Financial planning and financial advisory services were always reserved for the rich or they were too expensive to justify.

With the internet, the web, and mobility this is changing. Some companies have developed technology and business formats that enable the distribution of professional, one-on-one advice at a fraction of the cost of traditional services.

There are different levels of service depending on your needs. You can choose more sophisticated dedicated advice or you can use question and answer databases and then hire a professional if needed.

No matter what your financial planning needs one of these services will have the solution for you:

When you need a specific answer to a particular financial issue this free service provides the solution. It consists of enabling users to ask specific financial planning questions like “do I need to set up a trust?” or “how do I calculate my retirement cash-flow?”. NerdWallet then uses its directory of Certified Financial Planners and has them answer the questions that are subsequently posted on their site. The company filters and curates the answers for accuracy and relevance. Since they have thousands of answered questions they have created a knowledge center where users can search for questions and answers and maybe find the right ones for them. If users want to actually contact the advisers to continue talking or eventually hire them, NerdWallet provides that service as well.

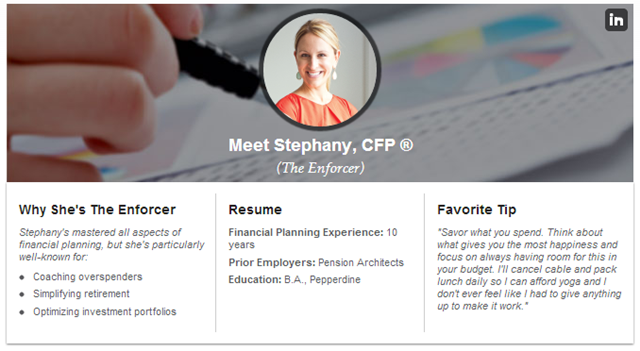

On this platform you contact a LearnVest Certified Financial Planner directly. Their system is based on programs that solve different aspects of your personal finances like starting and managing an investment portfolio, plans for paying down debt, or income and expense budgeting. Their service is priced for these programs and they all have a amonthly subscription of $19 as well as a set-up fee that ranges from $89 to $399 depending on the type of plan. This service is perfect if you need to solve specific aspects of your finances and you want personalized advice with a disciplined process to implement it.

If your finances have a higher level of complexity and you also need professional, ongoing, investment advice, then Personal Capital is perfect for you. For 0.90% a year they plan and manage your portfolio and you establish a relationship with a Certified Financial Planner that is also available when you need to talk about your money. Their service starts with a dashboard where you can link all your financial accounts so they can be tracked in one place. Then you open an investment account that will be managed by Personal Capital according to your needs. Their technology platform enables you to access your finances whenever you want, move money from anywhere to anywhere, and contact your adviser so you can both work on your dashboard in real time.

Conclusion:

Now there is no reason to go through the difficult task of managing your money on your own. Either for free or for a low cost there are different services available that provide solutions for a wide range of financial planning needs.

These new finance services are providing access to nearly everyone who has a computer or mobile device to a whole new world of sophisticated solutions that were only available to the rich.