You can listen to or watch this article here:

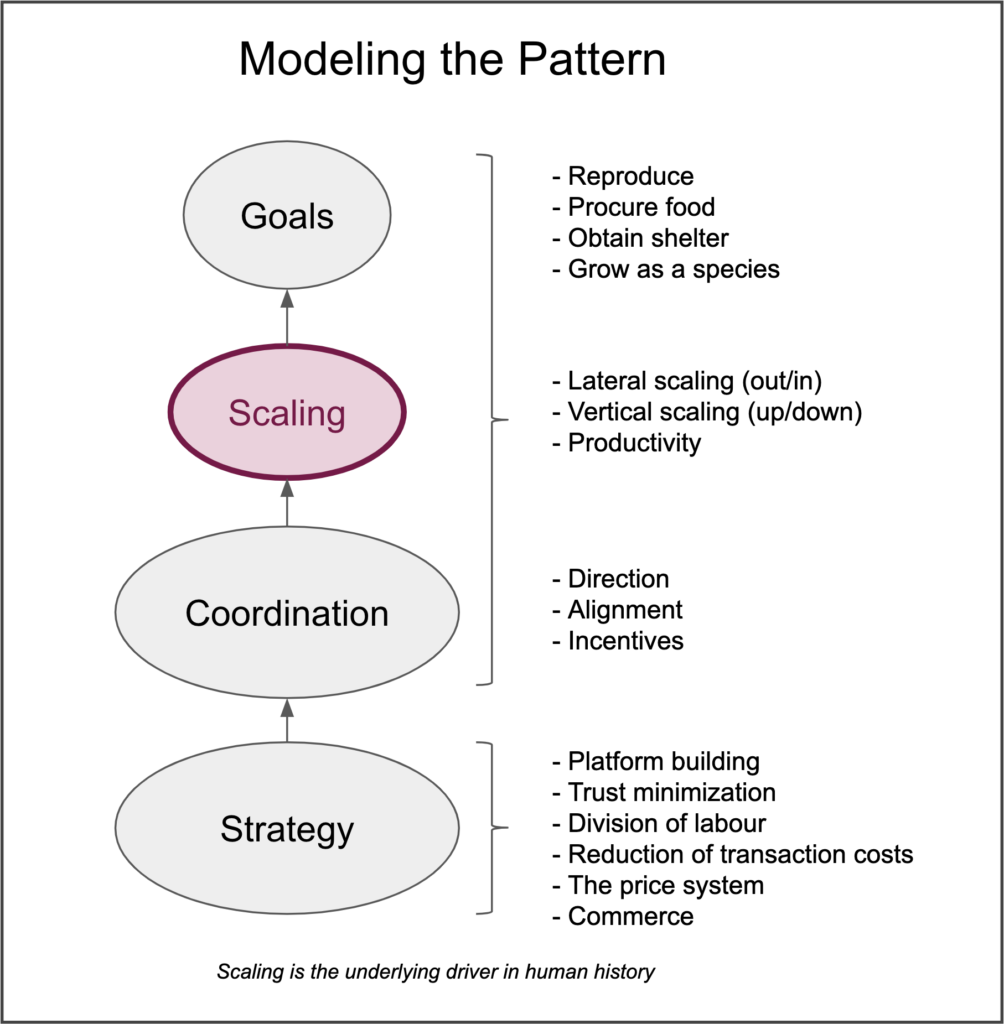

As I described in my human scaling model as related to blockchains, Scaling and Blockchain Governance, our individual evolutionary goals are to replicate our genes, procure food, and to obtain shelter.

Our success in these goals results in the growth of our species as an externality:

However, there is an emerging and continuous conflict in the model that expresses itself as the simultaneous opposing forces of centralization vs decentralization.

Platform building is a strategy that generally leads to centralization because commonly used platforms with network effects are like gravitational forces that drive people to focus on them to minimize mental and frictional costs. Examples of these platforms may be the banking system, social networks or even government systems when you think of them as decision making platforms.

Division of labour is a way to relieve individuals from tasks by transferring them to other individuals. When we all transfer to each other ever more specialized tasks, we are effectively centralizing those tasks because, instead of us doing everything for ourselves, we are delegating that to groups of individuals who eventually become like monopolies in their highly specialized activities. For example, there are ever fewer banks in the world that hold our deposits, very few social networks that control and store our online information, and every nation has only one national central government.

Trust minimization is what we do to compensate for the centralization forces in platform building and division of labour. Trust minimization is decentralizing because it seeks to disintermediate the monopolies of specialized individuals who control important parts of our lives, such as money, information and collective decision making. In the case of government, a typical trust minimization strategy is the concept of constitutional democracy, because it divides roles in the state (executive, legislative and judicial) and somewhat attempts to distribute decision making by establishing popular voting on a regular basis.

