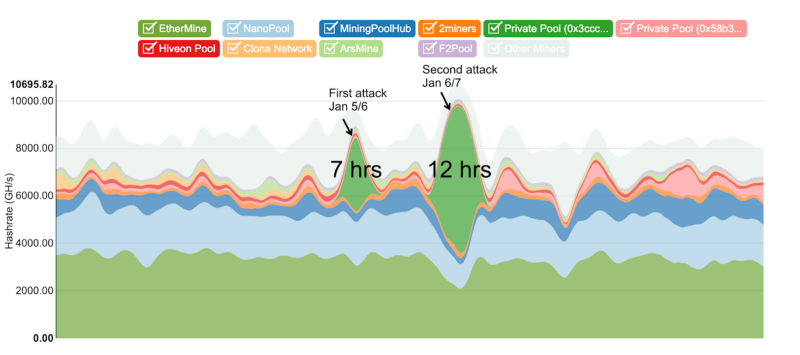

…even after the recently successful double-spending attacks.

In the past I have argued that if Bitcoin were to suffer a 51% attack, that would be the end of the experiment. This was in the context of Vitalik Buterin and Vlad Zamfir saying that BTC’s proof of work (PoW) security is the same as Proof of Stake’s (PoS) because, in the end, if there is a reorg, Bitcoin would fork to correct the reorg making it a subjective consensus security model just as Casper’s PoS. (Of course I don’t agree with them, even in the current circumstances.)

So, now That ETC has Been Successfully Attacked, These are the Questions I Make

- Is this the end of the ETC experiment?

- Is ETC’s Lindy effect back to zero? Or, does the network have marginal value other than its [currently low] security threshold?

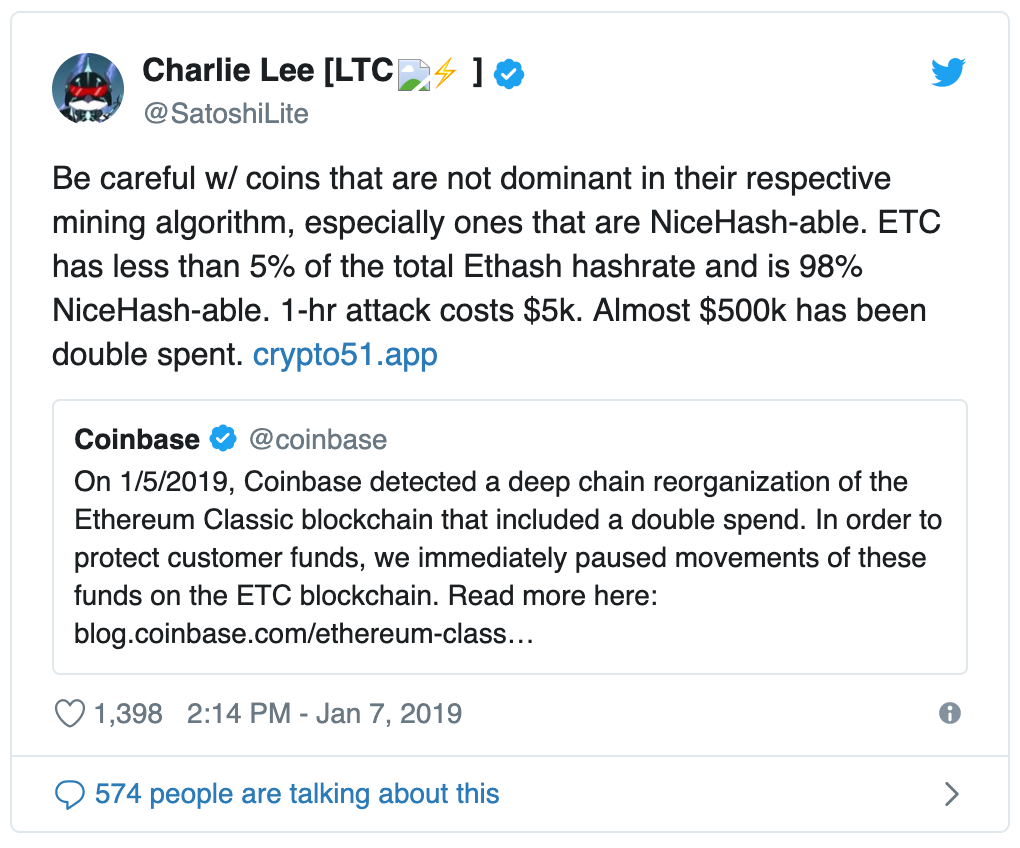

- If it does have marginal value, would a change of PoW mining algorithm to a niche that no other chain uses (so that it’s the dominant chain within that “algo niche” and attackers can’t rent hashing power in the NiceHash market — as referenced by Charlie Lee’s tweet below) be a good idea?

- The tradeoff of option 3 above is that miners would have to mine exclusively for ETC and there would be no compatibility to jump from chain to chain, so this may reduce their interest in mining ETC.

If I am Assessing the Situation Correctly, the Reason why the Current Breach was Possible was Because

- The ETC network is still small.

- As stated above, it shares the same mining algorithm as other larger networks, e.g. Ethereum, making it vulnerable to 51% attacks through renting compatible hardware with the same algo.

However, I Think There is Still an Opportunity for ETC for several reasons

- It is a proof of work, Turing-complete blockchain, with the cryptocurrency and smart contracts both fully integrated in the base layer.

- The above value proposition is different and more secure (provided that it gains significant size in the future) than all competitors as Bitcoin is not Turing-complete and requires sidechains for smart contracts, and all the other Turing-complete blockchains are either PoS or some other BFT consensus mechanisms, some including treasuries and voting, which are all significantly less secure than proof of work.

- The ETC ecosystem is still very focused on immutability as a core value, not having any formal governance mechanism, and guaranteeing emergent decision making thru free adoption of the network and rule changes.

- ETC has a fixed monetary policy.

- ETC is unique and the only blockchain in its niche.

- ETH, which currently shares the same proof of work +Turing complete niche, will very likely migrate to PoS and sharding which are both less secure technologies.

- Although Bitcoin is highly secure, it is unlikely that the world will use only one base layer blockchain to build all systems on top.

- The above is especially the case if that implies merged mining and drivechains which will create risky “super-miners” in that ecosystem.

Bear in mind that the current attacks ETC suffered are not a function of a flawed internal design or a ‘hack’ to the system. It was a double-spend mining attack and a breach of security which is a formal assumption in its design, which is vulnerable to 51% attacks, as in any other proof of work blockchain, including Bitcoin.

Conclusion

My personal opinion is that what happened is a significant setback, but I think ETC still has a unique positioning as a PoW + Turing-complete network with an active community with sound principles. The question is whether a recovery in the medium or long term is plausible or if the network, unless it grows significantly, is perpetually vulnerable, therefore unusable.

I think that continuing to build the stack as planned (a secure PoW base layer, with layer 2 sidechains, plus developer tools, continuous efficiency gains and adding of new features in the long term) will get ETC closer to the long term vision of a blockchain perfectly suitable for secure decentralized computing.

With the above in mind I think the best path is to explore a mining algorithm change to put ETC in a unique, incompatible PoW niche. Even if that implies a tradeoff as miners will have less optionality to point their infrastructure to different chains depending on the profitability of the day.

EDIT 1/9/2019: The ETC community is working on a post-mortem and contingency plan to deal with the recent attacks mentioned in this post. I have changed my position about a mining algorithm change as a PoW change as described above may not be necessary. So, I am open for ETC to stay with the current mining algorithm and/or implement other changes to mitigate this situation.

Code Is Law