I read and comment on this article in this video:

This is why Ethereum Classic (ETC) is in a great path:

1. The Discovery Logic

1.1. As ETC is discovered by the market (as seen by growth in all metrics in the last 8 months) then developers will start discovering its use cases.

1.2. The ETC ecosystem will affirm the Proof of Work (POW) based Nakamoto consensus and Ethereum Classic’s highly secure model and sound monetary policy to ensure its original Cypherpunk principles of trust minimization so the market will keep discovering ETC’s value and use cases.

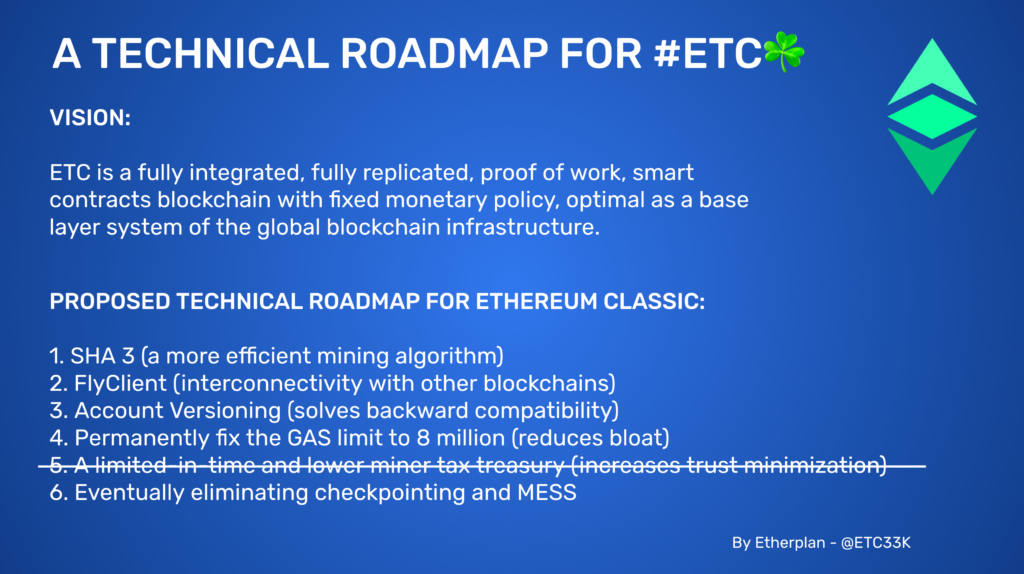

To do this the ecosystem will follow a highly secure and conservative technical roadmap.

It will add technologies that will make its mining algorithm more efficient and secure; enable full interconnectivity with other base layer and layer 2 systems; ensure backward compatibility of smart contracts in all future upgrades; and reduce bloat of the blockchain to increase node count globally.

In the process, the ETC community will reject technologies that risk centralization or undermine the full capacity of Nakamoto consensus. These include the proposed Treasury, checkpointing, sharded POW, and eventually eliminating MESS.

