You can listen to or watch this article here:

The problem that money solves is that humans have a limited mental capacity to track all relationships and economic exchanges with other humans, which makes it difficult to trust everyone regardless of the level of fondness for them.

This constrained human activity to families, clans, and tribes for a long time, but as groups and populations grew, the solution, to be able to trade and conduct commerce with non-kin groups and clans, was to use a third product that was valued by both sides of the trade: money.

The key characteristics of money to have this role, and to be highly valued by humans, were that it had to be scarce, durable, costly to create, portable, divisible, fungible, and transferable.

Gold

Many products have been used by humans as money. These ranged from stone tools to commodities, shells, fabrics, livestock, and metals. The precious metal that became the form of money and store of value by default for more than 7000 years was gold.

Gold has excellent properties because it is valued by everyone uniformly and it is scarce, durable, costly to produce, portable, divisible, fungible, and transferable. However, as villages and cities turned into nations, scaling gold became increasingly difficult.

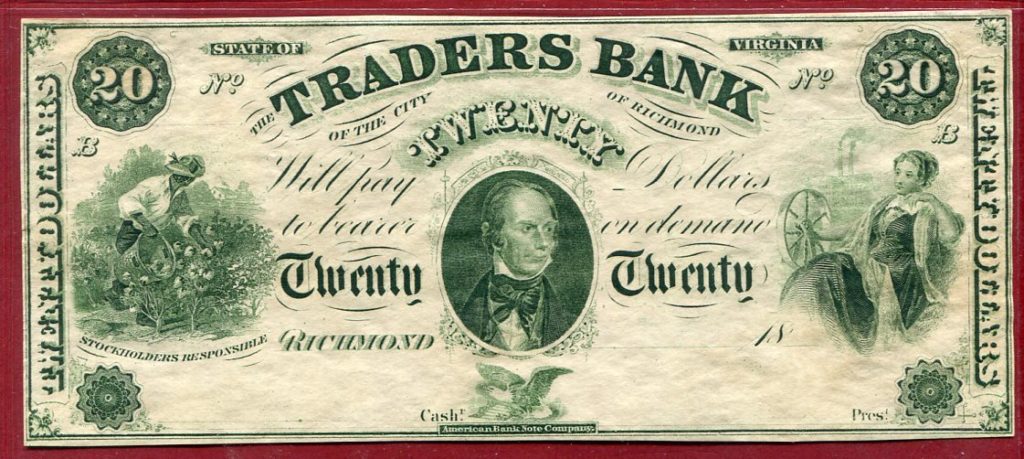

As a result, the solution to scaling the storage and easier transfer of gold, goldsmiths, who became the holders and storage services by custom, started to use notes representing their reserves, proprietary or of third parties, as a form of circulating currency.

These entities eventually became banks in modern times who issued bank notes backed by gold.

Fiat

As societies became more complex, banking systems grew with many banks issuing several types of notes, with different policies and styles of backing them with their reserves.

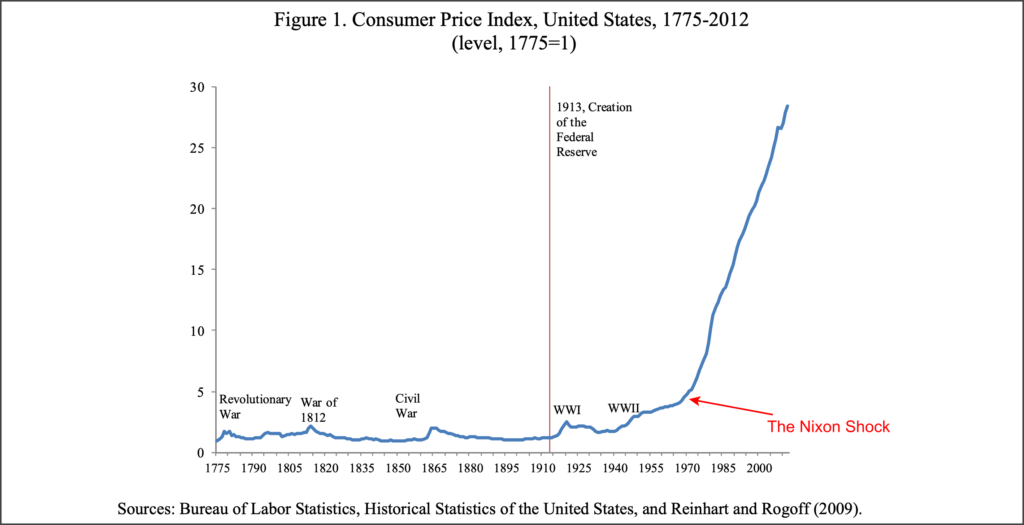

By the beginning of the 20th century the Federal Reserve was created and consolidated all note and money issuance by law, but still using gold as the hard asset that would back them.

After the depression that started in 1929, the federal government of the United States had a growing pressure to increase spending and issue money to try to stimulate the economy. This was a new style of central planning that became popular at the time, and is still popular today, promoted by John Maynard Keynes.

