Vladimir Tenev and Baiju Bhatt are two Stanford mathematicians applying their knowledge to Wall Street in two very unique ways.

Not only are they putting together a community of investors, traders, and pros to crowdsource their knowledge to enhance investing performance, but, in doing this, they are also breaking a long standing hold on Wall Street: control of information.

It could be said they are acting as a “Robin Hood” of stock market information. In fact, their app is called Robinhood!

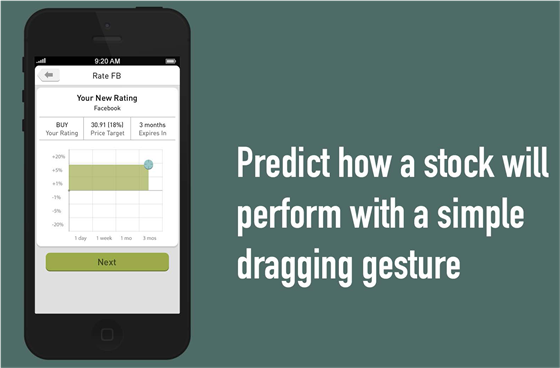

Robinhood democratizes who rates stocks by letting members assign buy or sell recommendations, price targets, and in what time frames to stocks. Just like in new media we can all be journalists, commentators, or opinion leaders, with the Robinhood app we can all be research analysts.

In this interview Vlad and Baiju talk about their backgrounds and explain their vision for Wall Street stock market information and how Robinhood works:

Check out the Robinhood App here >>>

This is the Vlad, Baiju, and thus Robinhood’s philosophy manifesto >>>