Wealthfront is a software based online Registered Investment Advisor (RIA). They provide portfolio management services. When you accept their personalized investment plan recommendation you can open an account and they implement the investments for your. To use it you can go to Wealthfront.com.

The company’s philosophy is very clear: “Every investor deserves sophisticated financial advice”.

The problem was that this advice was personal, impossible to scale, and therefore very expensive for medium and small investors.

To solve this Wealthfront built what is proving to be a very successful investment service which is already managing over $300 million in client assets.

The secret is combining highly sophisticated investment knowledge with well designed software and then distributing it through the internet for everyone to use.

With their platform, not only have they scaled the ability to reach millions of investors with high quality professional advice, but they have done so at a fraction of the cost compared to traditional financial services. Their fees are 0% for amounts of up to $10.000 and 0.25% above that level.

Features and how the Wealthfront investment process works:

Your investment profile:

Everything starts by understanding your profile as an investor and also your attitude towards risk. For this they have a set of questions that are easy to answer, but also provide them with important information about your financial assets, your objectives, and your potential behavior in different market scenarios.

Investment plan proposal:

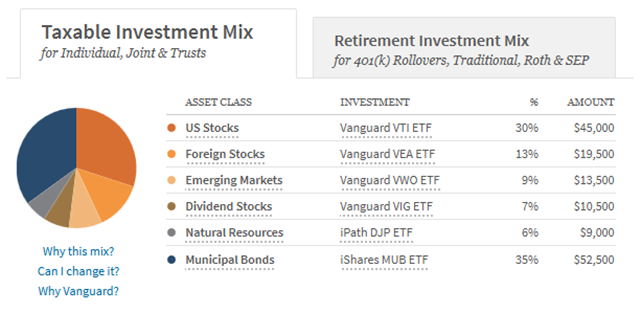

Based on your answers in the previous step they recommend a portfolio that is very well diversified and suited to your needs. They include a comprehensive variety of asset classes ranging from domestic, international, and emerging market stocks, to government, corporate, and high yield bonds. They use the Nobel Prize winning Modern Portfolio Theory and their investment strategy group is lead by Burton Malkiel, the writer of A Random Walk Down Wall Street and proponent of the Efficient Market Hypothesis.

Save your plan: Before you actually go ahead and make your investments Wealthfront gives you the possibility of just saving your plan so you can think about it or even implement it in your existing investment account for free. What is unique about this is that you don’t have to register so it’s confidential. If you wish to save your plan you only need to enter your email address and they will send you a link so you can visit your page whenever you want.

Open an account: If your wish to implement your plan with them then you can go through the formal account opening process. The system is a traditional “client agreement” and “know your customer” procedure. Your new account is opened at a partner broker dealer. You can open your investment account when you create your investment plan or anytime after that if you decided to save it instead. When you open your account and you fund it you can invest in your recommended portfolio immediately with the touch of a button.

Change your plan: At any time before you open your account or when your portfolio is already invested you can change your preferences and risk profile. When you do this the asset allocation recommendation changes and you can adjust your portfolio to your new parameters.

Taxable or Retirement: During the profiling and recommendation process you can indicate if you need a plan for an individual taxable account or for a 401(k) rollover, traditional, Roth and SEP IRA accounts. With your same objectives and financial profile they build a portfolio adjusted for each type of investment, but with different securities and strategy depending on their tax consequences.

Only ETFs: Since Wealthfront provides the investment intelligence there is no need to invest in expensive full service mutual funds or managed products. This let’s them select, for each asset class, the best ETFs (Exchange Traded Funds) for your portfolio with the lowest management fees. There are ETFs for all asset classes, they trade in stock exchanges, and thus are the prefect vehicles to implement your diversified investments. ETFs cost only an average of 0.18% a year in additional management fees.

Ongoing asset management: Overtime parts of your portfolio will outperform others. Wealthfront monitors your portfolio continuously and makes adjustments to bring it back to your recommended mix. Before each rebalancing they consider tax implications and they use any new income, like dividends or new deposits, to maintain the correct distribution.

Continuous tax loss harvesting: Tax loss harvesting is the process of selling the worst performing investments to offset capital gains in winning investments. Wealthfront not only does this automatically, but it does so continuously throughout the year for accounts over $100.000 in assets. According to the company continuous tax loss harvesting may increase the returns on your portfolio an average of 1% after taxes. This more than offsets the cost of their service plus the fees of the underlying ETFs.

All questions are answered:

As you can see above Davis Janowski was recently hired to head Wealthfront’s editorial team and Knowledge Center, he was the Financial Technology Editor at InvestmentNews, a leading publication for financial advisors.

This is part of the company’s effort to keep investors and prospective clients completely informed about their service, investment opinions, and all aspects of managing their money.

The company is also very open to explain its investment methodology in detail in their Wealthfront Investment Methodology White Paper.

Conclusion:

Within the investment arena there are several service models that suit different investor profiles. Wealthfront is clearly for “delegators”, investors who prefer to spend their time enjoying life and managing their careers rather than picking stocks or trying to outsmart the markets.

If you are looking for an online investment firm with a top notch investment team, a transparent service, and very low cost for any size portfolio then Wealthfront is for you.

—

Watch this interview with Adam Nash, COO of Wealthfront, where he talks about the company and how the service works: