The mission of Etherplan is not only to help individuals and families everywhere in the world build their smart investment plans on Ethereum, but also to enable small businesses and organizations to create and manage their smart retirement plans on the platform.

One of the great benefits of Etherplan is that, regardless of their geographic location, it allows people and businesses have their investments, advisors, beneficiaries, and trustees, all in one place. However, for business owners, managers and team leaders, the task of organizing all this and creating their employee retirement plans can be daunting. For that reason, this post seeks to help them understand the general structure of a retirement plan and how it can be implemented on the Etherplan platform.

Description

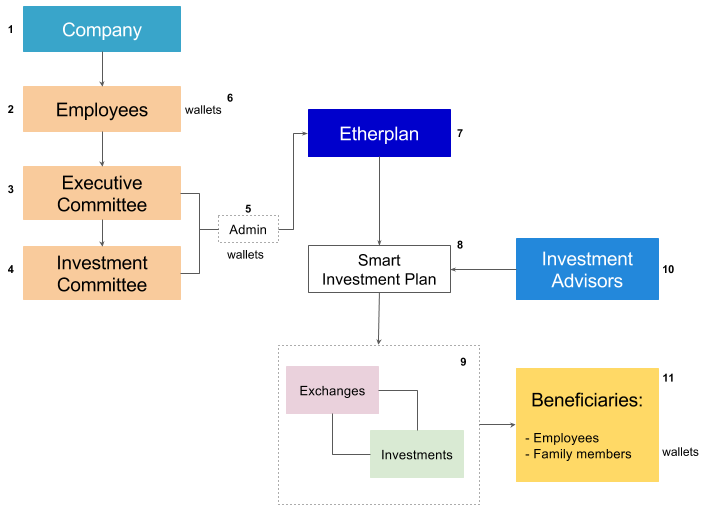

The best way to start understanding the general structure of a smart retirement plan, using Etherplan on Ethereum, is by examining the diagram below:

As it may be seen, there is a flow of funds from the company and/or its employees to a smart investment plan, which is a smart contract on Ethereum, on the Etherplan platform. Those funds are invested through decentralized exchanges in blockchain based assets using the help of investment advisors. After employees retire, there is a flow of funds from the smart investment plan to beneficiaries, who may be the employees themselves or their family members in case of employee death or disability.

Components

Following is a description of each component in the diagram and what is their role in the smart retirement plan process:

1. Company

The term “company” generally represents small business retirement plan sponsors, but there are also other kinds of organizations or associations who commonly set up and manage retirement plans for their partners, members, associates or employees who can also use Etherplan. These entities may be law firms, consulting firms, trade associations, unions, or educational institutions, amongst others.

Regardless of the kind of entity, plan sponsors must design and communicate the scheme by setting up an off-blockchain contract and documents outlining all the terms and conditions before they implement it on Etherplan. The retirement plan contract and documents are internal rules and agreements between the company and its employees.

2. Employees

The term “employees” generally represents small business employees, but partners, members, associates or employees of the other kinds of entities mentioned above are also included in the concept.

Employees must agree with the plan terms and conditions by signing a document to that effect. After this step, an account may be opened for them on the company smart retirement plan on Etherplan. As plan participants, employees will be included in the plan’s employee list, the beneficiary list and will be eligible for voluntary withdrawals or benefits payments upon retirement.

3. Executive Committee

Retirement plan design usually includes an executive committee which is in charge of decision making, general plan management and communications. As an example, if a small business has between 25 and 100 employees, a typical executive committee is normally comprised of three members among who may be the owner and other high level officers of the company.

Important roles of the executive committee include serving as a fiduciary [1], upholding the plan’s general rules and goals, keeping all parties informed, tracking which employees are retiring and activating scheduled payments to their personal accounts, redirecting payments to secondary beneficiaries in case of employee death or disability, and designating and monitoring the investment committee.

4. Investment Committee

The investment committee may also be comprised of three members, preferably different than the executive committee members, and are usually more familiar with financial markets and making investment decisions. The investment committee is in charge of defining the smart retirement plan’s time horizon, liquidity needs, risk profile, asset allocation, selecting investment advisors on the Etherplan platform, and tracking and reporting investment performance to the executive committee and participating employees.

5. Administrators

Although Etherplan makes it very easy to manage them, smart retirement plans may have several recurring tasks to execute on a daily, monthly or quarterly basis. For this purpose, administrators are usually designated. In the case of simple informational and reporting tasks, administrators may have sole access and permission for those activities. For more important or critical processes, multi-signature schemes may be established so that owners, senior officers and participating employees can provide consent for those sensitive actions e.g. investing funds, changing investment advisors, transferring wealth from the smart investment plan to retiring employee accounts, redirecting payments to secondary beneficiaries, etc.

