You can listen to this article and its explanation here:

This is a system that would be launched in parallel to the current logarithmically decreasing supply [1] of Ethereum Classic (ETC):

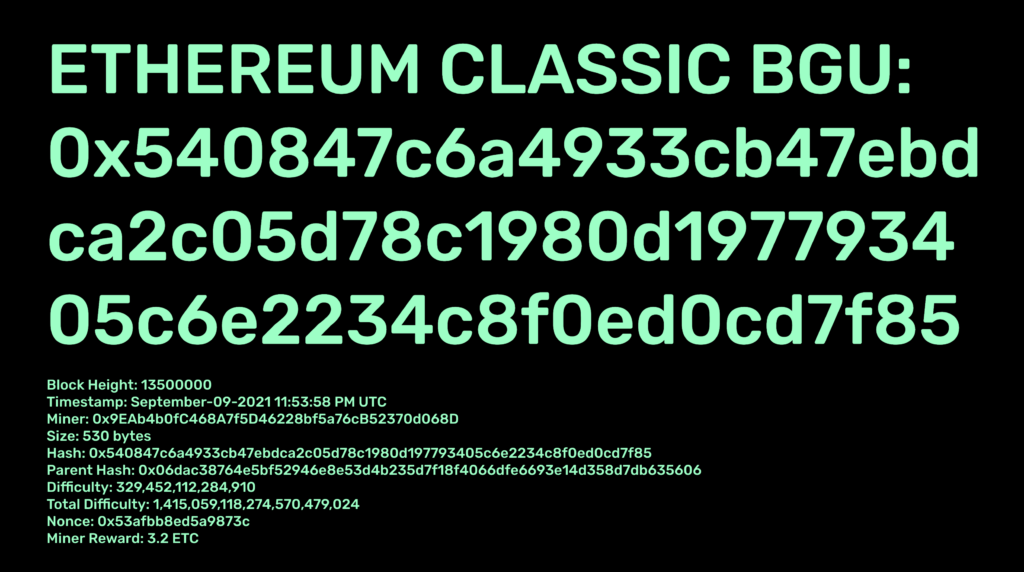

1. The system is a smart contract that gets all the blocks produced until the present and credits to all the accounts of all the miners who produced them retroactively the non-fungible Bit Gold [2] units (BGUs) of each block.

These BGU units are the proofs per block or block hashes, which are the real units of value in proof of work blockchains. They can be thought of NFTs (Non Fungible Tokens).

2. Now, the owner of each account of each mined block of the past has a BGU in a smart contract.

3. However, as the corresponding ETC coins of those past ~13.5 million blocks are freely circulating, those BGUs are locked so they can’t move them.

4. The only way to unlock the BGUs is to acquire coins (or get them from their other accounts) and transfer them to the smart contract.

5. The number of coins needed to release their BGUs is the same that were issued when the blocks were created (e.g. 5 ETC from block 1 to 5,000,000, 4 ETC from 5,000,001 to 10,000,000, 3.2 ETC from block 10,000,001 to the present, and so on into the future according to the supply schedule).

6. For future blocks, the account used to earn rewards (belonging to the miner or mining pool who worked on it) will get their non-fungible BGU and the rewards according to the ETC monetary policy as usual, but the miner or mining pool has the choice of using the coins or the BGU.

Example: If they send the coins to the smart contract, they can release the BGU, if not they can use the coins as usual, or they can just keep holding both indefinitely.

7. Once the BGUs are released, they can trade in a free decentralized market.

I think it must be easy to build a market where BGU owners can put their units for sale and bidders can buy them setting a market price for BGUs, as NFTs are traded today.

8. Once BGUs are released they can’t be sent back to the smart contract to get the original coins again. Those are technically burned.

9. Once free BGUs are in the market they may be used to build ingots, as per the original Bit Gold, and to back other coins or tokens that people may be free to issue as they please.

10. Free BGUs or ingots can be traded or just held as stores of value.

Notes

– I think the above establishes the “back up” Bit Gold system Nick Szabo has talked about in the past in case the community goes crazy with the monetary policy or the fee system doesn’t work [3].

– It creates a parallel Bit Gold system that may live together with the current monetary system.

– Whether eventually all the ETC are transformed into BGUs or not is a free market choice.

– Whether people build ingots and issue new BGU backed coins is also a free market issue.

– Whether the BGU system will eventually replace the ETC currency is doubtful because it seems that a perpetual option to transform ETC into BGUs prevents that.

– The above parallel system may be implemented with smart contracts without a hard fork, so it is very cheap to launch.

Or, it could be integrated as part of the base protocol as a hard fork.

Other than the BGU smart contracts with the characteristics above, all the other components (marketplace, ingot production, other coin issuance, etc.) could be left for others to build. The marketplace doesn’t really have to be built from the get go. I think we can leave the free market to do that if they wish.

What Are the Benefits of Creating This System?

1. It creates a parallel Bit Gold supply inside ETC, which is a much better monetary system because it is a perpetual issuance of BGUs per block, protecting the network from the social layer, and completely mimics the nature of gold in the physical world.

2. It does so in a non-traumatic way as the current ETC coin supply model continues uninterrupted.

3. It provides the “fallback” mechanism to Bit Gold which Nick Szabo talked about in case the fee model doesn’t work or the “community” goes crazy, like in ETH, and even in ETC, and they decide to change the coin supply again.

4. It potentially reduces the supply, or burns ETC.

Conclusion

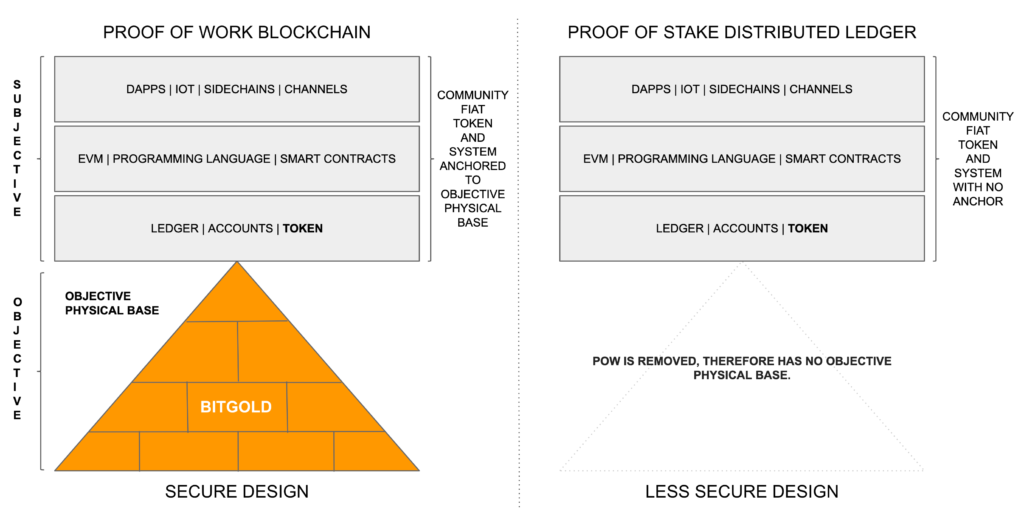

ETC, BTC, ETH are all community fiat systems [4] on top of Bit Gold. Those community fiat coins have no backing other than the full faith and credit of the “community”, where the core developers, miners, and node operators are The State.

The BGU system provides a much more robust and real “digital gold” system to ETC.

References

[1] The Ethereum Classic Monetary Policy Explained – by Donald McIntyre: https://etherplan.com/2020/02/25/the-ethereum-classic-monetary-policy-explained/10025/

[2] Bit Gold – by Nick Szabo: https://nakamotoinstitute.org/bit-gold/

[3] Bitcoin’s Security Budget In the Long Run – by Paul Sztorc: https://www.truthcoin.info/blog/security-budget/

[4] Why Proof of Stake Is Less Secure Than Proof of Work: https://etherplan.com/2019/10/07/why-proof-of-stake-is-less-secure-than-proof-of-work/9077/

“I call the subjective section in blockchains and distributed ledgers a ‘community fiat token and system’ as an analogy to fiat monetary systems, but instead of managed by governments or central banks they are managed by their ecosystems. In other words, all the rules, balances, smart contracts, and applications can be changed if agreed upon by the participants.”

Code Is Law