The problem with a possible on-blockchain trust minimized insurance or even parametric insurance product is that the security risk of the external sources of information that report perils is difficult to reduce beyond a certain level.

My guess is this could be called the “oracle risk”.

However, inside the blockchain there are hazards, risks, perils, and losses that must be possible to track and report on in a trust minimized way because they are not external but information generated and captured inside the highly secure environment of the blockchain.

For example, a 51% attack is a peril that creates identifiable losses. The hazard may be a drop in hash rate and the risk is that low hash rate increases the probability of 51% attacks.

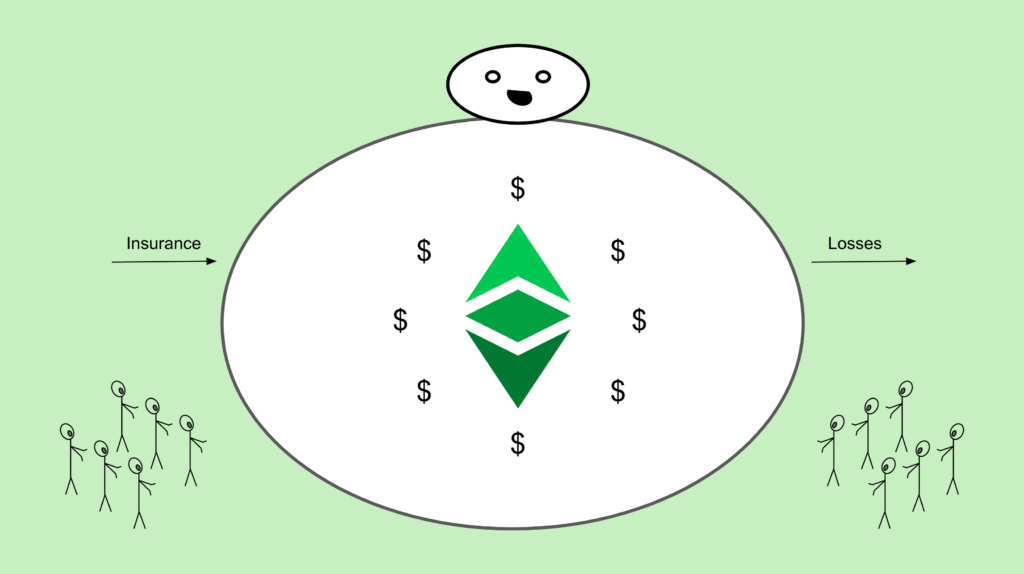

I think all the variables mentioned above may be quantified and priced by an on-blockchain parametric insurance system: When specific parameters are met; such as high or low hash rates, specific reorganizations, double spends, etc.; then a pool of funds may pay for the quantifiable losses, perhaps up to a certain extent. In this case the “parametric” part is the quantifiable variables and losses.

Because the losses are known as well (the double spend has an identifiable amount), they can be paid in full or with deductibles and maximum limits.

The premiums may be adjusted to reflect all the optionality in the policies.

I think something like this could be tried in a network as Ethereum Classic (ETC) that has a history of such hazards, risk, perils, and losses and supports smart contracts, which may be used to programme such a scheme.

The actuarial calculations should not be very hard and the crypto exchanges, custodians, and their insurers could use this kind of reinsurance.

Large crypto holders could also be interested in this kind of insurance and perhaps reduce their fear of self custody!

Other kinds of insurance coverage on other variables on the blockchain could be imagined if the protocol and its risks are analyzed this way. For example, lost funds, smart contract bugs, crashed multi-sig wallets, broken dapps, etc.

An additional benefit for ETC is that a parametric insurance system does not violate Nakamoto Consensus, while providing a way to recover funds in case of attacks or losses.

This would reduce the need for anti-Nakamoto Consensus features that were or are in the process of being added to ETC, such as MESS (Modified Exponential Subjective Scoring) and checkpointing.