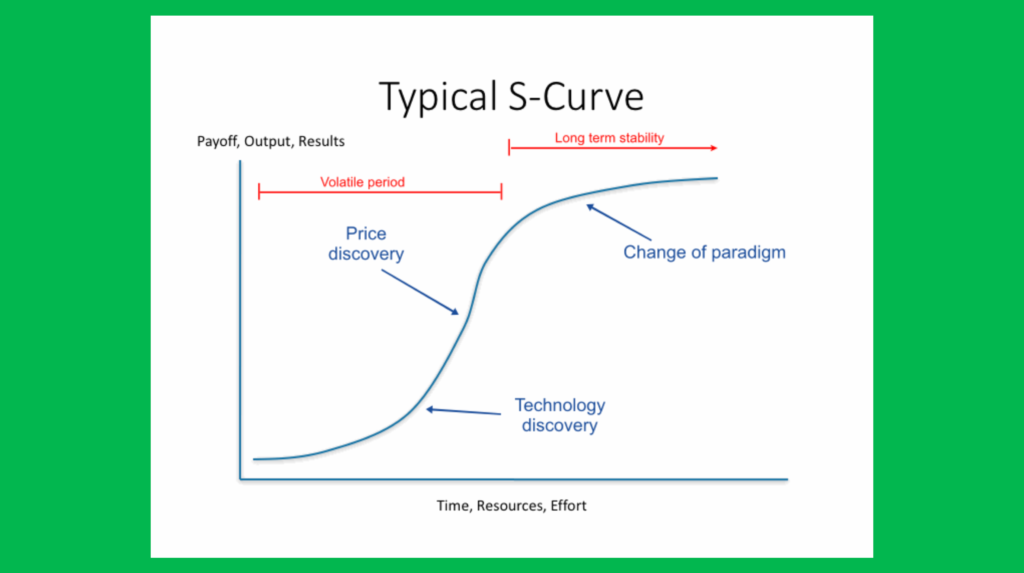

1.3. The same process of discovery mentioned above happened with Bitcoin and the Internet in general:

– In 1994 Google, Netflix, and Facebook did not exist, but as time passed and the technology evolved, new use cases were discovered and built by startups and developers.

– Bitcoin is 12 years old, and only now institutions, corporations, and governments are discovering its use cases.

The same evolutionary cycle will happen with Ethereum Classic but faster.

This is why Ethereum Classic is in a great path, but will probably be quicker because Bitcoin and Ethereum 1.0 already paved the way for it.

2. The Positioning Logic

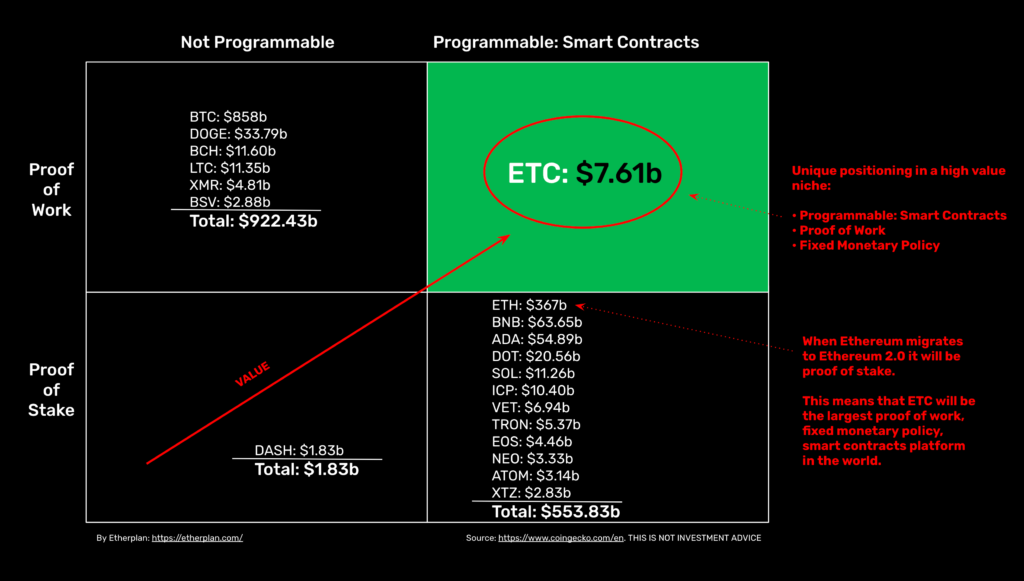

ETC is in a very unique position in the blockchain industry.

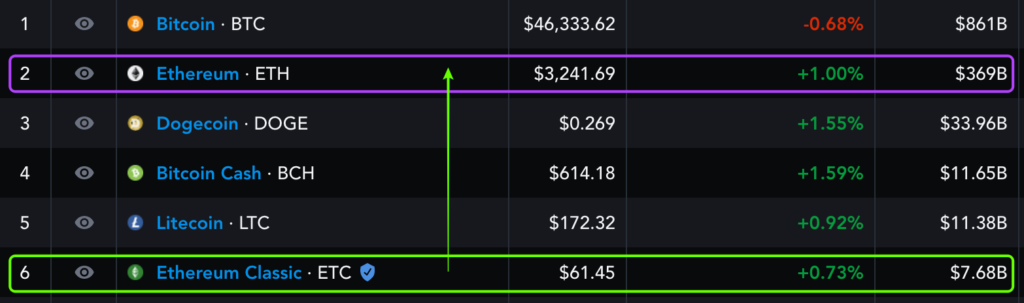

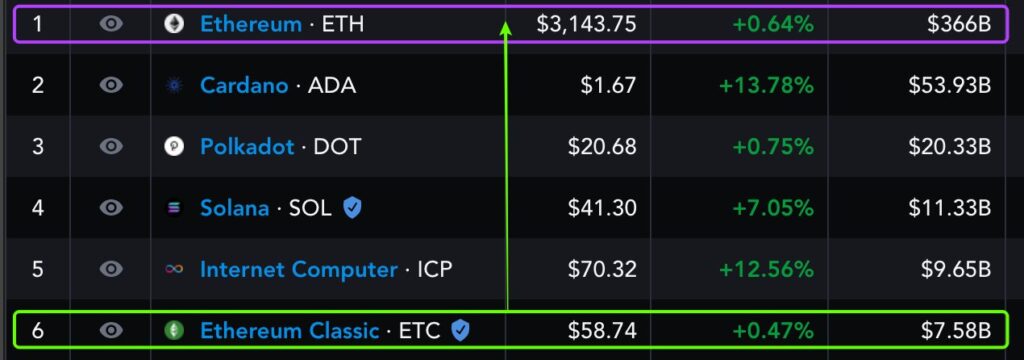

It is the 6th largest Proof of Work blockchain in the world.

However, it is an inexorable reality that when Ethereum 1.0 migrates to Ethereum 2.0, then ETC will become the largest POW, fixed monetary policy, programmable blockchain in the world.

Not only that, but ETC is in a really distinct niche, totally different than all the other large blockchain systems in the world.

All the other large chains are either POW but not programmable (i.e. due to their UTXO transaction model, Bitcoin and the other POW chains can not be programmable at the base layer, but only through layer 2 systems), or programmable but with the Proof of Stake (POS) consensus mechanism, which is known to be more scalable but much less secure than POW.

To recap, there are 2 great external opportunities that will enable ETC to grow exponentially:

1. Ethereum 1.0 will migrate to Ethereum 2.0 very soon, leaving the space open for ETC to occupy it.

2. As Bitcoin and the other POW blockchains are not programmable at the base layer due to their UTXO model, ETC will be much more versatile and useful at the base layer.

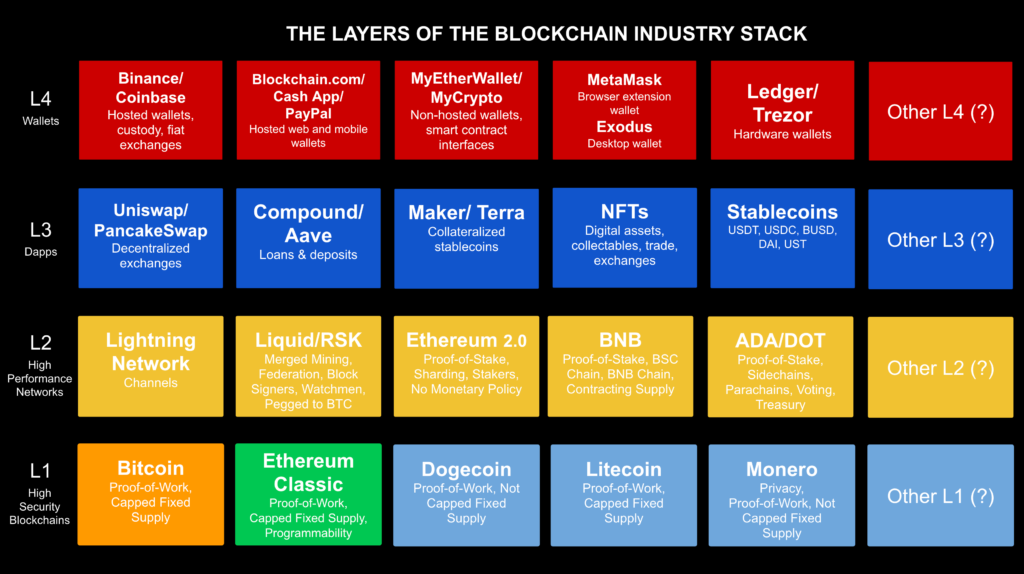

As seen in the table above, when the whole blockchain industry becomes fully layered, ETC will move to surpass the other POW chains at the base layer or L1 and become:

