In my investment thesis of January of 2021 I predicted a price for Ethereum Classic (ETC) of $7,000 in ten years [1].

However, in that report I was very conservative estimating that, in aggregate, the proof of work base layer networks of the blockchain industry were going to match the value of gold in ten years.

I also used a fully diluted basis for the supply numbers of both Bitcoin (BTC) and Ethereum Classic (21 million and 210 million respectively) to set the future prices for both cryptocurrencies.

In contrast, in this article I am going to use a more realistic approach where Bitcoin, by itself, will eventually match the value of gold.

The logic that drives this model is the notion that Bitcoin will eventually be worth as much as the global stock of gold, and that ETC will eventually be worth at least 50% of the value of Bitcoin.

I also use the timing of the 4 year crypto bull market cycles (e.g. 2013, 2017, 2021, 2025, and 2029), rather than estimating an arbitrary date in the future (ten years in the previous report), and I use estimates of actual supply numbers, rather than the fully diluted quantities.

The price targets for ETC in this model are $1,000 in the current 2021 crypto bull market cycle, $8,729 by the end of the expected 2025 cycle, and $33,807 by the 2029 cycle.

Assumptions

Crypto Moves in Cycles

As evidenced by the bull markets of 2013, 2017, and the current one in 2021, Bitcoin, and crypto in general, move in 4 year cycles, presumably following the Bitcoin halvings [2] which occur every 4 years.

Accordingly, my current estimates will be following those cycles, so I show how the numbers looked in 2013 and 2017, and I am going to estimate price targets for BTC and ETC for the current 2021 cycle, and for the coming ones in 2025 and 2029.

The Current Cycle of 2021 Is Not Over

Despite recent volatility, judging by the magnitudes of past crypto bull market cycles [3] and the current global macro economic environment; where money printing, fiscal deficits, and national debts are swelling [4], and interest rates are near zero or negative; I believe the current bull market is not near its end.

In this context, I believe that both BTC and ETC will continue to advance significantly in price during this cycle as the technology and price discovery processes continue.

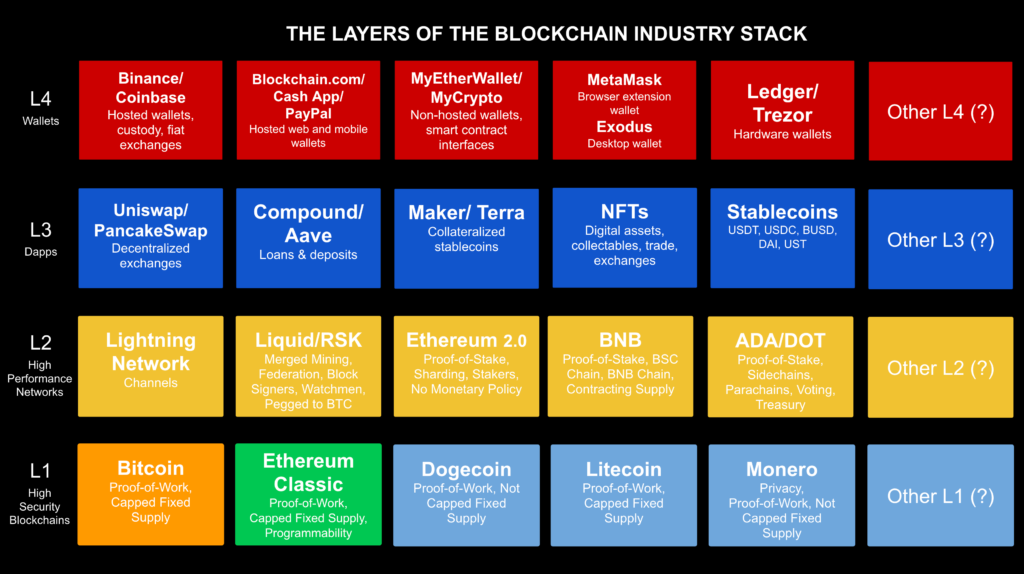

The Blockchain Industry Stack Will Be Layered

As many systems in nature, society, and technology, the blockchain industry stack will be layered [5]. As proof of work Nakamoto consensus [6] is more secure [7] [8] but less scalable than proof of stake, then proof of work blockchains will be the layer 1, L1, or base layer of the technology stack.

