Like I wrote in my previous article, a Smart Investment Plan (SIP) on Ethereum is an account that a customer opens on the Ethereum network to save and deposit money, that is subsequently invested, and when a specific event happens, the funds are paid out to the customer or his/her designated beneficiaries.

SIPs may be used for personal finance goals like retirement, emergency funds, college funds, targeted savings, funding big purchases, deferred gifts, and estate planning. Also, since SIPs may be initiated by individuals or groups, they can be used for retirement and pension plans.

As a type of decentralized autonomous organization (DAO) SIP smart contracts are programmed to follow a logical investment process to manage customer’s funds.

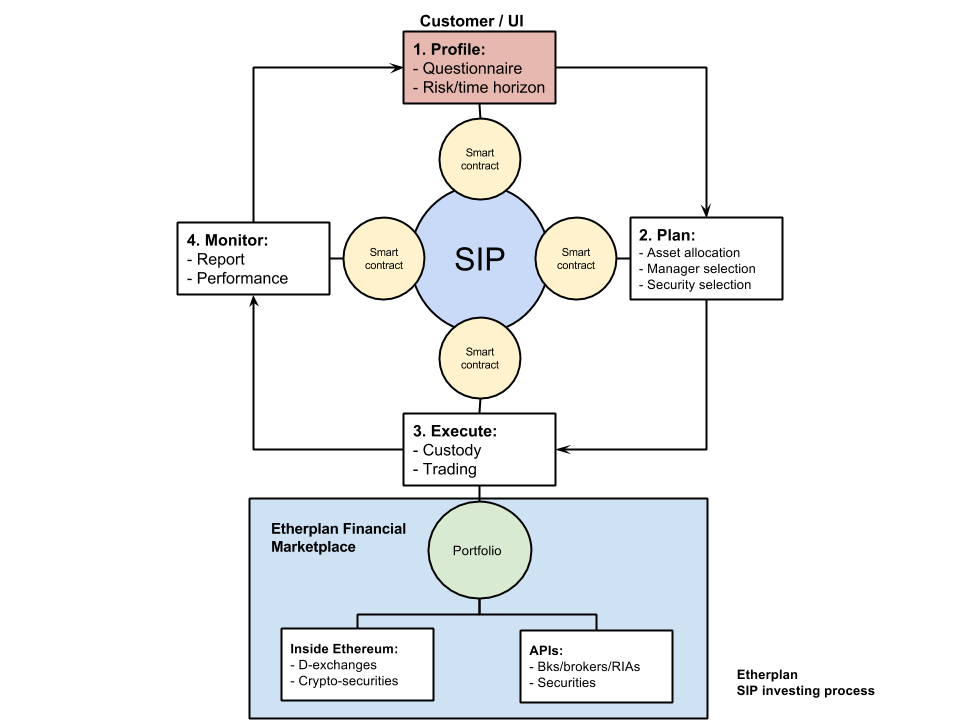

The SIP Investment Process

As shown in the graph below a SIP follows 4 steps:

1. Profile

In this step customers answer some questions that are defined based on behavioral economics research to uncover important information about the investor’s risk tolerance, time horizon, and other parameters that help define the planning stage in the next step.

2. Plan

The planning step uses algorithms developed based on modern portfolio theory (MPT) and efficient market hypothesis (EMH) to build portfolios that will match or slightly beat performance in financial markets. The three levels defined in this step are: portfolio asset allocation, investment manager selection (if the customer indicates), and investment securities selection. Oracle services like Augur are used by smart contracts in this step to “see” the markets, analyze statistics, and decide the final values and allocations.

3. Execute

After the investment plan is defined and approved by the customer in the previous step, the next step in the process is to execute the trades. Because Ethereum provides an account system, many of the assets may be hosted in the network and thus under SIP custody. For the securities that are traded off-blockchain, the algorithms use APIs with financial institutions to enter their orders. Oracle services are used by smart contracts in this step also to track and verify market trading information and financial provider custody.

4. Monitor

Since investment goals and investor preferences may change overtime, and for evaluation purposes, portfolio reports are sent to customers in this step for their review. Customers may change their personal profiles and investment parameters on step 1 so the SIPs may adjust the portfolios accordingly.

