It used to be that financial advice was given to us by a banker, a stock broker, an insurance professional, or someone close to us who could help us like our accountant, a family member, or a friend.

In the last decade a new professional has emerged, the financial advisor, who came with the promise of independence and lower fees.

Independence means that they work for you and don’t have a bias to sell the products and services of a particular financial institution. This has been a great step forward for investors, but still you need substantial money to invest to justify an advisor’s work and the cost to you.

For smaller investments and fast, intelligent risk management companies like Betterment provide advice, asset allocation, and the account to implement your strategy.

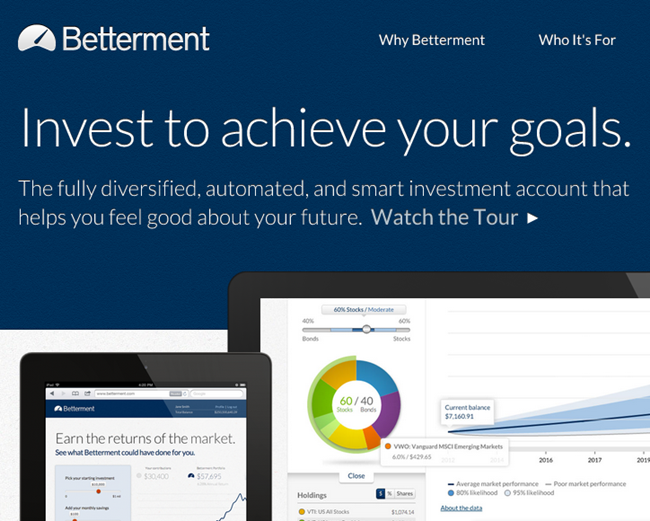

Betterment is not a bank, a traditional broker, a financial advisor, nor a mutual fund company, it is an online financial advisor that gives you the asset allocation advice you need based on your profile and objectives. After they help you structure your portfolio you send them the money to invest and they implement and keep track of your investments giving you a continuous service for monitoring and re-balancing your portfolio.

Betterment does all this at a fraction of the cost of any type of traditional mutual fund company, financial advisor, or brokerage firm.

For us who need simple, intelligent advice on how to start or continue saving and investing at a reasonable cost compared to traditional providers Betterment is a smart option.

Go to Betterment and see how you can increase your wealth without unnecessary bells and whistles: