Mint is not a financial software, it’s your integrated dashboard to all of your finances. With some more integration and user adoption Mint will be the real portal to the whole retail financial sector. Mint is the mother of all financial apps.

For now it has “only” 10 million users and it “only” provides account data aggregation, but in the future it will not be difficult for the company to include transactional capabilities, this will turn your Mint into the “operating system” of your finances and the whole retail financial sector.

During the 90’s Mint’s parent company, Intuit, the makers of Quicken, slowly managed to aggregate the account information of an ever increasing number of banks, brokers, credit card companies, and other relevant financial sector companies. It was not easy as players feared being “aggregated” would turn their businesses into commodities.

Quicken, Mint’s predecessor, said “we are not a financial institution, we are only an information system”. By the end of the decade it was the other way around: banks couldn’t be out of the Quicken aggregation system as customers would migrate to providers who would support the software’s service.

Quicken had everything ready for the next step, to include transaction capabilities so clients wouldn’t have to leave to go to the bank’s websites to do things with their money or get new services like a loan or open an account. Also, Quicken launched its cloud services Quicken so users could organize their money on the web instead of on a desktop app.

But it didn’t happen, Intuit seemed to be stuck with industry resistance and customer experience “block” as it didn’t know how to integrate design to move to the next step.

Then came Mint, a 2005 start-up that promised to integrate your finances even easier than Quicken or Quicken. Mint is organized around you and not around your accounts. It is easy to move from account balances, to budgeting, to goal setting, and the best part is that as you deal with your money issues it very appropriately bring tips, advice, and, of course, financial products offers.

Mint was acquired by Intuit and integrated into Quicken in 2009.

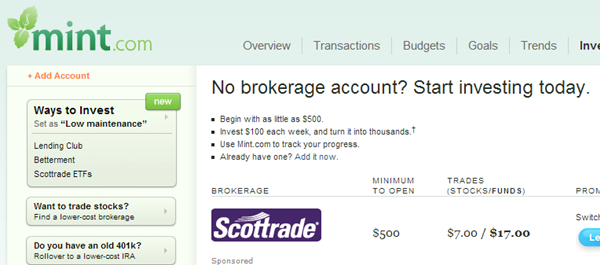

Today you can manage all your personal finances on Mint as it aggregates your information from all financial institutions, and you get advice and ideas on how to better manage your money. It also brings offers of financial services just when you are thinking about them, it will not be too long when you will be able to actually move your money from your Mint even if it is at another entity. You will be able to get new services from the Mint website or app, you will transfer money and do payments to other Mint users, all of this while you diversify your risk with several providers, but aggregated on one front end: Mint.