You can listen to or watch this article here:

This past Wednesday, June 19th of 2019, I went to the Boulder Blockchain Meetup and I was asked “Why do you think Ethereum Classic is still viable after the 51% attacks this year? Why does ETC even have value today?”.

I have to admit I was nervous as the question was being formulated because I was not ready with a prepared response to overcome such a legitimate objection. After all, the whole blockchain industry has been induced to believe, even by Satoshi, that blockchain reorgs and double spends are catastrophic for Bitcoin, or any proof of work blockchain for that matter.

So, my response was somewhat disorganized, but went something like this:

During the days of the 51% attacks in ETC, which happened between January 5th and January 7th of 2019, I was personally devastated. All the ETC community was shocked by the events. I had worked in a previous project with Elaine Ou, a highly respected scientist and blockchain expert, and with her we had argued with Vlad Zamfir on Twitter that if a 51% attack ever happened in Bitcoin, then it was “game over”, the project would be dead:

I though ETC was going to go to $1. I even proposed a proof of work mining algorithm change to try to save the chain.

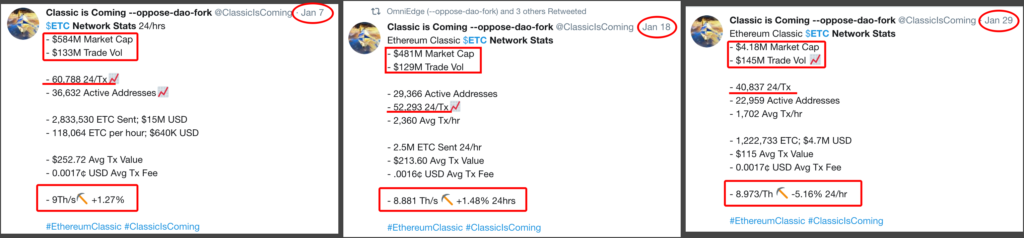

However, as time passed and we discussed the events within the ETC community on the community Discord (we were online 24 hours a day!), some voices of reason, and reality, started to show us a different story. Even as Coinbase suspended trading, and even with the 51% attacks, ETC was not crashing in the market and all drivers and metrics were performing normally, as if the attacks had never happened:

As may be seen above, from January 7th, when we were still unaware of the extent of the attacks, to January 29th of 2019, ETC experienced a relatively mild downward trend in its key metrics, especially considering that a “catastrophic” double spend attack was performed: Market capitalization was down, but that was in the context of a generalized bear market, which reached its lows in early February. Twenty four hour transactions were also down, but within the historical range, and also affected, as all blockchains at the time, by the generalized bear market. And, the mining hash rate was surprisingly stable during the period at around 9 Th/s, which is also the historical average.

When I had insisted about my idea of changing the mining algorithm, Anthony Lusardi and Yaz Khoury, of the ETC Cooperative, argued that it was not necessary because a) it would be a change at the protocol layer which is something I had been against, b) a chain reorg using 51% hashing power is an assumption of proof of work blockchains, therefore the network worked as designed, and c) in any case, a double spend is a problem between the sender and the receiver of ETC, not a systemic failure of the blockchain.

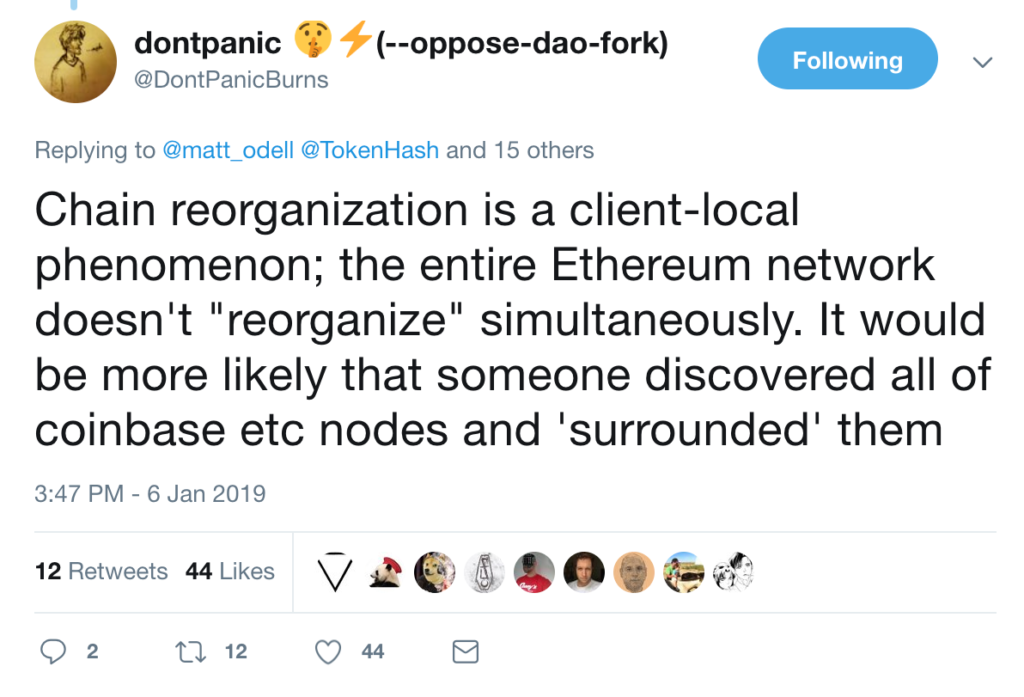

The first person in ETC I had seen argue about the “local” nature of a double spend was blockchain architect, administrator of the ETC community Github, Cody Burns on Twitter:

Then, @phyrooo, another active community member, wrote an article that provided a rational explanation for ETC’s resilience. In it he wrote:

The 51% attack is not an attack on the network itself but rather on ‘naive’ network participants. Whenever we make a transaction we can decide the number of blocks we are willing to wait to ‘convince ourselves’ that the transaction is set in stone. In both Bitcoin and Ethereum chains, the transaction finality is merely probabilistic. However, even though it is probabilistic, with the current Bitcoin network hashrate you can be pretty sure that waiting 30 blocks will give you a VERY nice guarantee that the transaction will stay on the chain.

Even Elaine Ou changed her views about 51% attacks and wrote an article on Bloomberg about the ETC attacks and how risk is explicit and manageable by users in proof of work blockchains. Unlike the traditional banking system who hides risk:

It was once thought that a successful 51 percent attack would similarly undermine the integrity of a cryptocurrency. The purpose of a decentralized blockchain is immutability, and if it fails at its one job, merchants and exchanges would refuse to accept payments, participants would flee, and the network would collapse and die.

With the exception of PiedPiperCoin, all previously attacked cryptocurrencies are still chugging along.

Attacks are easier on lesser-known blockchains: To become a majority miner on Ethereum Classic costs only about $4,000 an hour, and the honest blockchain could be outpaced in less than 15 minutes. Participants should either wait longer to confirm payment, or transact in smaller amounts.

Financial institutions make people feel safe by hiding risk behind layers of complexity. Crypto brings risk front and center and brags about it on the internet. It’s a bit uncivilized, but for some participants, a world where risk is quantified and individual is preferable to one where it’s unknown and distributed.

When it comes to killing a blockchain, 51 percent is not nearly enough.

Zachary Belford, ETC core developer at ETC Labs Core, conducted an investigation and a subsequent post mortem meeting on Jan 9th. In it, the conclusions were that ETC had worked as designed, that no material changes were needed at the protocol layer, and that ecosystem growth was the underlying driver that would minimize 51% attacks in the network going forward.

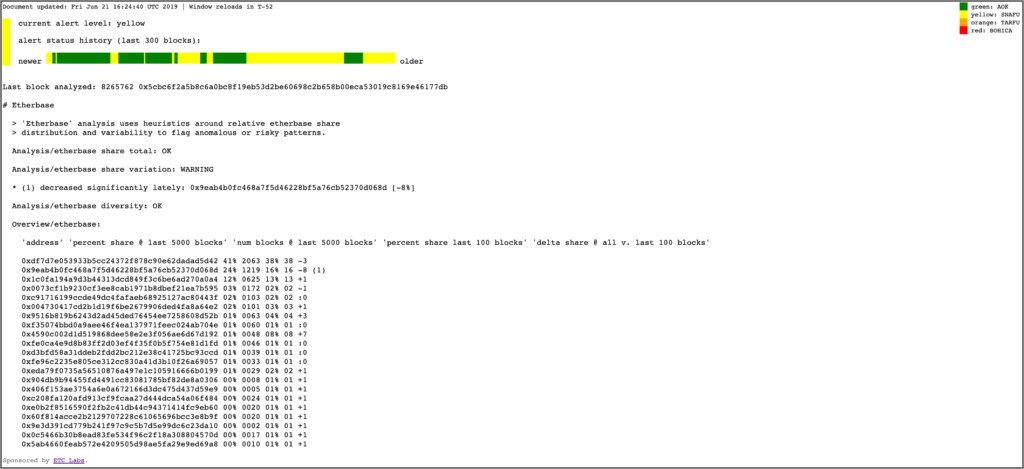

A decision that was made, though, was to build a monitoring system to alert the ecosystem about possible suspicious activity in the network, this was built by Isaac Ardis, who is also an ETC core developer and ETC Labs Core:

One very interesting, and unexpected thing that happened after the attacks is that the hackers who performed the 51% attacks actually partially returned the money to the victims who were mainly exchanges. CoinDesk wrote about one of the of those reimbursement events:

Cryptocurrency exchange Gate.io said Saturday that $100,000 in ethereum classic has been returned following a recent hack.

The exchange at the time identified three addresses that it said were tied to the attacker in question.

China-based security firm SlowMist first detected the 51 percent attack and detailed the event in a blog post on Wednesday last week, and said it was willing to work with Gate.io, Bitrue, and Binance in order to locate the attacker.

What the above shows is that the social layer, as blockchains like ETC are necessarily transparent, has tools and ways of combating double spends in addition to simply waiting for more confirmations. 51% attacks are evidently not only a technical prowess that demands a significant effort, but also demand having the capital to perform them in the first place, and attackers assuming the risk that they will be tracked and possibly prosecuted on traditional legal systems.

Conclusion

My summary of the events and the reaction of the community is that:

- 51% attacks are not the boogeyman we all came to believe in the blockchain industry.

- Double spends are a local problem between senders and receivers.

- As Anthony Lusardi wrote, even before the ETC attacks, receivers can protect themselves by using more block confirmations.

- Reorgs are very expensive technically and risky at the social layer.

It takes a lot of mental and emotional stamina and cognitive work to process these things when your preferred blockchain is attacked. Nevertheless, as it is demonstrated above, ETC has incredible and brilliant talent working on it. That, together with real life experience, however traumatic, is part of the journey.

ETC is signaling to the world the information that proof of work is more resilient than previously thought, and that antifragility and Lindy effect are significant drivers that are evidently working in Ethereum Classic’s favor.

Why does ETC have value? Because of its sound design and the brilliant talent working on it.

Code Is Law