6. Wallets

All participants in the smart retirement plan have what are called wallets. Wallets are the Ethereum blockchain accounts. Technically they are the combination of cryptographic private and public keys that are used to securely move funds on the Ethereum blockchain.

As plan sponsors and participating employees may send funds to the smart retirement plan and then employees will receive benefits upon retirement, they all need to have Ethereum wallets. Executive and investment committee members must also have wallets so they can sign and co-sign instructions to the smart investment plan on the Etherplan platform. Administrators need to have their Ethereum wallets to execute their tasks on behalf of the plan sponsors and the committees. Finally, participating employee family members who are designated as secondary beneficiaries must have their wallets connected to the Etherplan smart investment plan as well so they can be eligible to receive benefits in case of employee death or disability.

If all the people mentioned above, except secondary beneficiaries, already have wallets because they are participants in the company’s smart retirement plan, then they can use those same keys to satisfy all their rights and roles in the system. All wallets are very easy to create on the Etherplan accounts section. Administrators may be in charge of managing and associating all participating keys to their specific rights and roles in the plan using secure multi-signature processes.

Although wallet security is the responsibility of smart retirement plan sponsors and all other users, online key management courses and guidance will be available through Etherplan. In case of loss, multi-signature account and wealth recovery protocols may be implemented. Popular wallet solutions such as Metamask, Trezor, Ledger Wallet, regular keystore files and other highly secure technologies will be supported on the Etherplan platform as well.

7. Etherplan

The blue Etherplan box in the diagram represents the web and mobile applications that plan sponsors and their designated administrators will use to set up and manage their smart retirement plans on the platform. Within the app, users will be able to add and manage the status of participating employees, add or change executive and investment committee members, manage administrators, create or connect all participant wallets, manage investments and investment advisors, modify plan rules, and initiate payment schedules to employees or their secondary beneficiaries amongst other activities.

8. Smart Investment Plan

The smart investment plan is a smart contract on Ethereum designed to support all functions of small business smart retirement plans. The way it works is that plan sponsors, participating employees, executive and investment committees, administrators and secondary beneficiaries will be connected to it. Each type of account will have the rights and permissions corresponding to their roles in the plan. The smart investment plan will hold retirement assets, interact with decentralized exchanges to buy and sell crypto-assets and other investments, let designated investment advisors enter orders, and be the source of payments to retiring employees or their beneficiaries.

The smart investment plan will be programmed to work as a trust [2] according to the retirement plan contract. This means funds will be segregated from the plan sponsor and managed by the executive committee and the investment committee through the designated administrators, but the economic benefit will be directed to the smart retirement plan’s primary and secondary beneficiaries e.g. participating employees and their families or other beneficiaries.

9. Exchanges and Investments

The exchanges and investments will be third party decentralized solutions on Ethereum. Decentralized exchanges such as EtherDelta and 0xproject will be used to monitor markets, extract data to update portfolios and execute trades. The investments will be cryptocurrencies such as Ether, Bitcoin, Litecoin, and Zcash; app tokens such as Augur REP, Gnosis, Golem, and Filecoin; tokenized traditional securities such as stocks, bonds and ETFs; and regular commodities like gold and silver.

10. Investment Advisors

Since Etherplan, Ethereum, decentralized exchanges, crypto-assets and blockchain tokens representing securities and commodities are all global, registered investment advisors everywhere in the world will be connecting to offer their services to Etherplan users including small business smart retirement plans. Plan sponsors will be able to use existing advisors on the platform or will be able to invite and onboard their preferred providers to connect them to their smart investment plans. Etherplan will have a vetted advisor list (EVA) to screen advisors and provide assurance to users that they are properly registered in their jurisdictions.

11. Beneficiaries

The beneficiaries of smart retirement plans on Etherplan are divided into primary and secondary. By default all primary beneficiaries are the participating employees. However, in case of disability or death, employees will be able to add secondary beneficiaries who may be their family members, charities or other entities. Plan participants may be able to add more layers of beneficiaries e.g. tertiary beneficiaries, and designate specific percentages to each of their beneficiaries.

Integrating Common Retirement Plan Types and Features

Depending on the country and jurisdiction where plan sponsors and employees may be located, there may be national or local laws and regulations that may apply to determine retirement plan types and features that may be implemented.

Fortunately, Etherplan is a very versatile platform so the majority of the most frequently used types and features for retirement plans may be easily integrated. Although plan sponsors and participants using Etherplan are responsible for checking and making sure their plans adjust to local regulations, the most common formats that can be integrated into Etherplan smart investment plans are listed below.

Retirement or pension plan

The difference between retirement and pension plans is related to who contributes and how contributions and benefits are determined. In retirement plans, employees contribute to their retirement accounts and sometimes employers may contribute as well, a process called matching. In these plans, usually contributions are defined and the benefits upon employee retirement are variable depending on the amounts contributed and performance of the investment.

In pension plans, the only contributor is the company which deposits funds into the plan for the benefit of its employees. Typically these plans have defined benefits, meaning the payments to employees upon retirement will be a set amount independently of how much the employer deposited in the fund during the employee’s active years.

Employer matching

As mentioned above, in retirement plans employers may decide to match in part or in whole what their employees contribute to the retirement plan. For example, if an employee contributes 5% of her annual salary to her account in the plan, the employer may match that same 5% amount or offer to match a lower percentage such as 2.5%.

Taxation

Depending on the jurisdiction, retirement and pension plans may enjoy tax benefits. For example in the United States, plan sponsors and employees may contribute up to a certain amount of employees’ annual income in pre-tax money into their retirement plans as long as they are one of the federally enacted and approved systems. Other countries may not have such tax advantages, but many employers nevertheless encourage retirement plans and even match contributions, which usually have vesting schedules, to promote loyalty and reduce payroll attrition.

Vesting schedule

Usually, and rightfully so, when participating employees contribute to their employer’s retirement plan they have immediate ownership and access to their accumulated savings if they want to withdraw them. Sometimes they may incur in tax penalties if there were government tax incentives. However, when employers contribute or match contributions, it is very common to establish vesting periods, which means the employee will not be able to own or withdraw that money for a period of time, or sometimes even until retirement.

Individual accounts or general fund

Retirement plans may be structured as individual accounts or as single consolidated funds. Individual accounts allow employees to have their own smart investment plan on Etherplan and each plan participant may decide how it is invested. If plan sponsors prefer a single consolidated smart investment plan, as seen in the diagram, then the funds will be invested as one portfolio and each employee will own a share of the fund. Etherplan will support both and other more complex formats as well.

Self managed or professional investment managers

Regardless of the possible formats described above, sometimes, but not always, plan sponsors or participant employees wish to manage their retirement funds themselves. However, the majority of retirement plans hire investment advisors for that task or invest in managed products. Etherplan will support all formats.

Lump sum withdrawal or scheduled payments

Upon retirement, all personal contributions, vested funds and their investment returns will be available to the employee. The employee will have the option of withdrawing a lump sum or select a payment schedule from the plan. Another option is that the employee may withdraw the lump sum and immediately buy an annuity. Etherplan will support all mentioned formats.

Reporting

As fiduciaries, plan sponsors and their executive and investment committees have the obligation to report on the plans structure, rule changes, investment performance and other aspects on a monthly, quarterly and annual basis. Etherplan will have a full report generation suite to that effect.

A Note on Fiduciary Duty

As noted above, plan sponsors, and the executive and investment committees will have a fiduciary duty towards retirement or pension plan beneficiaries. Those duties and the level of responsibility vary depending on the jurisdiction. As an example this is the way the United States IRS describes it:

“In general terms, a fiduciary is a person who owes a duty of care and trust to another and must act primarily for the benefit of the other in a particular activity. For retirement plans, the law defines the actions that result in fiduciary duties and the extent of those duties.”

It is important to note that even if Etherplan runs on a highly secure decentralized platform such as Ethereum, that doesn’t mean that all investment risks are eliminated. Also, as retirement and pension plans are common group efforts, mutual responsibilities, rights and obligations between the parties are still valid even if working on trust minimized platforms.

Conclusion

Small businesses, groups, and organizations will organize their smart retirement plans on the Etherplan global wealth management platform helping them access investments and advisors everywhere in the world and easily integrating the specific rules and conditions of their national, local and company rules and policies.

Etherplan will make it very easy for small business owners and plan sponsors of any kind to set up and enroll their partners, members, associates or employees.

Smart retirement plans will enjoy the great benefits of reducing systemic risk on a highly secure, trust minimized platform while honoring the mutual rights and obligations between sponsors and participants.

References

[1] IRS: Retirement Plan Fiduciary Responsibilities: https://www.irs.gov/retirement-plans/retirement-plan-fiduciary-responsibilities

[2] Robert Herian: Trusteeship in a Post-Trust World: Property, Trusts Law and the Blockchain: http://www.academia.edu/23964505/Trusteeship_in_a_Post-Trust_World_Property_Trusts_Law_and_the_Blockchain

Code Is Law