You can listen to or watch this article here:

A while ago I wrote an article that compared Fedwire, the Federal Reserve’s real time gross settlements (RTGS) system, transaction volumes with Bitcoin’s capacity before and after the SegWit upgrade.

In this essay, I will compare seven major currencies in the world and their centralized high value RTGS systems with Bitcoin (BTC) and Ethereum Classic (ETC), as blockchain base layers, independently and combined.

Summary

- All traditional RTGS systems are part of a layered stack.

- RTGS systems are the “apex” high value settlements and finality engines in traditional fiat payment systems.

- The major systems analyzed are Fedwire (US dollar), Target2 (Euro), CHAPS (British pound), SIC (Swiss frank), HVPS (renminbi), CHATS (renminbi and Hong Kong dollar), BOJ-NET (Japanese yen), and FXYCS (Japanese yen).

- Bitcoin individually has higher daily and yearly volume capacity than all systems individually, except Fedwire.

- Ethereum Classic individually has higher daily and yearly volume capacity than all systems individually.

- Bitcoin and Ethereum Classic combined have higher yearly annual volume capacity, but lower daily capacity than all systems combined, however this is overcompensated because BTC and ETC operate 24/7/365.

- If mainland China volumes are added, then both Bitcoin and Ethereum Classic lag in transaction capacity on a daily and yearly basis.

- Base layer proof of work blockchains as Bitcoin and Ethereum Classic are analogous to RTGS systems in the blockchain industry, but with the invaluable advantage that they are trust minimized, decentralized, unrestricted across national borders, and programmable with smart contracts.

- However, both Bitcoin and Ethereum Classic would benefit with incremental scaling overtime.

- BTC and ETC individually and/or combined could capture the global highest value segments in RTGS settlements first, while they scale overtime.

- Another possible path is for BTC and ETC to capture specific types of transactions, such as cross border settlements.

- Due to physical and security constraints, to scale and integrate with retail systems, the crypto industry needs to be layered following traditional settlement systems patterns.

- Traditional settlement systems are controlled by central entities and are not socially scalable globally. Only local authorized members have access to RTGS finality.

- Bitcoin and Ethereum Classic are permissionless and socially scalable globally.

Methodology

All values are expressed in US dollars (USD).

The data was retrieved from the original sources (see links to RTGS systems below), when available, or from data compiled by the Bank of International Settlements. The latest year where all data was available for all systems in this article was 2017.

USD is US dollar, EUR is Euro, GBP is British pound, CHF is Swiss frank, RMB is Chinese renminbi, HKD is Honk Kong dollar, and JPY is Japanese yen.

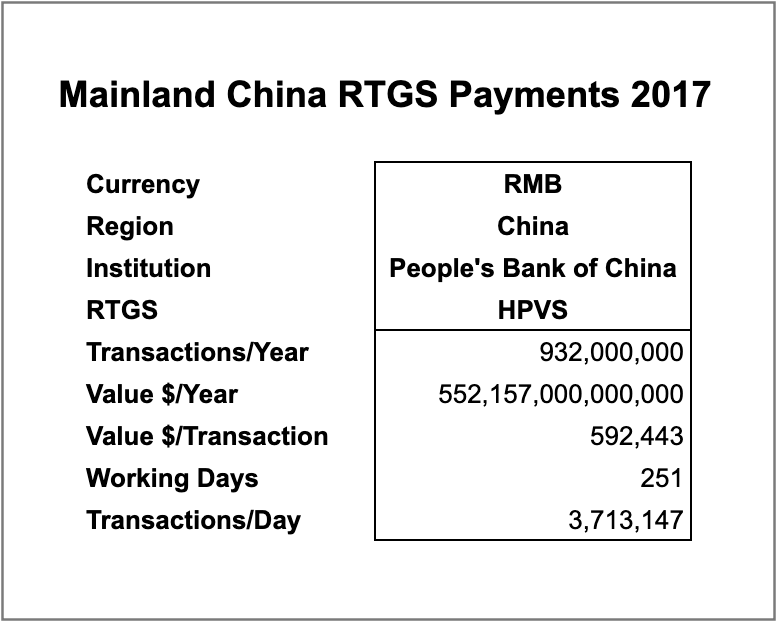

For USD, only Fedwire was used as the CHIPs system ultimately settles all net balances with that system. For CHF, SIC aggregates all payments made through the system, but small payments, from CHF 1 to CHF 4,999, were excluded for this analysis to show only large value payments. For RMB, the data from the mainland HVPS system is shown separated from the aggregate table (Major Currency RTGS Systems) because it includes retail payments and there was no information available to segregate them, but the data is shown separately. For RMB and HKD settled in Hong Kong the data is unified and shown in the aggregate.

Bitcoin pro forma data assumes BTC has a capacity of 576,000 transactions per day after the SegWit upgrade, based on 4000 transactions per block, that are created every 10 minutes, which is 144 blocks per day.

Ethereum Classic pro forma data assumes ETC has a capacity of 680,000 transactions per day based on an average of 67,000 gas per transaction and an average gas limit of 8,000,000 gas for ETC blocks, that are created every 15 second, which is 5760 blocks per day.

Both ETC and BTC work 24/7/365 while all other systems work on working hours, 5 days a week and 251 days a year on average. This has the effect of closing the gap, and even overcompensating, the relative transaction volumes between BTC and ETC vs all traditional systems when quantified on a daily vs yearly basis.

Pro forma data for BTC and ETC dollar value per year and per transaction takes the total aggregate yearly value for the seven RTGS systems analyzed to deduce what values BTC and ETC should move to be equivalent.

As per the “format war” hypothesis where very few base layer blockchain systems will exist in the future, Bitcoin is given a 66% share at the base layer, and Ethereum Classic a 33% share.

Results

1. Structure of Traditional Payments Systems

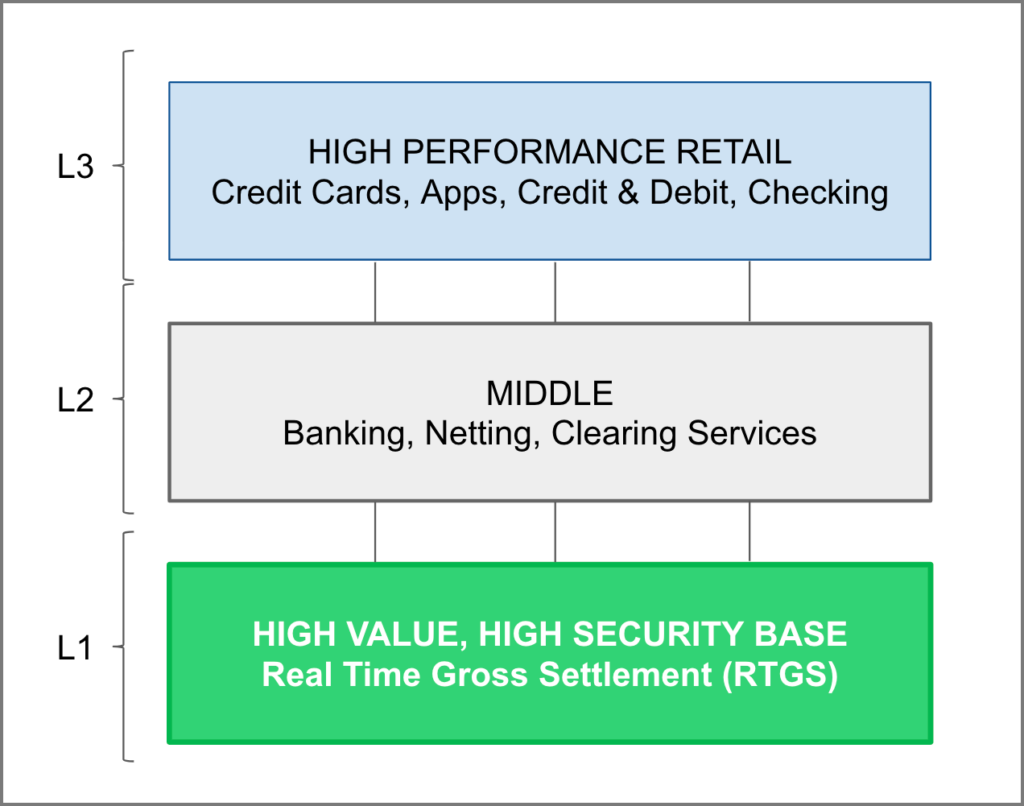

The first thing worth observing is that all payments systems are generally organized in three layers.

The top layer, or layer 3 (L3), are normally retail, high performance tiers with credit card, online apps, credit and debit systems, checking, and other systems depending on the region. These systems may be independent or operated by banking institutions, but in the majority of cases, they serve as front end, consumer, and business facing systems, gathering large volumes of small credit and debit payments, and sending them to the middle layer for clearing and execution.

The middle layer, or layer 2 (L2), is the normal banking layer, where banking institutions receive all intraday transactions, clear and net them, and then submit them to send or receive the final balances from the central banking base layer.

In this middle layer there are also some intermediate private high value net settlement systems such as CHIPS in the US, or Euro1 in Europe. When these systems net out large value transactions, for example FX trades or other non urgent large payments, on a daily basis, they send the final netted balances between parties at the end of the business day to the central banking base layer for final settlement.

The base RTGS layer, or layer 1 (L1), is the ultimate or what I call the “apex” settlements and finality engine, that takes and executes high value payments as they arrive. This means there is no netting or waiting periods for netting so transactions are immediate and final. This makes it a highly secure tier, optimal for time sensitive, important high value payments that need finality immediately.

The base layer systems such as Fedwire (US dollar), Target2 (Euro), CHAPS (British pound), SIC (Swiss frank), HVPS (renminbi), CHATS (renminbi and Hong Kong dollar), BOJ-NET (Japanese yen) or FXYCS (Japanese yen) act as the ultimate high value finality engines in their respective jurisdictions. In all cases, these systems are either owned and operated by the central banks in their respective jurisdictions, or are “systemically important” or critical infrastructure private systems contracted and overseen by the central banking or local monetary authorities.

2. Major Currency RTGS Systems Aggregated

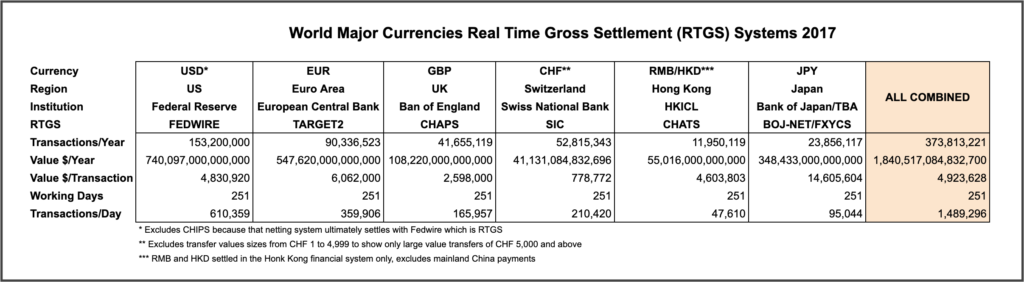

In the table below it can be seen the RTGS systems, ex-China mainland, corresponding to each of their settled currencies:

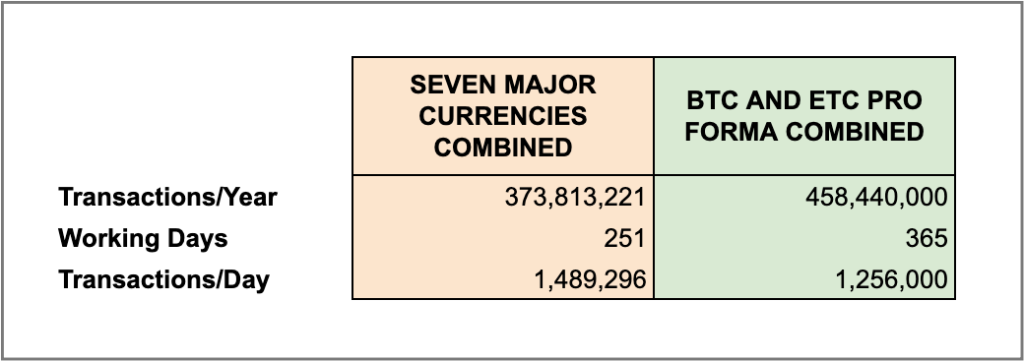

In 2017 all the systems combined processed 1,489,296 transactions per working day. They worked for 251 days in 2017, on average, so the total volume for that year was 373,813,221 transactions.

As for value, they processed over of $1,84 quadrillion, which was over $4,9 million per transaction, on average.

3. Bitcoin and Ethereum Classic Aggregated

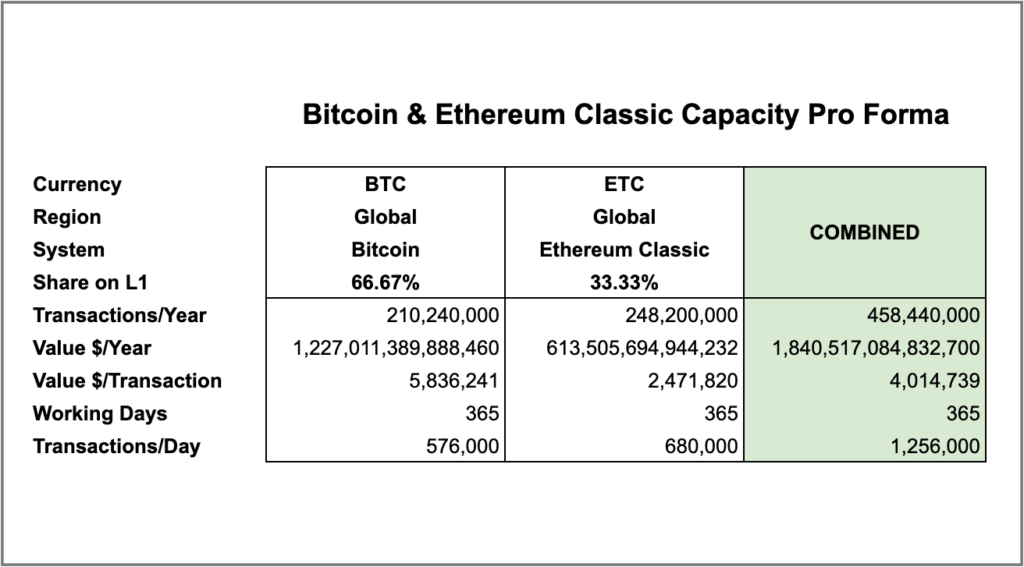

In the table below it can be seen the Bitcoin and Ethereum Classic transaction capacity pro forma data taking into account their projected shares at the base layer as mentioned in the methodology section:

As it can be observed, both Bitcoin and Ethereum Classic have a higher yearly transaction capacity individually, in their current versions, as compared to all RTGS systems individually.

In daily transaction capacity, both Bitcoin and Ethereum Classic surpass the daily volume of all systems individually, except for Bitcoin with Fedwire where it is slightly under in this metric.

As to the aggregate, all RTGS systems combined have a higher daily performance than BTC and ETC combined. However, this comparison is overcompensated, as BTC and ETC combined have a higher transaction capacity in the yearly volumes. This is because all traditional systems work for 251 days a year on average, while BTC and ETC work 24/7/365.

When plugging the total yearly value of $1,840,517,084,832,700 the aggregate traditional systems processed in 2017 to Bitcoin and Ethereum Classic, it can be seen their average transaction value would be $4,014,739, which is under the $4,923,628 of the combined RTGS systems. This shows the BTC and ETC slack in capacity in yearly volumes.

4. Mainland China Comparison

The data from mainland China is excluded from the aggregate analysis above because there is a significant portion of transaction volumes and values reported by the People’s Bank of China for their HVPS system that are smaller retail and business payments. This is shown by the significantly lower average per transaction of $592,443:

Nevertheless, even if 2/3 of all transactions were arbitrarily excluded, just as an exercise, the renminbi HVPS system would still total around 310,000,000 transactions per year, which is under, but not far away of the total volume of 373,813,221 by all other systems combined. It is still below the BTC and ETC capacity combined, but, when aggregated with the other systems, they would totally surpass Bitcoin and Ethereum Classic’s current capacity.