As the proof of stake consensus mechanism is less secure but much more scalable, then proof of stake networks will be the layer 2, L2, or performance layer of the blockchain industry stack [9].

Only 3 or 4 Blockchains Will Win In Each Layer

Because of economies of scale, network effects, power law, and the need for diversifying systemic risks [5], there will only be a few winners in each layer of the blockchain technology stack.

As is usual in infrastructure, technology industries, and in currency markets, very few players will achieve large scales.

This will distribute the market shares of the winners in each layer more or less with a 50% for the top networks, 25% for the second players, 12.50% for the third, 6.25% for the fourth, and the remaining 6.25% will be distributed among many other less significant systems.

Bitcoin and Ethereum Classic Will Lead In the Base Layer

The base layer will eventually evolve to have Bitcoin, as the historical digital gold asset in the industry, with a share of 50%; ETC, as a programmable digital gold asset [10], with a share of 25%; another two proof of work networks (presumably, by current ranks and functionality, either Doge Coin, Bitcoin Cash, Litecoin, Monero, Zcash, or others) with 12.50% and 6.25% respectively; and the rest with the remaining 6.25%.

Ethereum Classic is likely to gain the preeminent position with Bitcoin [11] described above because of its “Code Is Law” philosophy [12] [13], the fact that it is programmable hard money, has zk-SNARKs capabilities for privacy [14], that smart contracts are hosted and executed within its highly secure environment [15] [16], and that it has a fixed monetary policy [17].

Bitcoin Will Match or Surpass Gold’s Valuation

Due to its level of trust minimization, quality as a store of value, global seamless reach, the fact that it may be held and transferred through communications channels, and its characteristics of sound money, Bitcoin will eventually, at minimum, match the global valuation of gold.

Gold has about $9.45 trillion [18] in value today, and is projected to be worth around $10.3 trillion in 2025 and $11.22 trillion by 2029. The price projections of gold assume that gold will increase in price from the current levels at the average projected inflation rate for the next 4 and 8 years which is 2.17% [19].

Given that Bitcoin already achieved a valuation of more than $1 trillion in 2021, and the steep curve of the previous and current crypto bull market cycles, I believe it is very likely Bitcoin will reach the value of gold by the 2029 cycle.

Ethereum Classic Price Predictions

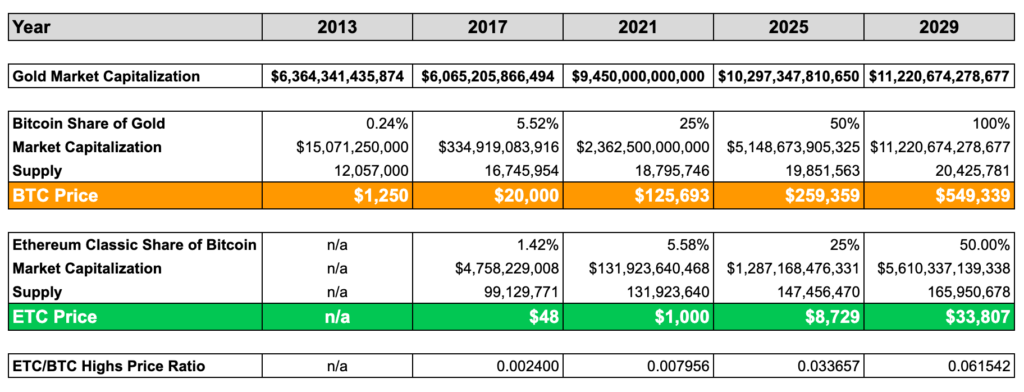

Below is a table that includes the crypto bull market cycles of 2013 and 2017, the currently undergoing 2021 cycle, and the projected 2025 and 2029 cycles.

Below is an explanation of each section of the table above.

Estimated Gold Market Capitalization

The global stock of gold was valued at between $6 trillion and $6.4 trillion during the 2013 and 2017 cycles. As described in the assumptions section above, in 2021 its value is $9.45 trillion, and is projected to be worth around $10.3 trillion in 2025 and $11.22 trillion by 2029.