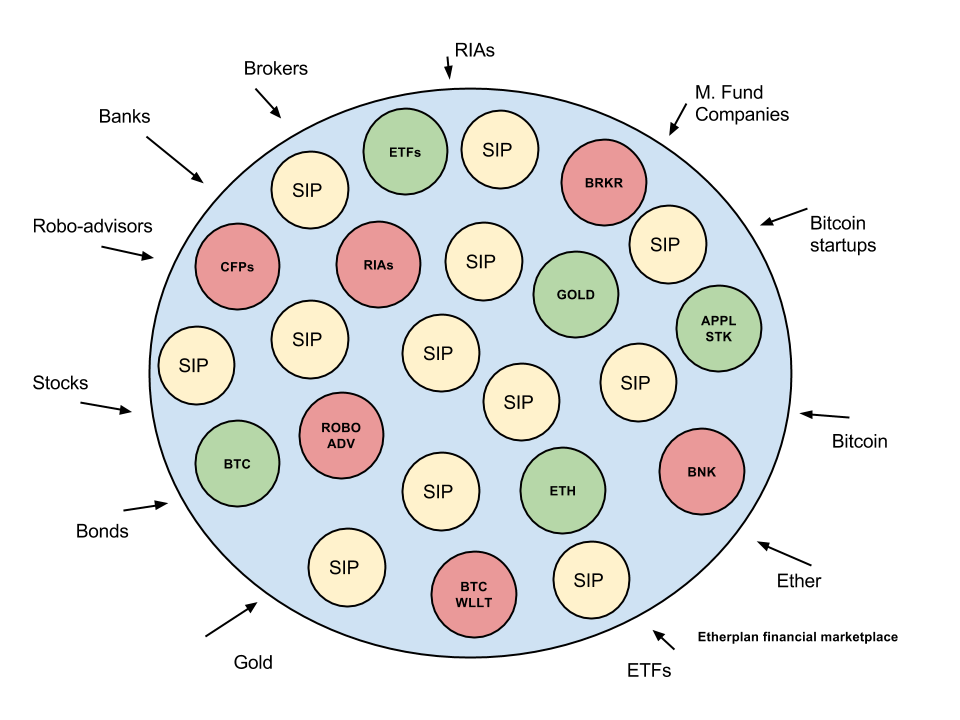

The Etherplan Financial Marketplace

To facilitate the interaction between SIPs, financial providers, and individual securities, a financial marketplace is provided.

As shown in the graph above, SIPs constitute the “buy side” in the marketplace and financial institutions, investment professionals, and other “sell side” participants may offer their services and be hired by SIPs.

In the marketplace, SIPs may also find and invest in specific securities that trade within the Ethereum network like asset backed securities representing specific stocks, bonds, ETFs, and metals like gold as well as cryptocurrencies like Ether and Bitcoin among others.

If customers decide to hire an investment advisor to represent them and invest their portfolios they may also be participants in the Etherplan Financial Marketplace.

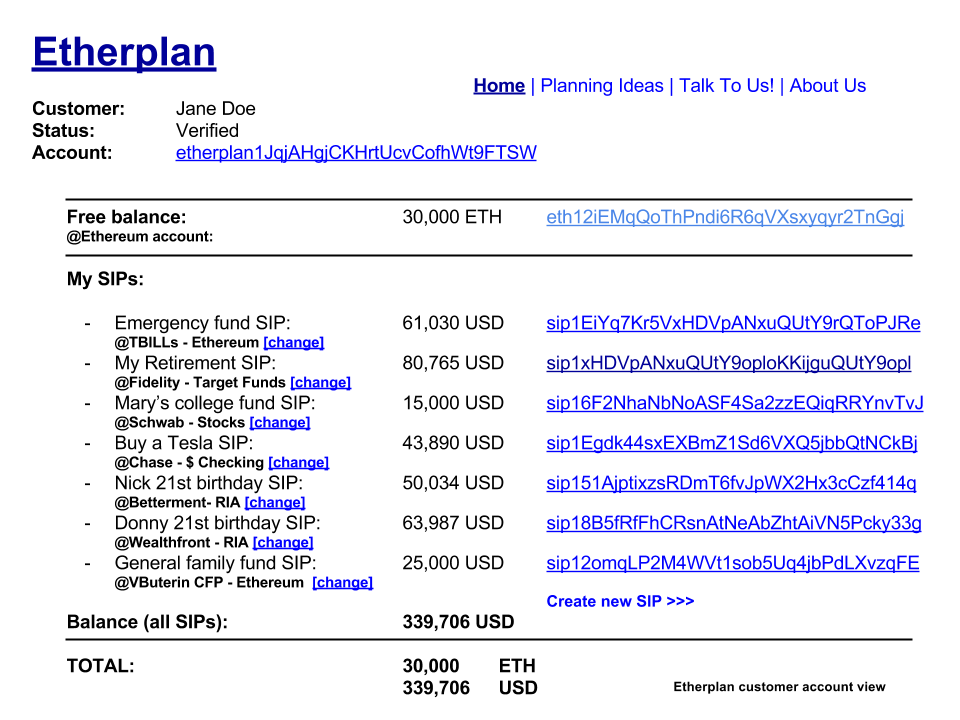

Etherplan Customer Account View

SIPs are created by customers for their specific financial goals and customers may have several SIPs in their Etherplan accounts.

The graph below is an example of an Etherplan account:

As may be seen above, a theoretical customer, Jane Doe, has several financial goals and they all constitute different SIPs in the Ethereum network.

