Bitcoin dust is the accumulation of the small fractions of BTC, as expressed in decimal numbers, that are left “abandoned” in accounts as they are either too small for their owners to care, or can’t be transferred because network transaction fees are the same or higher than the values themselves, therefore making such transfers uneconomical.

For example, if an account has a balance of BTC 0.00013439, but the current mining fees per transactions in the free market are around BTC 0.001, then it would cost more than the actual balance to move it:

BTC 0.00013439 - BTC 0.001 = BTC -0.00086561

To analyze the possible future of this dust at the base layer, I checked the history of Bitcoin fees relative to market prices and projected what may happen in the future.

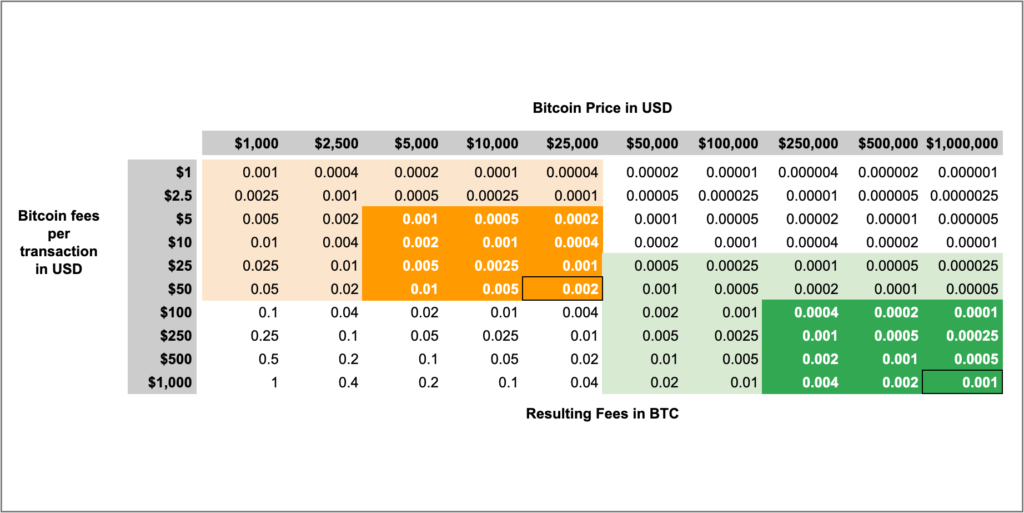

I came up with the following table:

By listing possible BTC fees and prices in USD in the lines and columns of the table, the resulting fees in BTC can be calculated.

The “fee-to-dust indifference points” are the fee levels in BTC, which are the levels at which it is indifferent to transfer the same number of BTC. Below those points, transfers generate losses to senders, and above those levels they start to become economical.

The orange area shows roughly the ranges where the price of Bitcoin and the transaction fees have actually been in the last ten years, particularly since 2013. The green area shows the range of prices and fees where I think Bitcoin transactions will be in the medium to long term.

The darker orange and darker green areas are where BTC prices and fees were highest in the recent past, and where I think they will be in the medium to long term, especially taking into account that block capacity will likely be permanently utilized at 100% when Bitcoin enters its maturity phase between $250,000 and $1,000,000.

As an example, when Bitcoin reached its last peak of $20,000, fees reached up to $54 per transaction. If it were to overshoot in the short term, say to $25,000, with a transaction fee of $50, then the BTC indifference point to transfer dust will be BTC 0.002 (see the table above).

I do think BTC will reach a peak of $1,000,000 in the long term, and when it is at around that range I think it is very possible, due to demand in what will be very limited block space, fees may very likely reach levels of $1,000. In that case the fee-to-dust indifference point will be 0.001 (see the table above).

My first observation with this thought experiment is that it doesn’t seem that “stacking sats” (or stacking satoshis in crypto-slang, which is the minimal divisible quantity of a BTC) is a good idea at the base layer.

In the places where BTC prices and fees have been since 2013, and may be in the future, it seems that it hasn’t been, and will not be, economical to move numbers below the forth decimal point. However, sats exist at the eighth decimal point. Therefore sats, which would be worth 1 cent of a US dollar when BTC trades at $1,000,000, seem to be a quantity more optimal to deal with on layer 2 solutions.

Another observation is that dust trapped today below the forth or fifth decimal points doesn’t seem will ever be recoverable.