Now that @Jack Dorsey, the founder of Twitter, auctioned a tweet for $2m as an NFT, I could say that the original idea below I sent to my friends by email in June of 2017, were NFT’s (perhaps my conceptualization and language at the time were not sufficient at the time).

However, a difference persists; NFTs are just a sort of booking system that provides some uniqueness to a non-fungible or collectable object (i think they could be used for digital and non digital objects), my idea was to use “bit gold”, as jewels put a design on top of gold, as the underlying unique commodity on top of which the intellectual item was adhered to or linked.

In any case, NFTs seem to me like a good idea as these are unique collectables. The system below with a reverse auction of hash power to mine bit gold just produces an NFT with proof of work.

I think Bit Gold, Bitcoin, Ethereum, Ethereum Classic, Zcash, Litecoin and other proof of work blockchains are chains of NFTs, but where the non-fungible object (the block or the block hash) is internal to the highly secure blockchain environment.

The “community tokens” layered on top ($BTC, $ETH, $ETC, $ZEC, $LTC, $XMR, etc.) are fragile (meaning the “community” can change the monetary policy, thus supply) fungible units because I think Satoshi did not know how to solve the non-fungibility aspect of bit gold (perhaps because of the absence of a decentralized or trust minimized exchange).

Below is my idea from 2017.

Unforgeable Costliness Tokens (UCTKs)

Fri, Jun 9, 2017, 9:12 PM

I designed a “reverse mining” model where unforgeable costliness is more clear and tangible than with just the production of scientific discoveries in the form of digital information.

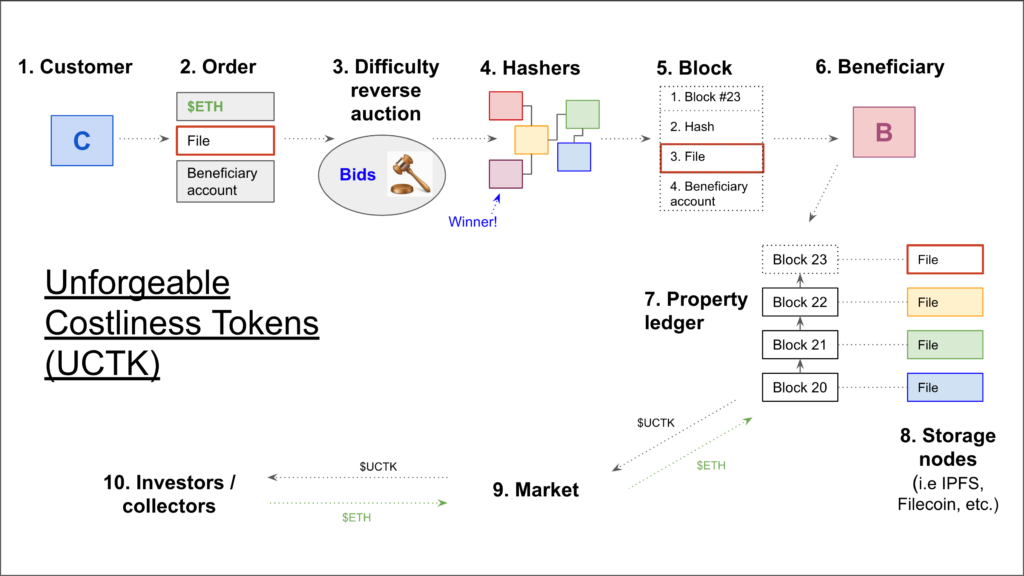

The system establishes some machines as “hasher” nodes in the network that are commissioned for a fee. On the other side, “customer” nodes can submit important files, scientific files, art or items of affection to be hashed and introduced into the property ledger on Ethereum as an Unforgeable Costliness Token (UCTK):

1. Customer

They are people with important or valuable information such as scientific discoveries (i.e. gravitational wave data, scientific papers, new or old math theorems, proofs, etc.), items of affection (i.e. photographs, videos, love messages, etc.) or artistic creations (i.e. poems, song lyrics, books, music sheets, etc.) who may submit their files to be expensively hashed, thus unforgeably costly, and included in a property ledger in a public network like Ethereum or Ethereum Classic.