When we evolved to create the price system, using money as a coordination device to conduct commerce, we were seeking to reduce transactional costs by minimizing conflict between untrusting groups and the cognitive load of having to think of many prices between an unending variety of products. Selecting unified forms of money tends to centralization because it induces economic agents to use the platforms that support the currencies we selected. For example, the US dollar is an important worldwide currency standard that induces large numbers of consumers, businesses and governments globally to use the US central banking system to store and transfer value.

How is all of the Above Related to Social Attacks on Public Blockchains?

If we want to coordinate by building platforms to divide labour, but at the same time those lead to centralization with trusted third party risks, then we are presented with an unsolvable social tension that persists in time. Trust leads to cost reductions, but also leads to increased centralization risks. And this balancing act is constant.

Public blockchains, both for monetary systems or smart contracts, are trust minimization strategies. We seek to solve the “trusted third party problem” by creating peer to peer systems to connect, which, at the same time, use strong cryptography based tools to minimize risk.

Because trust minimization does not mean “trustless”, and economic agents naturally seek to maximize returns, blockchains import the same dynamics: Miners want more revenues, full nodes want the integrity of property and agreements for their users, and developers want their innovations to be adopted.

Not only do these core stakeholders naturally incur in these tensions, but the broader blockchain ecosystem, with consumers, businesses and governments are increasingly interested in advancing their interests as well. For example, more consumers want the value proposition and benefits of blockchains, corporations want high performance and scalability, banks don’t want to lose their margins, and governments don’t want monetary policy out of their control.

How are These Persistent Tensions Manifested as Social Attacks on Public Blockchains?

Public blockchains are objective and inert mechanical systems, so the tensions described above that play in favor or against them are primarily at the social layer. Within this layer, hackers may launch technical attacks, such as 51% double spends, sybil identity forgery, or network partitions. On the other hand, individuals and organizations can also launch purely social attacks that can eventually undermine the integrity of the networks.

Since the creation of Bitcoin, there have been all sorts of these purely social attacks, many of them absolutely inoffensive, such as just criticizing its technical design, declaring it useless against traditional alternatives, such as gold, or building substitute systems with marginal benefits, such as Litecoin in October of 2011.

However, in the last few years the conflicts have been in crescendo. During the block size debates between 2015 and 2017, there was an agreement made in New York, hence its name, NYA, with miners, representing 80% of hashing power, full node operators and exchanges, which sought to change the rules of the network for business reasons, such as faster scaling and performance, disregarding important technical and security concerns.

In the Ethereum blockchain, in 2016, there was a bug in an application called TheDAO that enabled a hacker to steal funds from its users. Subsequently, the core developers and the Ethereum Foundation decided to implement an irregular state change to bail out the application. This was done even if didn’t affect the core protocol in any way, while violating basic blockchain principles, such as immutability of the state.

In the Ethereum Classic blockchain, there was not only a technical 51% attack performed earlier in 2019, but in the last eight months the largest core developer team’s parent organization did some controversial moves, such as removing admins from the community Github repo, creating a parallel protocol improvement proposal process, and making a unilateral announcement changing a future block number for the upcoming Atlantis hard fork.

At the time of writing this article, there are many ongoing social attacks on public blockchains. These range from large corporations launching their own currencies, falsely describing them as “cryptocurrencies”, comparing them to Bitcoin as “stable” while saying BTC is “speculative” and “volatile”, and explicitly characterizing public blockchains as “used by crooks”, to politicians and Nobel prize economists actively calling for cryptocurrencies to be shut down.

Other types of social attacks come within industry participants who seek opportunistic gains by designing on-chain voting systems claiming Bitcoin has unruly governance, creating competing alternatives of proof of work, the underlying technology that secures public blockchains, while falsely characterizing it as a technology that is bad for the environment or inefficient, when in reality it actually helps the environment and it is purposely inefficient to favor social scalability.

What Some see as Toxic Others see as Security

A strategy that has naturally evolved in the blockchain industry to compensate for our natural tendency toward centralization has been to use social media, such as “Crypto Twitter” or Reddit, to vigorously denounce social attacks that are perceived as undermining the integrity of public blockchains.

The dynamics of this supposedly “toxic” behavior are to seek symmetry against the forces that are perceived to put in danger the principles of blockchains. When one side has capital and resources to push an agenda, the other side has social media, which is a leveling technology used to compensate and balance power.

Conclusion

As platform building and division of labour tend to centralize systems, posing risks to users, trust minimization strategies seek to neutralize those forces.

Public blockchains are trust minimization strategies as they seek to use strong cryptography, proof of work and economic incentives to connect users to help them coordinate, while minimizing dependency in trusted centralized parties.

As all stakeholders in public blockchains have inherently selfish interests, they engage in a constant dynamic of social attacks which are subsequently counterbalanced by using defensive strategies. Amongst these defensive strategies are communication actions on social media, wrongly described as “toxic”, that reduce asymmetries between powerful and common participants in the industry.

Because these dynamics are not solvable other than by playing out in the free market, public blockchains are, and will always be, under constant social attack.

Code Is Law