winner takes all” kind of market. This means that when the sector as a whole, and some of the blockchains inside the sector individually, reach a certain critical mass, they will enter a runaway growth phase in total market size and relative market share, where very few chains will be the “winners” and they will likely be very big.

The current period, where there is no defined winner and the general sector is still small relative to the competition and its total addressable market, is called the “standards war” or “format war”. In history, there have been many ways in which standards have been established in the market.

Some examples of industries that have gone through intense standards wars with a single or very few resulting winners have been: electricity alternative current vs direct current, railway gauge, Betamax vs VHS video standards, and during this information age, the browser war and the operating systems war, amongst many other format fights in the past

I think the most comparable products to blockchains that are sensitive to externalities are operating systems, e.g. Windows, macOS, Android, IOS, Linux, Apache, etc. This is because, in essence, notwithstanding the large efficiency differentials, both blockchains (especially Ethereum and Ethereum Classic) and operating systems serve as multipurpose computing or computing enabling systems across the world where developers can create and build new applications and use cases on top.

Having said the above, if we see how operating system markets are distributed today we will see that there are always very few, usually 3 to 4, winners and then a residual list of players who either find a niche or become irrelevant.

Some examples of few winners in the consumer operating system market are:

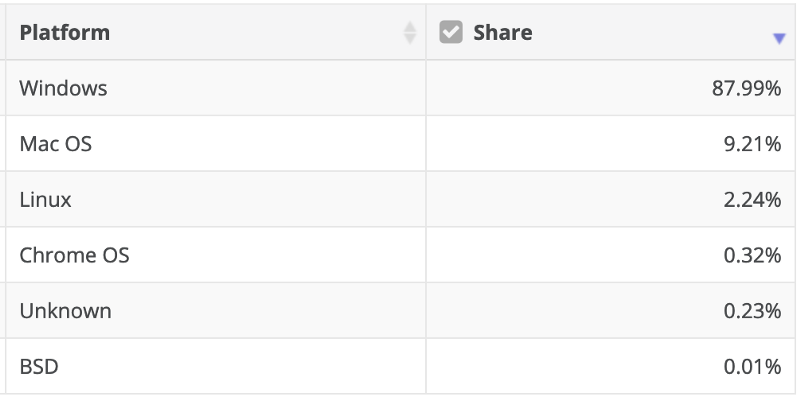

Desktop and Laptop OS Shares

Mobile OS Shares

All Global Consumer Devices Combined (Desktop/Laptop, Mobile, Tablet, Handheld, and TV) OS Share

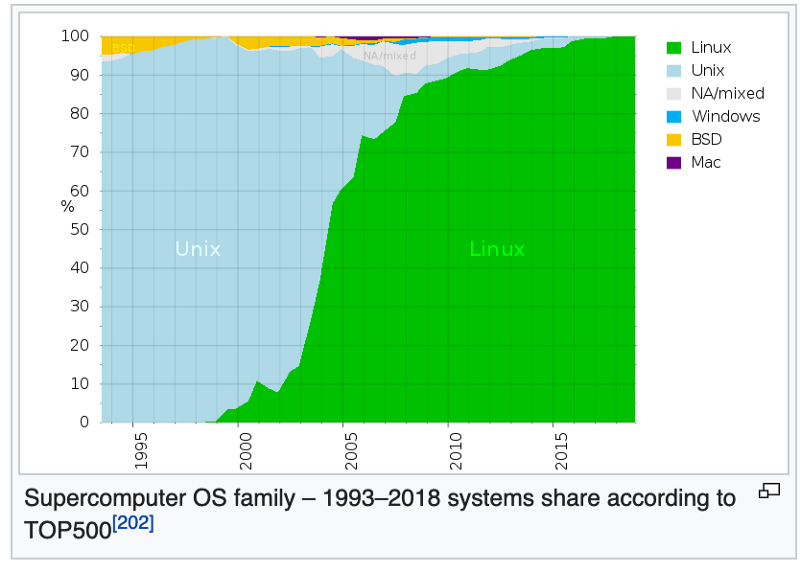

As blockchains, especially highly secure base layer chains, may be regarded as non-consumer facing, but backend computing infrastructure, I include below examples of enterprise operating systems, web server systems and super computer market share data.

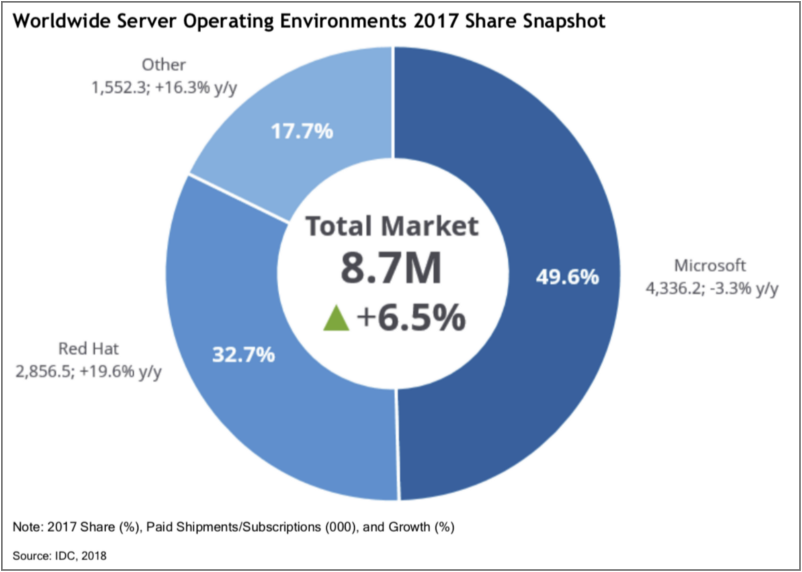

Enterprise Server OS Market

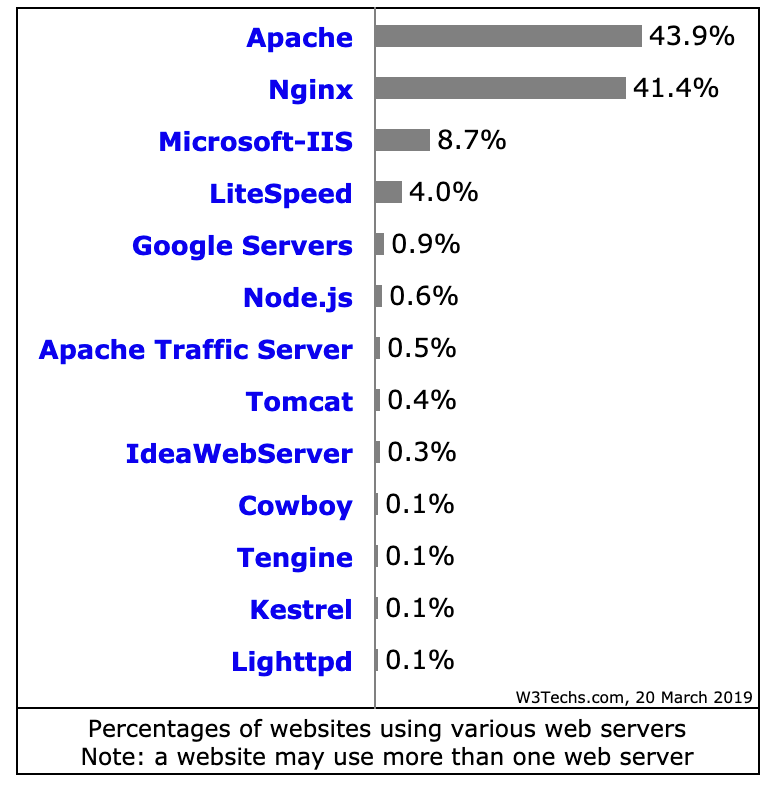

Web Server Market Share

Supercomputer OS Market Share

As can be seen in all operating system segments above, there are usually one or two players at the top who command the largest market shares. Then, the third and fourth players experience a significant lag, and, usually, after the third and fourth players, the market shares of the remaining systems become practically insignificant.

Of course the blockchain industry is very unique because secure chains are not only analogous to a computer operating systems, but also contain currencies and smart contracts, which represent property and agreements. However, it is safe to say that currencies in general also have network effects, either locally in their jurisdictions or globally, and that the shared internal state of secure blockchains are also environments with strong externalities.

Due to the above, my guess is that after this period of standards wars, there will be very few winning blockchains, say, 3 or 4, and whichever group of chains wins will have market shares roughly as the operating systems I used as examples above. As a gross simplification, my “guesstimate” is that more or less 4 chains will win, with more or less 50%, 25%, 12.5%, 6.25% of market shares respectively, and all the rest the remaining 6.25%.

Conclusion

Because human brains have limited capacity and we tend to seek for standardized platforms to reduce transactional costs and increase cooperation, I think it is highly unlikely that many chains will be operating at the base layer in the future as many advocate.

Of the few that will make it I feel very confident Bitcoin will be one of the selected ones by the market for its size, liquidity, and historical importance.

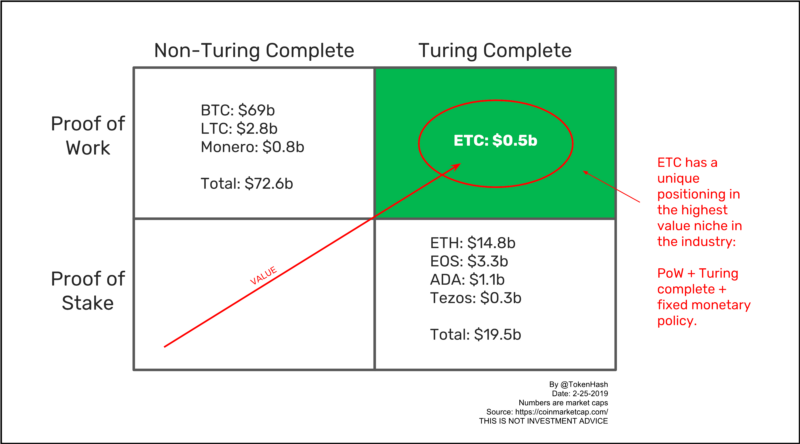

The other one that I feel very comfortable with is Ethereum Classic because, when Ethereum migrates to proof of stake and sharding, ETC will be the only proof of work and Turing complete chain with a fixed monetary policy, and that is a very valuable position.

As to which other blockchains may make it, I think developers, researchers, designers, miners, stakers, node operators, and the other participants in their ecosystems need to find, as soon as possible, a valid and specific problem they can solve, with a logical and well thought solution, if they aspire to eventually occupy one of the obviously scarce and highly valuable positions in the base layer of the blockchain stack.

Code Is Law