Through the marketplace, each SIP has invested its corresponding customer funds at different providers, securities, or blockchains.

The free balance that is not invested in any SIP is 30,000 ETH that is deposited in the customer’s regular Ethereum account.

The customer may instruct their SIPs to change providers or securities from their accounts.

As an example, the “My Retirement” SIP allocated its funds at Fidelity and invested in target date funds, has a total value of $80,765, and its corresponding SIP number on the Ethereum blockchain is sip1xHDVpANxuQUtY9oploKKijguQUtY9opl.

Other SIPs are invested in different ways, for example the “Emergency fund” SIP only bought a Treasury Bill directly on an exchange in Ethereum because it’s objective is extremely conservative. The SIP at the bottom, the “General family fund” SIP hired, as per customer instructions, Financial Advisor Vitalik Buterin, CFP to manage its portfolio!

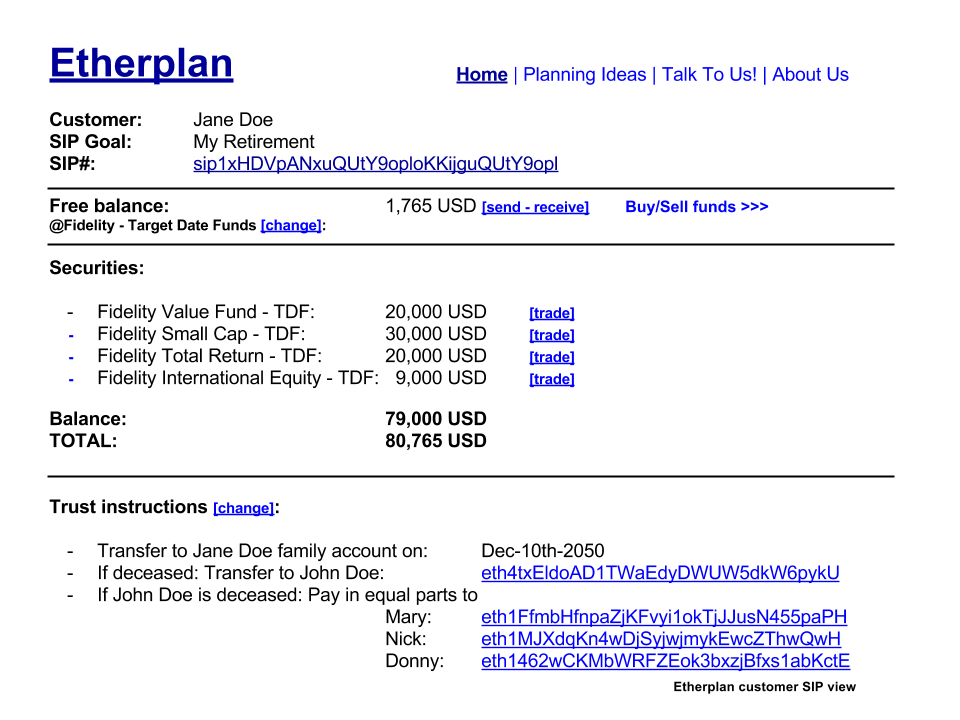

Specific SIP Customer View

The graph below shows Jane Doe’s “Retirement” SIP:

As it may be seen above, the portfolio @Fidelity has four target dated funds and the customer may also change or sell them.

The SIP Trust Instructions

The interesting part of the SIP customer view above is that, at the bottom, it shows the “trust instructions” by the customer when she created the SIP for her retirement goal. These instructions mean that the SIP is going to autonomously execute them, like a real life trustee, when the events described occur.

For example, if the date of retirement comes, the funds will be automatically transferred to Jane Doe’s family account or any other account she may specify.

If Jane Doe is deceased before or at the time of the retirement date, the SIP will transfer the funds to her husband’s account.

If the husband, John Doe, is deceased then the SIP will distribute evenly the amount of the funds to Jane’s three children, Mary, Nick, and Donny.

The customer may change her trust instructions whenever she wants, but if she dies, the funds and the instructions will be managed and executed for the benefit of her designated beneficiaries.

Conclusion

SIPs created by customers on Etherplan have two major roles, investing funds and executing trust instructions according to customers needs and profiles.

To invest the funds, SIPs perform a series of sophisticated algorithms to plan, invest, and interact with providers and investment vehicles on the Etherplan Financial Marketplace.

Customers receive reports to monitor their SIPs and adjust their preferences. While they are alive they can also change their investment and trust instructions, but if they pass away they are executed for the benefit of the designated beneficiaries.

Disclaimer: The public companies and brands mentioned in this article are used as examples and are not related to Etherplan. The investment ideas in this article are only for descriptive purposes. The information in this article does not constitute an investment recommendation or financial advice in any way.