You can listen to or watch this article here:

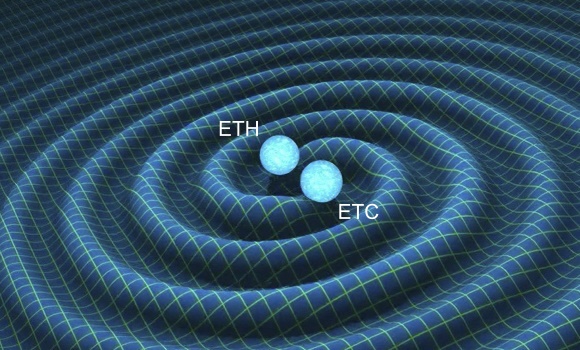

In the context of positioning Ethereum Classic (ETC) as a secure base layer system when Ethereum (ETH) migrates to ETH 2.0, there have been increasing conversations about the possibility of perpetuating ETH 1.x, the potential Ethereum legacy proof of work chain, after ETH migrates.

I personally think it’s good that ETH 2.0, ETC and ETH 1.x potential outcomes are being debated as I think the market, especially developers, consumers, enterprise, and government, need the smart contracts industry to settle on a few winning systems to be able to start investing serious money and building viable products on these highly valuable blockchain technologies.

If the L1 and L2 hypothesis is plausible, ETH 2.0 will have a lot to deal with in terms of competition with systems such as EOS, ADA, Tezos, Libra, Polkadot, Dfinity, and all the other clones, but can anchor itself for security on ETC and/or ETH 1.x.

However, whether ETC or ETH 1.x are perpetuated, and which establishes itself as the prevailing Turing complete + PoW base layer is yet to be seen.

I don’t see multiple players at the base layer, though.

As to a rivalry between ETC and ETH 1.x that would be inevitable because both would be looking to have the largest market share possible in the same exact position in the market.

However, there are two tokens today (ETH and ETC) and anyone can have in their portfolios both tokens as ETC is super cheap to accumulate at this time. For example, at the time of writing, for an ETH whale, who has, say, 100,000 ETH, he or she would only have to invest ~3010 ETH to be able to acquire 100,000 ETC in the market. This means that splitting Ethereum into ETH 2.0 and ETH 1.x tokens, to have an additional base layer investment, not only doesn’t make sense financially, but it creates an additional asset in a market that is totally oversaturated.

In that scenario, and after the dubious token festival of the last 2 to 3 years, why would Ethereum split again and create a 3rd token?

In other words, what would be the exact purpose and use case for ETH 1.x?

In my opinion, a marginal ETH 1.x would be, in any case, a low quality, low value residue of ETH because:

- 100% of accounts, balances and dapps will be duplicated on ETH 2.0.

- ETH 2.0 will have higher performance and scalability.

- The monetary base will also be duplicated after they split.

- ETH 1.x has no clear monetary policy.

- It would have to fork again to establish a monetary policy.

- A new monetary policy will not be credible.

- It is extremely bloated.

- It contains the precedent of an irregular state change.

- It would create a redundancy at the base layer.

For all of the above, I think ETH 1.x will not inherit the demand, developers, nodes, and hash rate from a potential Ethereum split, and will probably not be viable in the long term.

The above article is based on a Twitter thread about the subject between @avsa, @cyber_hokie, and @BobSummerwill.

Code Is Law