– The largest POW smart contracts blockchain in the world.

– The second largest POW blockchain in the world.

3. The Price Predictions Logic

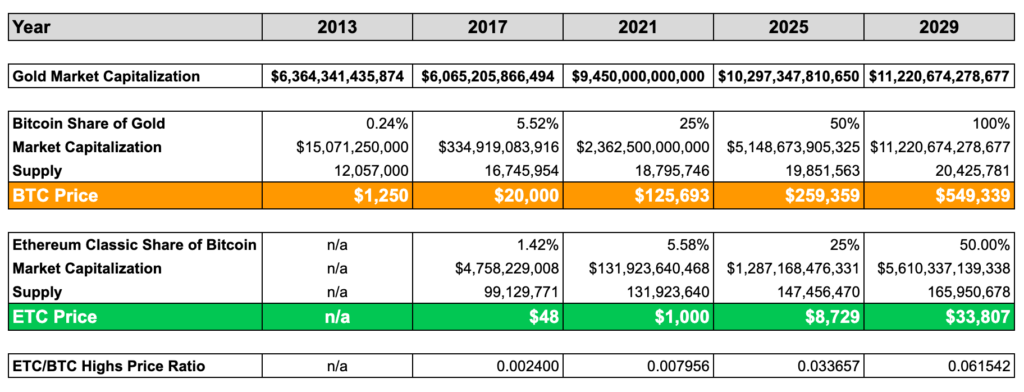

As Bitcoin is digital gold and ETC is programmable digital gold because both have identical monetary policies (i.e. BTC has a hard cap of 21 million, ETC has a hard cap of 210 million, and both decrease their supplies logarithmically) then the best analogy for predicting their price is the market capitalization of gold.

As gold inflates in price into the future due to lax central bank monetary policies worldwide, it will likely reach a valuation of at least $11.2 trillion by 2029.

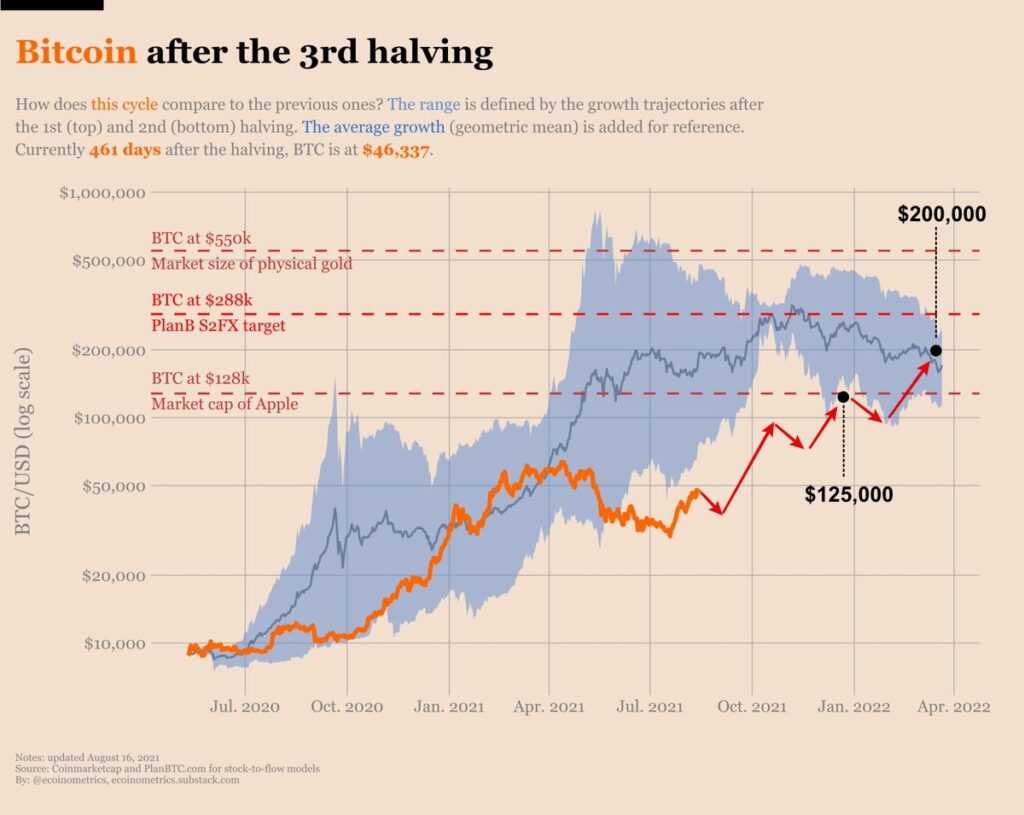

As seen in the chart below, it is very likely that BTC will rise to $125,000 in 2021 as the crypto bull market cycle resumes again from now until December.

This will put BTC at a ratio of 25% relative to gold.

Then ETC will rally from the current $60 to $1,000 this year because:

1. BTC/ETH usually lead the rally and then ETC follows.

2. ETH will migrate to ETH2 soon after Dec 2021.

3. ETC will surpass DOGE, BCH, and LTC because it is much more versatile and useful with smart contacts at the base layer.

In the future crypto bull market rallies of 2025 and 2029 Bitcoin will very likely reach a 50% and 100% valuation relative to gold respectively. This will put it at around $259,000 and $550,000 during those cycles.

Because ETC will rise to be the largest POW smart contracts blockchain in the world and the second largest POW network at the base layer beside Bitcoin, then it will likely reach a valuation of 25% and 50% relative to Bitcoin in the next crypto bull market cycles of 2025 and 2029.

The above will put ETC at around $8,700 in the 2025 crypto bull market cycle and $33,000 by the one in 2029.

This remains a conservative assessment because ETC is actually more versatile, programmable, and useful than Bitcoin itself, so it is entirely possible that it could reach the same valuation or even surpass it, eventually.

Further Reading

• Why Proof of Work Based Nakamoto Consensus Is Secure and Complete

• The Ethereum Classic Monetary Policy Explained

• The Ethereum Classic Ideal Long Term Roadmap

• Ethereum Classic Use Cases: A Business Development Roadmap

• Why Ethereum Classic Should Not Create a Treasury

• Response to Charles Hoskinson’s Comments About the Treasury Part 1

• Why Proof of Stake Is Less Secure Than Proof of Work

• Ethereum Classic vs Ethereum 2.0, What Is the Difference?

• Ethereum 2.0’s Success Is Ethereum Classic’s Success

• What Is Ethereum Classic’s Contribution to the Blockchain Industry?

• The Logic of Why Ethereum Classic Will Rise 1000x in the Medium to Long Term

• How Ethereum Classic Will Surge Past $7,000 in the Next Ten Years

• Ethereum Classic History and Recovery

• Ethereum Classic Price Predictions for the Current and Coming Crypto Cycles

Risks, Disclaimer, and Disclosure

It is important for readers to understand that the author’s or Etherplan’s opinions are not investment or financial advice. Readers and investors should do their own research, would be well advised to invest what they can afford to lose, and are responsible for their own decisions.

Crypto markets and high technology are risky and very volatile and price predictions and targets may or may not occur.

Etherplan’s vision for Ethereum Classic is particularly dependent of a successful migration of Ethereum 1.0 to Ethereum 2.0.

However, as it is truly decentralized, other ETC ecosystem participants may have other opinions about the blockchain’s roadmap, future positioning, and potential value within the blockchain industry.

100% of the author’s financial portfolio and wealth is invested in Ethereum Classic.

Code Is Law