Estimated Bitcoin Prices

Given the above projected values for the global stock of gold, the Bitcoin market capitalization is projected to be worth $2.36 trillion, or 25% share of gold, by the end of the 2021 cycle; $5.15 trillion, or 50% share of gold, by the end of the crypto bull market cycle of 2025; and $11.22 trillion by 2029 when it matches the global market capitalization of gold.

Adjusting for its supply schedule, the corresponding price targets for BTC for the present and future crypto bull market cycles would be:

2021: $125,623

2025: $259,359

2029: $549,339

Estimated Ethereum Classic Prices

Given the above projected values for Bitcoin, the Ethereum Classic market capitalization is projected to be worth $131.92 billion, or 5.58% share of Bitcoin, by the end of the 2021 cycle; $1.29 trillion, or 25% share of Bitcoin, by the end of the crypto bull market cycle of 2025; and $5.61 trillion by 2029 when it reaches an expected 50% share of the market capitalization of Bitcoin.

Adjusting for its supply schedule, the corresponding price targets for ETC for the present and future crypto bull market cycles would be:

2021: $1,000

2025: $8,729

2029: $33,807

Rationale

As explained in the introduction, the logic of the model is that Bitcoin will eventually be worth as much as the global stock of gold, and that ETC will eventually be worth at least 50% of the value of Bitcoin at the base layer of the blockchain industry stack.

The success of the second layer, or layer 2, is actually also a driver [20] for ETC’s value as many of those systems will seek the security of its blockchain, likely anchoring their state and seeking monetary stability.

Layer 3 and 4 will also use ETC in various forms as dapps, wallets, and other systems will use it for security services and to provide high value products and services to their users.

As seen in the diagram above, Ethereum Classic is the only major smart contracts platform that is proof of work based Nakamoto consensus; its database is fully replicated on a global scale; has a fixed monetary policy; and, thus, will serve as a secure system for high value settlements and monetary services for large proof of stake networks such as Ethereum 2.0, BNB, Cardano, Polkadot, Internet Computer, Solana, VeChain, EOS, Tron, NEO, Tezos, Cosmos, and others [21].

Due to this enhanced functionality at the base layer, it will likely surpass other less versatile proof of work networks, such as Doge Coin, Litecoin, Monero, Bitcoin Cash, and others to position itself well within the top #10 in the popular crypto lists.

References

[1] How Ethereum Classic Will Surge Past $7,000 in the Next Ten Years – by Donald McIntyre: https://etherplan.com/2021/01/03/how-ethereum-classic-will-surge-past-7000-in-the-next-ten-years/14847/

[2] Bitcoin Halving – by Investopedia: https://www.investopedia.com/bitcoin-halving-4843769

[3] Ecoinometrics – May 10, 2021:

“We are almost one year after Bitcoin’s 3rd halving and one thing is sure: the halving was not priced in.”

Source: https://ecoinometrics.substack.com/p/ecoinometrics-may-10-2021

[4] Stanley Druckenmiller: Current Fed policy is totally inappropriate: https://www.cnbc.com/video/2021/05/11/stanley-druckenmiller-fed-policy-criticism-us-economy.html

[5] The Format War, Layering, and Systemic Risk Will Define the Future Landscape of the Blockchain Industry – by Donald McIntyre: https://etherplan.com/2019/06/15/the-format-war-layering-and-systemic-risk-will-define-the-future-landscape-of-the-blockchain-industry/7820/

[6] Why Proof of Work Based Nakamoto Consensus Is Secure and Complete – by Donald McIntyre: https://etherplan.com/2020/03/21/why-proof-of-work-based-nakamoto-consensus-is-secure-and-complete/10509/

[7] Why Proof of Stake Is Less Secure Than Proof of Work – by Donald McIntyre: https://etherplan.com/2019/10/07/why-proof-of-stake-is-less-secure-than-proof-of-work/9077/

[8] Proof of Work Has Division of Power, Proof of Stake Does Not – by Donald McIntyre: https://etherplan.com/2019/05/18/proof-of-work-has-division-of-power-proof-of-stake-does-not/7619/

