A blockchain monetary policy determines issuance and destination, if destination is changed, as in the Treasury proposal [1], then the monetary policy is changed.

Coin burning also changes the monetary policy because it is essentially a change in issuance:

Issuance per block – burned coins = net issuance.

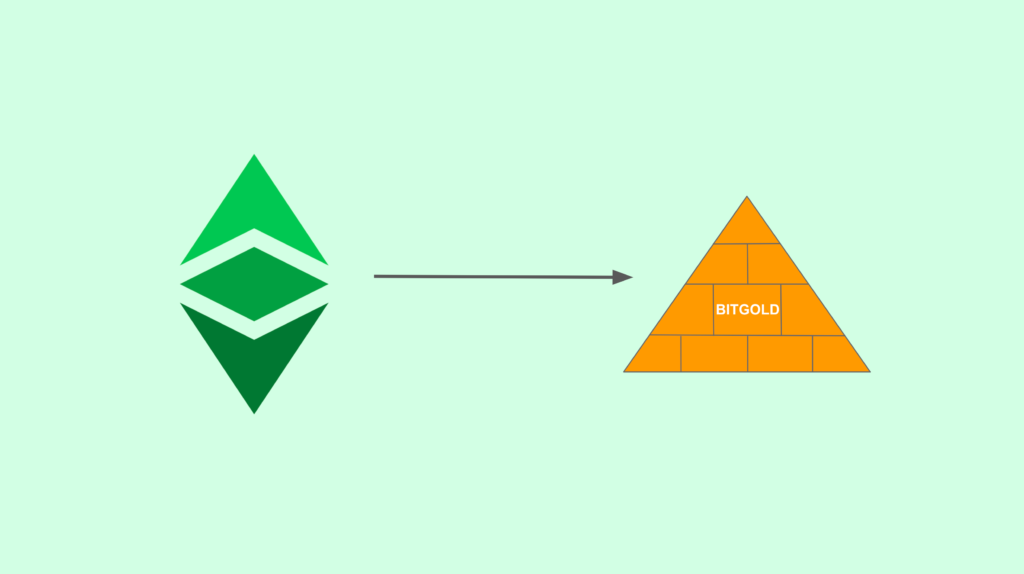

The only kind of monetary policy change I would agree to is a migration to Bit Gold [2], which is a regression to the origins of cryptocurrencies where the object of value are the proofs per block and not arbitrarily issued coins as Bitcoin and all these networks do.

These arbitrarily issued coins are basically “community fiat money” [3] where the devs, miners and node operators are The State.

In all truth Bitcoin and Ethereum Classic ARE NOT digital gold…they are arbitrarily issued coins per block. Just a software parameter.

This is why they are so prone to manipulation and constantly attacked [4] by crazy developers and “computer scientists” who are central planners by heart.

Bit Gold is as secure as real gold…it is impossible to forge and to issue more or less.

However, just like gold, it may be “mined” perpetually. This is good and bad.

Good: it solves the “fee model” [5] problem because miners can earn bit gold perpetually.

Bad: this perpetual issuance becomes like gold that perpetually dilutes itself at a rate of ~1.7% per year due to new mining.

Once ETC is migrated to Bit Gold, then the proofs per block can be grouped into bundles and sold as fungible bundles just like gold bars or ingots.

Then, these gold bars may be used to back ERC20 tokens so we can have fully fungible and divisible currencies.

Another thing that is a change of the monetary policy is that mining guarantees the most “fair” and rational distribution of the next 80 million [6] ETC.

This is because, to earn all those future coins, miners actually have to buy machines, hire people, build data centers, and pay for enormous quantities of electricity to be able to win the rewards.

As these costs approximate the value of the coins, the great majority of the rewards per coins have to be sold into the market for them to pay for all their costs.

This forcefully injects the coins into the economy in the most rational way.

The same dynamics are obviously retained if ETC were to migrate to Bit Gold.

References

[1] Ethereum Classic Treasury: Response To Charles Hoskinson: https://etherplan.com/2021/06/01/ethereum-classic-treasury-response-to-charles-hoskinson/15909/

[2] Bit Gold – by Nick Szabo – December 29, 2005: https://nakamotoinstitute.org/bit-gold/

[3] Why Proof of Stake Is Less Secure Than Proof of Work – by Donald McIntyre:

“I call the subjective section in blockchains and distributed ledgers a ‘community fiat token and system’ as an analogy to fiat monetary systems, but instead of managed by governments or central banks they are managed by their ecosystems. In other words, all the rules, balances, smart contracts, and applications can be changed if agreed upon by the participants.”

Source: https://etherplan.com/2019/10/07/why-proof-of-stake-is-less-secure-than-proof-of-work/9077/

[4] EIP 1559: The Final Puzzle-Piece to Ethereum’s Monetary Policy – by David Hoffman: https://medium.com/@TrustlessState/eip-1559-the-final-puzzle-piece-to-ethereums-monetary-policy-58802ab28a27

[5] Bitcoin’s Security Budget in the Long Run – by Paul Sztorc: https://www.truthcoin.info/blog/security-budget/

[6] Ethereum Classic’s Monetary Policy Explained: https://etherplan.com/2020/02/25/the-ethereum-classic-monetary-policy-explained/10025/

Code Is Law