Other Considerations

It is worth noting that even if the seven base layer RTGS systems used in this analysis must represent a large portion of all global daily payment settlements, especially cross border transfers, there are still a good portion of systems not included that are relevant. For example, Canada, India, Brazil, and all other central banking systems in the world are not included. However, those operate mainly domestic systems while Bitcoin and Ethereum Classic are most valuable, thus useful, for international settlements.

Another consideration is that no securities or derivative settlements systems are included in this analysis. That is because the corresponding monetary DvP payments, on the payment side, are already included in the RTGS systems values. On the other hand, traditional securities represent debt and equity, which derive their value from future cash flows, which would also be included. Derivatives are primarily agreement systems, which will likely be managed, cleared and netted on L2 system in the blockchain industry, not at the base layer.

Conclusion

RTGS systems are what I call the “apex” settlements and finality engines in traditional banking systems. They aggregate all banking money movements and are the ultimate point where all payments converge and are executed as they are received, in their respective jurisdictions. They provide senders and receivers with the maximum possible settlement finality and certainty in fiat systems.

Base layer proof of work blockchains as Bitcoin and Ethereum Classic are analogous to RTGS systems in the crypto industry, but with the invaluable advantage that they are trust minimized, decentralized, unrestricted across national borders, and, because of those reasons, provide much higher finality guarantees. BTC and ETC are also programmable with smart contracts, especially ETC at the base layer, while the others are not.

Both BTC and ETC individually have higher transaction capacity than all systems individually compared in this article. When aggregated, BTC and ETC combined have a lower daily capacity than all systems combined, but that is overcompensated with a higher yearly throughput because BTC and ETC work 24/7/365 while the other systems work only on working hours, 5 days a week, 251 days a year.

However, both Bitcoin and Ethereum Classic would benefit with incremental scaling overtime as all settlements systems are not included in this analysis and the data does not reflect future growth trends. Notably, the Chinese mainland RTGS system, HVPS, may be processing similar volumes as all global currencies combined, but specific data about this is not available. On the other hand, all other systems in the world, however small, are not included in the analysis.

Bitcoin and Ethereum Classic could, individually and/or combined, penetrate and capture the highest value segments globally first, while they scale overtime. Another possible path is for BTC and ETC to capture specific types of transactions initially, such as cross border settlements.

Due to physical and security constraints, to scale and integrate with retail systems, the crypto industry needs to be layered following traditional systems patterns.

Traditional settlement systems are controlled by central entities, therefore are not socially scalable. Only authorized local members have access to RTGS finality.

Bitcoin and Ethereum Classic are permissionless and socially scalable globally.

Links to RTGS Systems:

- Fedwire (US dollar): https://www.frbservices.org/resources/financial-services/wires/index.html

- Target2 (Euro): https://www.ecb.europa.eu/paym/target/target2/facts/html/index.en.html

- CHAPS (British pound): https://www.bankofengland.co.uk/payment-and-settlement/chaps

- SIC (Swiss frank): https://www.snb.ch/en/iabout/paytrans/sic/id/paytrans_swiss_interbank_clearing

- HVPS (renminbi): https://www.imf.org/external/pubs/ft/scr/2012/cr1281.pdf

- CHATS (renminbi and Hong Kong dollar): https://www.hkma.gov.hk/eng/key-functions/international-financial-centre/financial-market-infrastructure/payment-systems/

- BOJ-NET (Japanese yen): https://www.boj.or.jp/en/announcements/education/oshiete/kess/i10.htm/

- FXYCS (Japanese yen): https://www.swift.com/news-events/press-releases/japanese-payment-market-infrastructure-supports-swift-gpi-tracking-of-cross-border-payments

- Bank of International Settlements Selected Payment Systems: https://stats.bis.org/statx/srs/table/PS3

Code Is Law