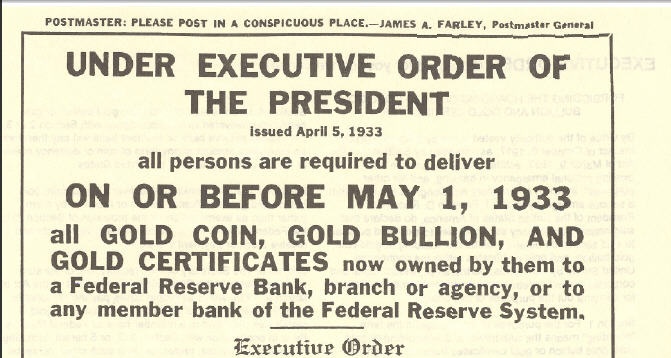

The problem was that the need to back every dollar note with gold became a constraint, so the United States government decided, in 1933, to end the gold standard by decree and forced the population to give up their gold and to transfer it to the Federal Reserve.

The gold standard ended for the general public, but during World War II, there was an agreement in 1944 between nations called the Bretton Woods Agreement that established a fixed exchange between international currencies, with the dollar at the center, and the gold in the Federal Reserve as the ultimate asset backing it. This meant there was still some backing by gold, even though the general public did not have any access to it, as only the participating countries’ central banks had that privilege.

But, if the gold standard can be violated for the public, why not end it completely for everyone?

That is exactly what Nixon did in 1971.

What is called the “Nixon shock” was the final blow to any type of real asset backing notes, thus creating pure fiat money: The United States decided to end the Bretton Woods agreement and determined that, if people were already using money without the ability to exchange it for gold, that meant that it was absolutely unnecessary to limit issuance by the constraint of gold reserves.

From then on only the full faith in the United States in general, or the Federal Reserve in particular, was going to guarantee the scarcity of the currency.

Needless to say, inflation ensued.

Just to be clear, as some people still confuse this, neither the money of the United States, nor the great majority of countries in the world, have any backing by anything other than the promise of their politicians and central bankers that their money will be sound.

Bit Gold

The problem of fiat money is not only that it is prone to inflation, but that it is run by trusted third parties. Trusted third parties, such as commercial banks, are security holes because they hold our money and wealth, our personal data, manage everything on centralized servers, and they can be hacked or they can commit outright fraud.

This is why cypherpunks had, for decades, been researching for ways of delinking again the capacity of creating money from politicians and central bankers, to minimize human agency risk, guaranteeing scarcity, but within global permissionless computing systems.

One of the attempts was Bit Gold by Nick Szabo.

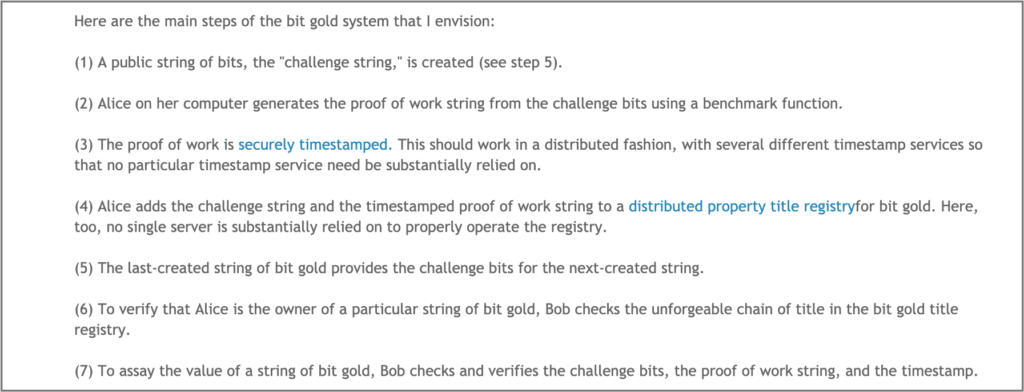

Based on his study of the origin of money, Szabo’s Bit Gold seeks to recreate the properties of gold, but in digital permissionless peer-to-peer networks. Its goals are to mimmic gold by creating digital scarcity, and to eliminate the need of trust in third parties so the system can be safe and socially scalable.

The way it works is by having a network of nodes solve a mathematical puzzle that is very costly computationally to perform. Once the digital puzzle is solved, the proof of its solution, called proof of work, is credited in a distributed ledger so the participant who solved it can hold and transfer it to anyone he/she likes.

As time passes by, all the proofs that are created, the digital gold, can be put together into bundles that resemble ingots in real gold. These ingots can be used to generate and back tokens, or bit gold “coins”, which may be divisible and fungible, thus used as money.

This structure largely gave Bit Gold all the desired features of scarcity, durability, costliness, portability, divisibility, fungibility, and transferability, but in a trust minimized setting.

Bitcoin

However, Bit Gold was never actually implemented because it still had two obstacles: It needed a trust minimized market to be able to turn irregular proofs of work into homogeneous bundles, or ingots, and it depended on a distributed ledger of property titles in a normal peer-to-peer network of nodes with a low fault tolerance, which made it equally susceptible to attacks as previous attempts by cypherpunks at digital money.

