Manilla is a digital bills and statements organizer and online file cabinet. To use it you need to go to Manilla.com or download their mobile app on the Apple App Store or the Google Play store.

It is a very focused service with a unique business model which is why it is so attractive and is actually accelerating its user growth. Since the company came out of beta in 2012, it has gained 500,000 customers, but they project to grow to 1.000.000 in just the next 6 months.

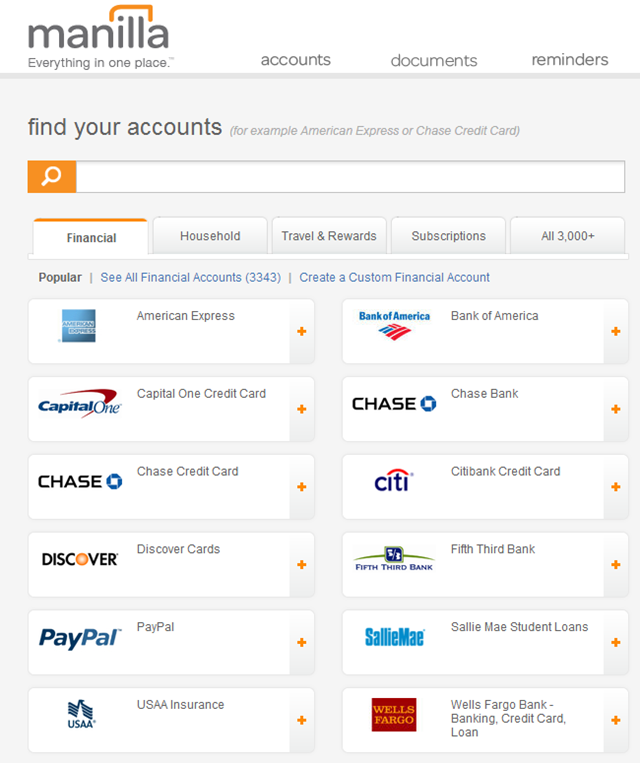

Manilla’s solution is to organize and actually replace all paper bills and statements we receive on a regular basis. The service has more than 3.500 statement and billing providers in its system including banks, insurance companies, brokers, electric utilities, phone services, rewards systems, and even daily deal services like Groupon and Living Social. With this amount of services it is difficult not to find your providers on their platform!

It all starts by linking all of your accounts on Manilla. You do this by entering the ID and password of all of your providers just like when you use their websites or apps. Once you do this you will have everything in one place on the Manilla dashboard. From then on you will be able to check your account balances and bills on their service using only one password and also your old paper statements will be eliminated and replaced by electronic files that will be stored digitally and organized for ever so you can have them handy and check them whenever you want.

This is Manilla’s introductory video:

The great difference between Manilla and Mint, Check, or any other account tracking and budgeting service is that Manilla is completely focused on organizing your life. It is the best in helping you manage and store all your paper statements, bills, alerts, and notices from all your providers and it doesn’t have a budgeting, goal setting, categorization, reports, or even a bill payment system.

The above is what makes Manilla so easy to use, focused, and satisfies the needs of a growing share of American households who don’t use such features to manage their money.

What they do provide, and this is also what makes them unique, is a full communications channel directly between you and your providers. This is, when you use Manilla to track a specific account you go to a special page where you can link and manage your relationship with that specific provider. This is like a private space where the brands can also send you messages or communicate important things free of clutter or advertising from other brands.

In a world where all new finance services are trying to dis-intermediate our relationships with our providers this is the most powerful feature of their service. It is so valuable that Manilla users are reporting much more engagement with their providers through Manilla and actually use their websites much more than before. So, in this sense, Manilla is really establishing a better connection between us and our providers which seems logical and beneficial for both sides.

Conclusion:

To summarize, on Manilla we link all of our accounts and providers in one place, eliminate all paper bills and statements, digitally file everything, enhance our communications with our providers, and therefore, significantly organize our lives!

In this interview with Newfination, Sarah Kaufman, Manilla’s Marketing Manager, explains how Manilla works: