You can read Peter Rizun’s thread here: https://twitter.com/PeterRizun/status/1118314312269885440

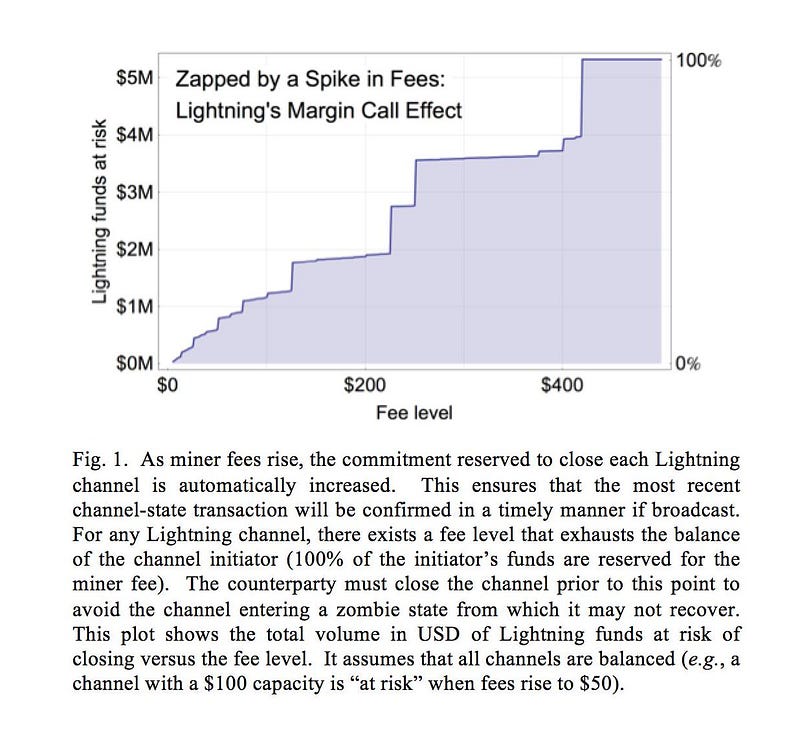

Peter Rizun told me he is writing a post about how a rise in BTC fees may activate a run on LN channels to close them, rendering, according to him, the Lightning Network ‘broken’.

However, on twitter he posted a figure in a thread that illustrates his point with regards to current channels opened in the Lighting Network:

Of course, that is exactly the same phenomenon that happens to accounts and transactions inside Bitcoin or any other money moving system in the world: A fee of X renders an account of X or a transaction of X uneconomic.

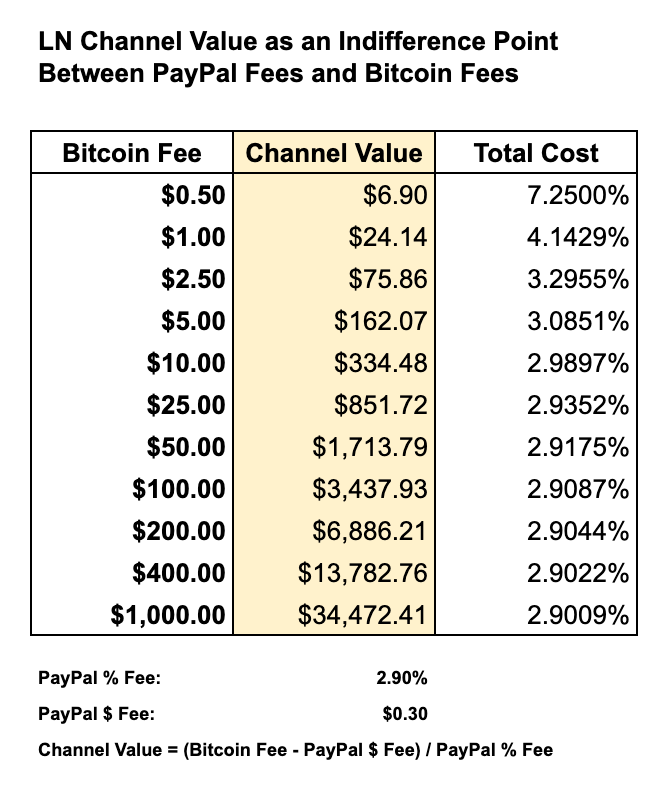

But to show that his finding is not very relevant, I did this table below, with future hypothetical Bitcoin fee levels as compared to PayPal, that shows that channels can adjust to perfectly reasonable values when fees goes up.

The chart shows an indifference point where a Bitcoin fee is equivalent to a current PayPal fee if it were liquidated. In other words, if the Bitcoin fees were $100, then a channel worth $3,437.93 would pay the same fee as a PayPal transfer if it were liquidated.

Of course whoever has accounts, transactions or Lightning Network channels of value X when fees are X, they either have to wait for another moment of lower fees to move their money or they should have managed their money better in the first place!

Code Is Law