The solutions to these two problems were presented by Satoshi Nakamoto when he created Bitcoin.

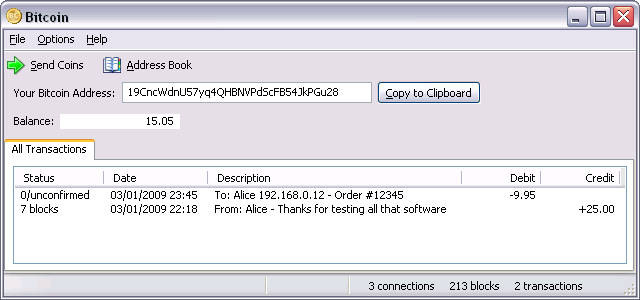

Bitcoin solved the bundling problem by creating a shortcut by having nodes create proofs of work and directly rewarding them with a fixed number of tokens, called bitcoins, deposited into their account, rather than having them hold the irregular proofs of work.

The security of the distributed ledger with property titles was solved by making the ledger itself the computing problem to solve by having all nodes send new transactions to all nodes and then hashing them as blocks of data and putting the hashes in a successive chain one on top of the other, thus creating a “block chain”.

The combined set of solutions that Satoshi invented are referred to as the Nakamoto consensus, which, due to the properties and benefits of the proof of work based mechanism, has much higher security guarantees than all previous systems.

With these innovations Bitcoin became the first trust minimized operating system of sound money in the world that has all the properties sought by people to use as money.

Ethereum Classic

Bitcoin’s brilliant invention of trust minimized digital scarcity is an incredibly beneficial step forward, but the next leap would be to be able to make it fully programmable.

The concept of programmability of money, property, and agreements is yet another of Nick Szabo’s extensive work in the space. He called this technology smart contracts.

Because of Bitcoin’s structure, it was difficult to add fully functional smart contracts, or decentralized programs, into the system. However, Vitalik Buterin came up with the solution by creating Ethereum.

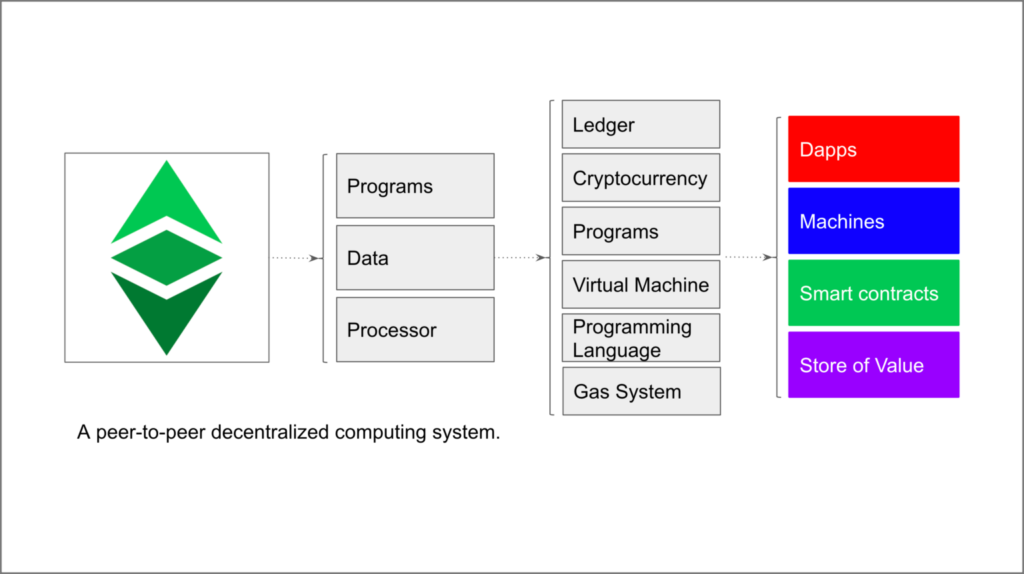

Ethereum Classic (ETC) is actually the original Ethereum network which was launched in 2015.

The way Ethereum Classic works is that it uses the basis of the proof of work based mechanism of Bitcoin, it has its own secure native token, but it adds a stateful blockchain, by including a virtual machine, a programming language, therefore the capability of storing and executing decentralized programs within the system.

These capabilities make ETC an optimal blockchain for decentralized applications, machine to machine interactions, smart contracts between people and businesses, and its native cryptocurrency, $ETC, can perfectly be used as a store of value.

As Bitcoin is considered “digital gold”, and Ethereum Classic’s native currency has the same characteristics and benefits, but is also programmable, then ETC can be considered “programmable digital gold”.

Ethereum Classic’s unique characteristics makes it an excellent environment for money, property, and agreements.

In other words, ETC is the ultimate expression of all the properties of money, but trust minimized, programmable, and highly secure on a global scale.

This is why Ethereum Classic has value.

Code Is Law