There is a lot of discussion and analysis about how the supposed governance systems of secure proof of work blockchains, such as Bitcoin, work.

However, the reality is that the Bitcoin network ecosystem utterly rejects what is called “governance”. It seeks the antithesis of governance, therefore rejects its patterns and internal structures.

Due to this, a more correct way of describing how Bitcoin’s organizational and decision making processes work may be better referred to as “ungovernance”.

In the last 3 million years, human evolution has taken social organization from a state of nature, where basic forces of incentives, conflict, and symmetry induced behavior, to rules based systems in the form of institutions and law, that work across genetic boundaries, as ever larger bands, clans, and tribes organized around villages, cities, and eventually nations.

This sociological evolution included basic rights, such as money, property, and agreements.

Traditional Governance Models

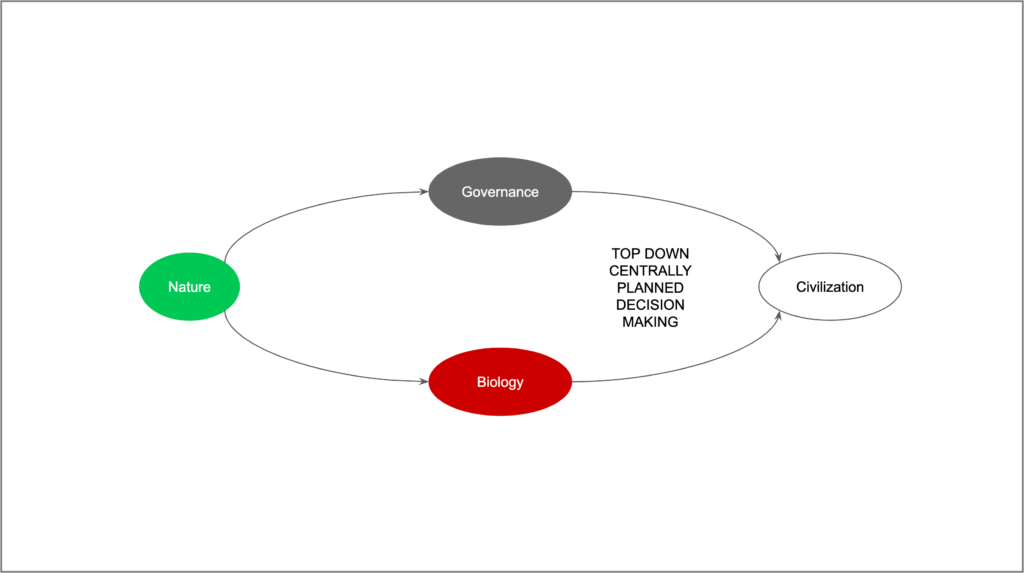

From a state of nature, sometimes called “the law of the jungle”, humans have developed governance systems and institutions that have enabled civilization.

Today, governance implies top down rule making processes and enforcement, institutions, central planning, social designs, constitutions, legal systems, voting methods, and formally designated leaders and representatives, amongst many other methods and tools.

However, that doesn’t mean that the more primitive and basic biological meta-group dynamics have been replaced, they are actually integrated as part of the system.

Biological meta-group dynamics remain in the form of alpha leaders and beta followers independent of formalized institutions.

For example, it is very common to see governments where formal leaders in power, such as the executive and legislative, appear as the persons in command, but, in practice, others are the ones holding real power. Lobby groups and strong technical government agency leaders, such as Alan Greenspan in his time at the Federal Reserve, may be examples of these primitive alpha-beta meta-group dynamics in politics.

Independent of formal governance and biological meta-group dynamics, the persistent problems in these systems are the systematic abuse of them, trusted third party risk, and subjectivity.

Top down governance systems, whether on traditional organizations or pseudo-blockchain networks, eventually inexorably seek to control money, property, and agreements which reside in digital form within their systems.

These are precisely the problems that secure proof of work blockchains seek to solve.

The Bitcoin Ungovernance Model

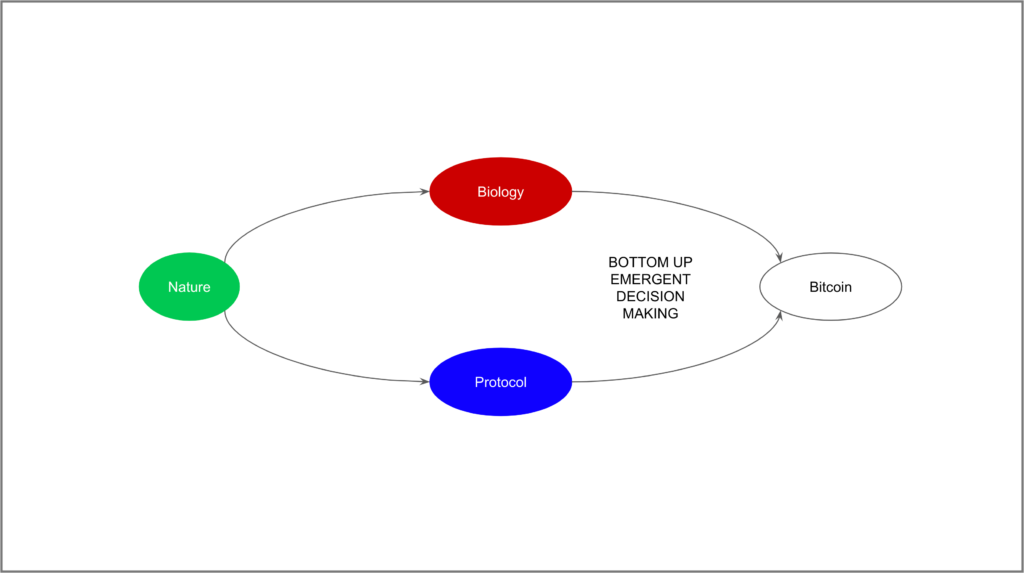

As mentioned previously, ungovernance implies exactly the opposite of traditional governance models.

In Bitcoin, ungovernance means that, from natural organization to blockchain, there is the biological meta-group dynamics mentioned before and, underneath, a strict protocol, which is internally secured by cryptography and the proof of work based Nakamoto consensus.

The underlying protocol was carefully designed to condition the behavior of all participants so their human action, even if they individually seek different functions or use cases for the system, actually reinforces the network and its security.

This means ungovernance is the absence, thus negation of all things that form governance. It can be described as a regression back to basic bottom up emergent organization in nature, but based on a strong set of artificial rules that protect and enforce basic rights.

This set of rules is essentially a sort of “bill of rights” but encoded on an immutable platform.

As in traditional governance, the biological meta-group dynamics of alpha leaders and beta followers also remain, therefore groupings and meta hierarchies still dominate the landscape.

Examples of alphas in blockchain networks may be Satoshi Nakamoto in Bitcoin, Vitalik Buterin in Ethereum, and Zooko Wilcox in Zcash.

These alphas may retain a natural leadership position in their respective ecosystems as they remain in their formal positions in foundations or other organizations; leave their formal positions, but remain active opinion formers; or, even if they have left entirely but left a strong legacy behind them.

If the cryptography, and biological and economic incentives work, then permissionless basic rights such as money, property, and agreements, on a global scale are enabled without the need of formal governance and trusted third parties.

The Future Is a Combined System

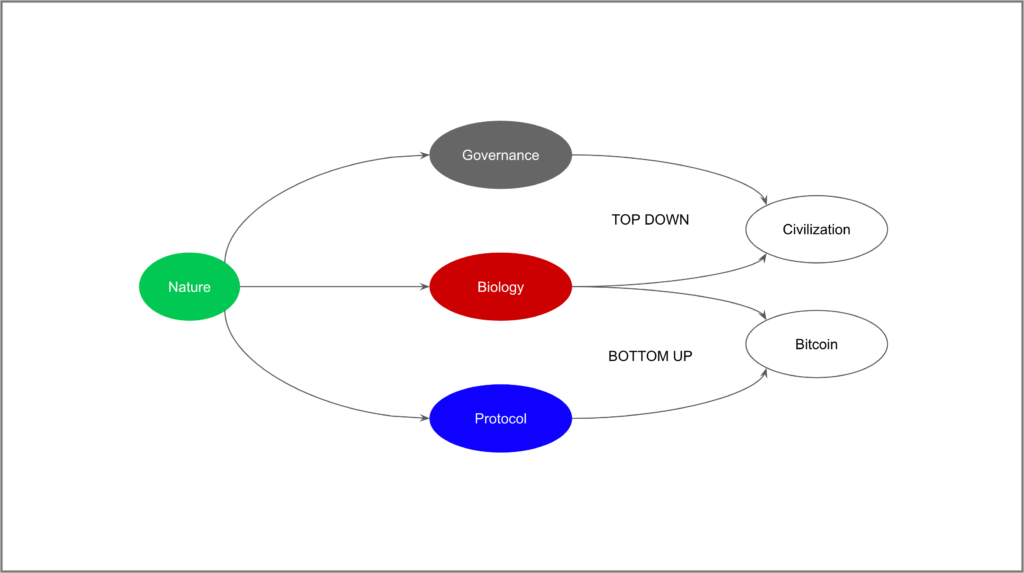

The fact that ungovernance exists in secure proof of work blockchains such as Bitcoin, does not mean that traditional governance systems are cancelled.

Legal systems and jurisdictions govern people and business off-blockchain.

An example of traditional systems managing off-blockchain conflict was the bankruptcy proceeding of the failed Bitcoin exchange Mt. Gox.

An example of a conflict that could have been perfectly resolved on traditional legal systems, but was not, was theDAO crisis in the Ethereum ecosystem. Perhaps, the controversial bailout they implemented, violating immutability, may have been avoided if they had pursued that alternative.

Other systems that may seek resolution in legal systems may be multi-sig wallet or smart contract hacks, ICO fraud, and stolen keys, amongst many others.

However, the cost of traditional systems may be significantly reduced or flattened, just like the internet flattened information and speech, which will eventually enhance social scalability across legal and cultural borders.

The BIP Process Is Not a Governance System

Many analysts and observers confuse the Bitcoin Improvement Proposal (BIP) process with governance. It is not, it is only a standards proposal process, and nobody has authority over anybody else. All participants reach rough consensus in an emergent way and voluntarily adopt the rules and changes if they choose to.

The beauty of the Bitcoin ungovernance system is that all participants have aligned incentives for the blockchain to work as designed, protecting their money, property, and agreements.

This means it is practically impossible to introduce controversial changes, but relatively easy to coordinate on a global scale to fix bugs, correct flaws, reverse involuntary chain splits, or upgrade the system, from time to time, with desired new features.

Conclusion

In a system such as Bitcoin, decision making and change are slow as the system was very well designed and established since genesis. It will likely be “ossified” in the future, which will make it even more immutable.

If what has been described in this article is correct, developers, analysts, and industry talking heads should stop promoting and trying to bring traditional governance systems to Bitcoin because they would make it less safe, thus less socially scalable.

Code Is Law