[9] Ethereum Classic vs Ethereum 2.0, What Is the Difference? – by Donald McIntyre: https://etherplan.com/2019/07/23/ethereum-classic-vs-ethereum-2-0-what-is-the-difference/8425/

[10] Why Does Ethereum Classic Have Value? – by Donald McIntyre:

“As Bitcoin is considered ‘digital gold’, and Ethereum Classic’s native currency has the same characteristics and benefits, but is also programmable, then ETC can be considered ‘programmable digital gold’. Ethereum Classic’s unique characteristics makes it an excellent environment for money, property, and agreements. In other words, ETC is the ultimate expression of all the properties of money, but trust minimized, programmable, and highly secure on a global scale.”

Source: https://etherplan.com/2020/04/09/why-does-ethereum-classic-have-value/10916/

[11] Bitcoin and Ethereum Classic Are Complementary Base Layer Systems – by Donald McIntyre: https://etherplan.com/2019/06/14/bitcoin-and-ethereum-classic-are-complementary-base-layer-systems/7804/

[12] Code Is Law And The Quest For Justice – by Arvicco – 2016: https://ethereumclassic.org/blog/2016-09-09-code-is-law

[13] The Meaning of Immutability in Ethereum Classic – by Donald McIntyre: https://etherplan.com/2019/01/24/the-meaning-of-immutability-in-ethereum-classic-etc/7381/

[14] What’s in Atlantis? EIP196/EIP197 (Precompiled contracts and zkSNARK) – by Stevan Lohja – ETC Cooperative: https://medium.com/@stevan.blog/whats-in-atlantis-eip196-eip197-precompiled-contracts-and-zksnark-8c1cfec7d3f9

[15] The Ethereum Classic Trinity Explained – by Donald McIntyre: https://etherplan.com/2020/02/04/the-ethereum-classic-trinity-explained/9845/

[16] Ethereum Classic Money, Property, and Agreements Explained – by Donald McIntyre: https://etherplan.com/2020/02/06/ethereum-classic-money-property-and-agreements-explained/9965/

[17] The Ethereum Classic Monetary Policy Explained – by Donald McIntyre: https://etherplan.com/2020/02/25/the-ethereum-classic-monetary-policy-explained/10025/

[18] Value of all the gold in the world – by Golden Eagle Coins: https://www.goldeneaglecoin.com/Guide/value-of-all-the-gold-in-the-world

[19] The projected inflation in US dollars of 2.17% for the next ten years is the average US inflation rate of the last 20 years. Taking as a base the current value of gold of $9.45 trillion, and adjusting it by 2.17% per year for 4 and 8 years results in a future value of gold of $10,297,347,810,650 for 2025 and $11,220,674,278,677 for 2029.

Inflation data source – Federal Reserve Bank of St. Louis: https://fred.stlouisfed.org/series/FPCPITOTLZGUSA

[20] Ethereum 2.0’s Success Is Ethereum Classic’s Success – by Donald McIntyre: https://etherplan.com/2021/04/23/ethereum-2-0s-success-is-ethereum-classics-success/15748/

[21] What Is Ethereum Classic’s Contribution to the Blockchain Industry? – by Donald McIntyre: https://etherplan.com/2021/04/20/what-is-ethereum-classics-contribution-to-the-blockchain-industry/15717/

Risks, Disclaimer, and Disclosure

It is important for readers to understand that the author’s or Etherplan’s opinions are not investment or financial advice. Readers and investors should do their own research, would be well advised to invest what they can afford to lose, and are responsible for their own decisions.

Crypto markets and high technology are risky and very volatile and price predictions and targets may or may not occur.

Etherplan’s vision for Ethereum Classic is particularly dependent [20] of a successful migration of Ethereum 1.0 to Ethereum 2.0.

However, as it is truly decentralized, other ETC ecosystem participants may have other opinions about the blockchains roadmap, future positioning, and potential value within the blockchain industry.

The author has direct and indirect financial interests in Ethereum Classic, Bitcoin, Ethereum, and Litecoin.

Code Is Law