If there has been a bad omen this dramatic year 2020 has been the unanimous consensus; in the United States, Europe, and elsewhere; to print trillions of dollars, euros, and other moneys; remarkably expanding their monetary bases, with no critical thought whatsoever, to compensate for the negative effects of the irrational COVID-19 reaction.

The negative connotation is the confirmation that, given a sufficiently external shock, consensus for any kind of solution, whether good or bad, across any regions or cultures, is easy to reach.

I think this is the ultimate point that some make when arguing for “weak subjectivity” and proof of stake systems, incorrectly using the term “absolute finality” when referring to such systems.

However, the original purpose of Bitcoin was to actually do away, as much as possible, with such subjective margins (hence risk or trust “minimization”). And, to do away with such margins is for a good ethical purpose (in philosophical and political terms) as even minimal margins of human agency are unavoidably eventually taken advantage of by cheaters and abusers.

I agree with weak subjectivists that Bitcoin isn’t free of such risks, but that does not mean that “because Nakamoto consensus has some trust margins, that means subjectivity is fine”.

That is the fallacy I think is put forward with the “weak subjectivity” justification (and “weak” is a euphemism, as minimal margins lead to full subjectivity anyway). In fact, weak subjectivity is only a temporary socially palatable precursor to full centralized control of systems.

The more reasonable or true argument is “because Nakamoto consensus has some trust margins, that means more work has to be done to reduce them even more”.

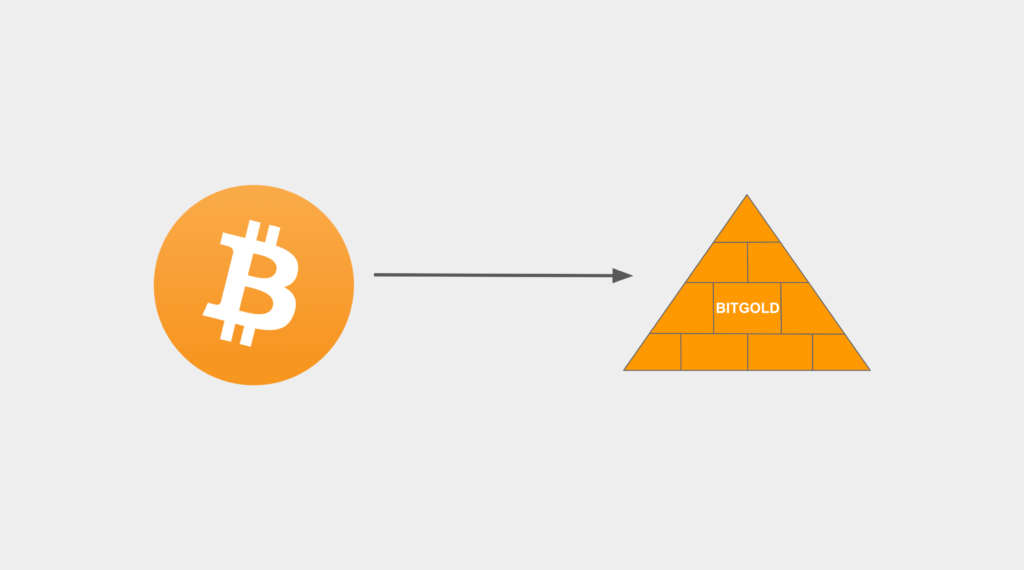

It is also why Bitcoin will likely migrate to Bit Gold when the time comes.

It is unlikely that proof of stake systems, and their complementary gadgets, can achieve that level of safety guarantees unless they become layer 2 systems on top of proof of work.

Code Is Law