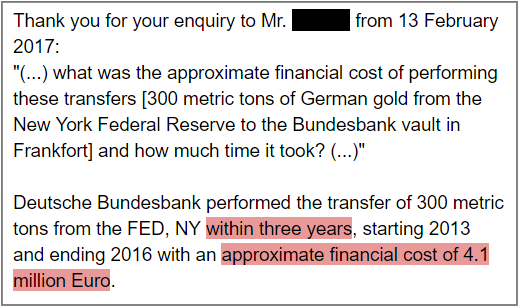

In February of 2017 I shared with the crypto-community the information Bundesbank sent me explaining that they completed the transfer of 300 metric tons of gold (~$12 billion at the time) from the New York Fed to Frankfurt, that it took 3 years, and cost € 4.1 million:

Fedwire Compared With The Bitcoin Network’s Hypothetical Volumes

In the same spirit of analyzing Bitcoin as a high value settlements system I did the following analysis using Fedwire historical data from July 2017 and comparing it with a hypothetical Bitcoin network pre-SegWit, post-SegWit and a pro-forma projecting some key data.

Results

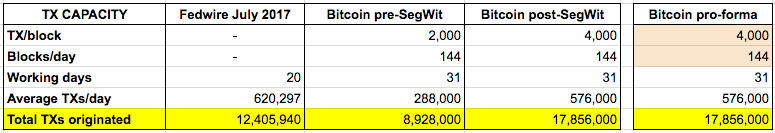

1. These are real July 2017 Fedwire wire transfers compared with the BTC network hypothetical TX volume capacity scenarios:

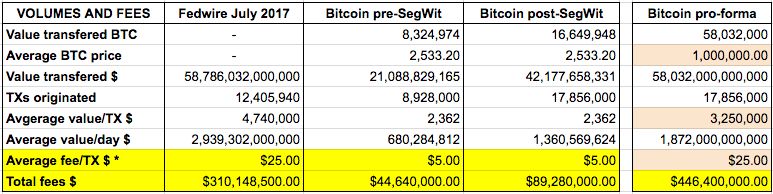

2. These are real July 2017 Fedwire wire transfer volumes and fees compared with BTC real July volume and average price, but hypothetical TXs, plus hypothetical post-SW & pro-forma volumes:

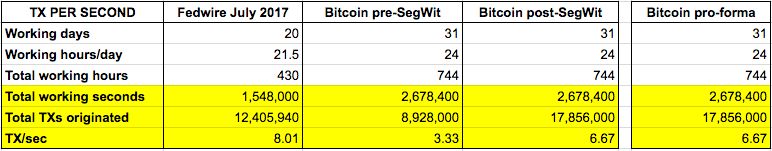

3. These are real July 2017 Fedwire wire transfers per second compared with BTC hypothetical pre-SegWit, post-SegWit and pro-forma TXs per second:

* Fedwire doesn’t charge fees directly, but banks charge an average fee of $25 per wire transfer to their end users.

Assumptions

Bitcoin pre-SegWit total TX capacity

2000 TXs per block with 144 blocks mined per day. However, many blocks were above or below those levels during July 2017.

Bitcoin post-SegWit total TX capacity

4000 TXs per block with 144 blocks mined per day. However, this is a number that has not been reached at the time of this writing because it will take a few months until all nodes in the system broadcast SegWit TXs.

Bitcoin pro-forma

I assume BTC/USD of $1,000,000 in the long term, average TX value of $3.25 million and an average TX fee of $25 in the long run.

Discussion

Some of the above assumptions seem very wild, but think of Bitcoin being used as a store of value and settlements layer by central banks, national treasuries, sovereign funds, money center banks, institutional investors, high net worth individuals, settlement for layer 2 systems such as Lightning Network, and many other possible high value transfer use cases.

Sources and links

- Fedwire July 2017 data: https://www.frbservices.org/operations/fedwire/fedwire_funds_services_statistics.html

- Blockchain-dot-info data (I downloaded the CSV file): https://blockchain.info/charts/estimated-transaction-volume?timespan=180days

- CoinDesk price data (I downloaded the CSV file): https://www.coindesk.com/price/

Code Is Law