2. Order

It is the process of submission and asking for hashing of a file, customers can select the amount in ETH they are wishing to pay for an expensive PoW hash (similar to the budget a boyfriend would pay for jewelry for a fiancé, or a patron would pay for an art commission), they include the file of digital content, and, if it is directed or gifted to a third party, they enter the address of the beneficiary (if not it is posted to the customer account on the property ledger).

3. Difficulty reverse auction

[This can be technical or economic -security issues, securing real value, etc.- so you may have better ideas for the bidding process] The way current PoW blockchains work are with defined rewards (e.g. per block BTC 12.5, ETH 5, or LTC 25), but in the case of UCTKs it is the other way around, the customer submits the amount they wish to pay for a block hash. If a customer decides to submit a file with ETH 5 or ETH 5,000 for a hash they can do so.

[I am not thinking of a special token for the difficulty-reverse-auction-market function unless you think it would be economically necessary or advantageous for security reasons]

The process is called “difficulty reverse auction” because when hashers see an order from a customer, with a file size and an amount, they can compete to bid up the level of difficulty and time they are willing to work at to produce the hash for said order.

Similar to the current TX fees in BTC, if customers submit a very low amount (or a very heavy file for such an amount), the hashing may take a long time to be bid and taken up by hashers, or hashers may offer low difficulty work (thus low value as a collectable) for such low payment (funny thought: this probably makes the system suitable as a “digital-jewelry” system where people can “prove their love” by spending a high amount for a PoW hash of a message of love or a cute photo for their “high-maintenance” love partners!).

In the above system, hash power is probably not only a sign of security (although security is also provided by the underlying network), but also a sign of value where the difficulty level quantity may be similar to carats in gold or karats in diamonds.

4. Hashers

Every node in the system may submit bids to the difficulty-reverse-auction-market to earn money, but probably there will be specialized machines in the future if the system is successful. The role of the hashers is to receive orders from customers, bid up the difficulty level so the system keeps its standards of value, hash the files with a PoW algorithm into blocks, and then deliver them to the property ledger in the accounts designated as beneficiaries of those UCTKs.

[the hashers in this system are *not* necessarily the miners of Ethereum or Ethereum Classic, but I am sure that eventually they will migrate to this system depending on the reward levels, or when Ethereum migrates to PoS that will orphan many miners. In any case, it is a good way to keep the underlying network competitive!]

5. Block

[This is technical so you may have better ideas] The blocks will include the hash of the last block, the expensive hash of the current submitted file, a pointer to the file in a parallel file storage network, the beneficiary’s account and, if necessary, a transferable token (the actual UCTK) so the collectable may be sold or transferred in the future. The UTCKs must be unique, non-fungible and non-divisible so they preserve integrity, therefore value, as digital collectables.

6. Beneficiary

The beneficiaries, like customers, are represented as account numbers on Ethereum, the customer can be the beneficiary of a block so in that case both are the same person like in real legal systems (insurance, retirement plans, trusts, etc.) but it can also be a third party (i.e. a loved one, charity, church, business partner, university, associate scientists, museum, etc.)

7. Property ledger

It is a property ledger (smart contract) on Ethereum or Ethereum Classic that will keep track of the chain of past blocks, accept new blocks from hashers, UCTKs, accounts, and transfers of property of the tokens. Like any other smart contract it will accept orders from normal accounts or other smart contracts.

8. Storage nodes

The files submitted may be stored in a P2P file network like IPFS, Filecoin, etc. as long as they can be securely associated on the property ledger to their corresponding block hashes (I don’t know how Rare Pepe associates their image files from the directory to the blockchain tokens, but we could do a similar system as Counterparty if necessary).

9. Market

To guarantee future circulation and use cases as collectables, there will be a UCTK market, similar to the bit gold design, where UCTK beneficiaries can sell their valuables and investors/collector can buy them for ETH (I am not thinking of a special token for this function either).

10. Investor/collectors

They are people or investment funds who are willing to buy UCTKs as collectables or to use them for bundles, guarantees, or other use cases.

Code Is Law