What follows is an email I just wrote to Vitalik Buterin, Founder of Ethereum. I did not edit grammar nor spelling to preserve originality.

Hi Vitalik,

Latest ETH stats are impressive and, I think, a significant undeniable achievement:

– 1.4m daily transactions

– $17m in transaction fees

– Average fee per transaction $12

– $5.14m in rewards

– Market cap of ETH: $43 billion

– Market cap of ERC20 tokens: $50 billion

– Wrapped Bitcoin inside Ethereum: $800m

– Hash rate: 245 TH/s

Although much of the activity may be the latest fad in #DeFi products and services, of which many may last or not, my observations are as follows:

Transaction volumes and fees are impressive and show the Nakamoto consensus model, given adequate calibration of parameters, can be successful and may pay itself by providing value in trust minimization on a pure fee basis.

The fact the average fee per transaction is around $12 is a symptom of success, not failure. Base layer blockchains are about security, not scalability. I think, eventually, fees on proof of work base layer chains will be perhaps $50, $100, or even $1000 per transaction, depending on daily volumes and network physical constraints.

That block rewards are significantly lower than transaction fees is part of the success I mention above, imo, but I would say it is not a good policy to manually change supply from time to time. Monetary policy must be fixed and predictable.

Note mining has not been centralized in Ethereum or Bitcoin even with today’s large market caps and rewards per block, and hash rates remain high and trending higher.

That the market cap of tokens (again, saving the fact that they may be ephemeral in some cases) is very high, especially to move USD in a trust minimized way (which is impossible in banking) in products such as Tether or USDC, is also a significant achievement, imo.

The proliferation of decentralized exchanges, however rudimentary, is a key internal feature (and indication of market demand) to eventually ensure full trust minimization in the complete life cycle of transactions.

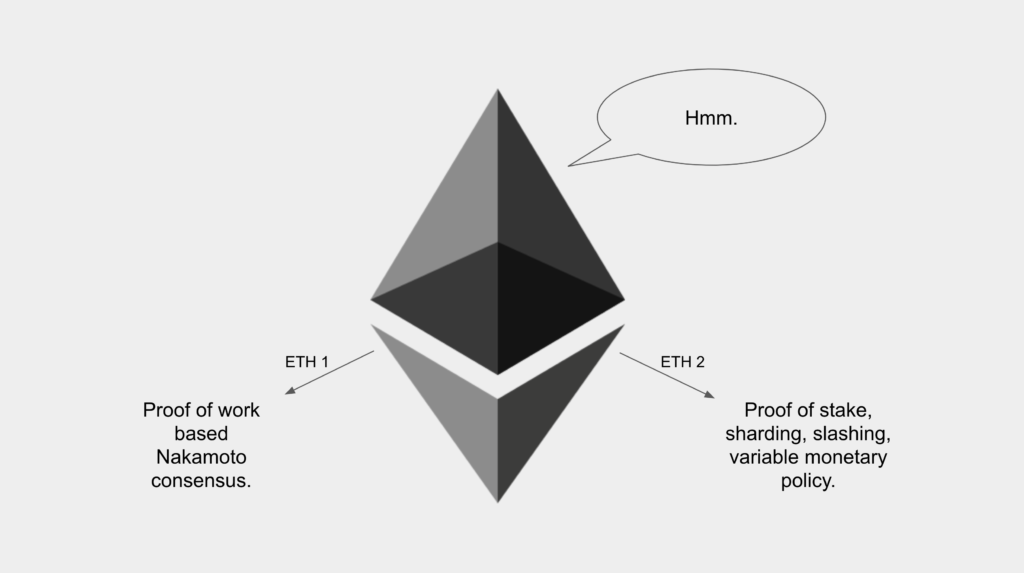

Implications for ETH 1 and ETH 2:

I think the evolution and development of Ethereum in the last five years, although you know I completely disagree with many policies and decisions that have been made, are proof of the high value of the current model. I understand scalability has been and is the next big challenge, but a full migration of what has been achieved to an unproven model (e.g. beacon chain, sharding, validators, proof of stake, slashing, weak subjectivity, etc.) is not only extremely risky, but I would say an irrational denial of what can so obviously be observed right now in concrete market demand and metrics. Trust minimization is the most important, if not the only paradigm of this industry.

I think, further validation of the Ethereum standard that you have invented (smart contracts on Nakamoto consensus) and successfully led to this point is the fact that Polkadot, EOS, Tezos, Cardano, and several others with not trivial market caps; with their “governance”, voting, nominators, bakers, block producers, epochs, treasuries, and so many other gimmicks; are essentially clones of Ethereum or even ETH 2, but with distracting trinkets. Their main selling point has been that they could get there first, but nobody is actually using those chains for anything valuable other than day trading and arbitrage.

Those systems, as is ETH 2, are complex and will inexorably lead to centralization and capture. Nobody wants to control a cloud service or its decision making process except owners with large stakes or governments. Users just want reliability and security.

However, the above does not mean ETH 2 is not valuable. Of course, at some point, trust minimization must scale, and very likely the peripheral ETH 2 shards may serve as sidechains to ETH 1 (and Bitcoin as shown by the success of WBTC). But ETH 1 should remain at the core as a security provider, not a PoS beacon system. Eventually, all PoS systems will be on AWS, Google Cloud, Oracle Cloud, AZURE, or telecom cloud services. But, I don’t think cumbersome systems with complex, capturable designs and governance can compete with those.

Congrats for the success of the current Ethereum.

Donald

[After re-reading this email I think I may post it on my blog etherplan.com]

—

Donald McIntyre | Etherplan

Code Is Law