Related video: When Ethereum Classic $1,000?

The Positioning Logic

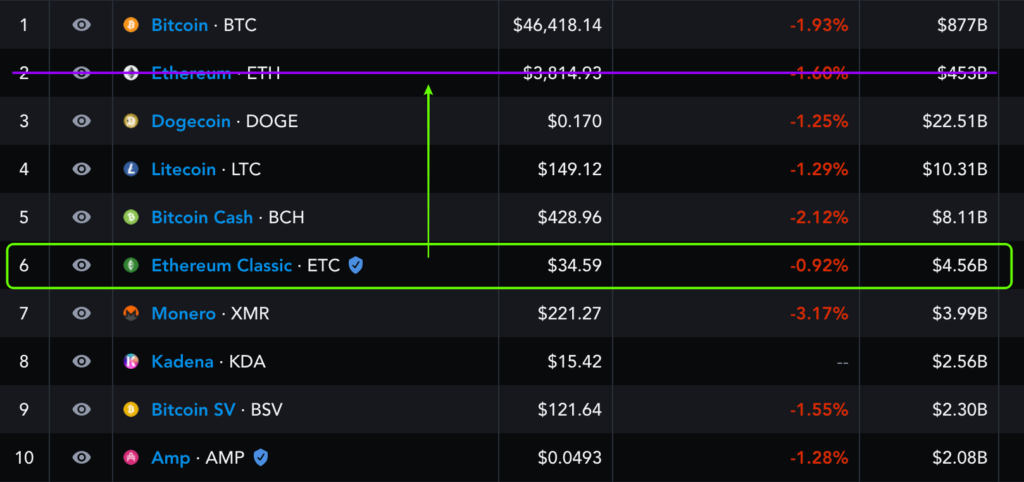

People should not use the typical CoinMarketCap and CoinGecko coin lists to see what is the position of Proof of Work (POW) coins. We should filter out the meme coins, shit coins, and stable coins and only rank the POW coins to get a better view of the ranks of coins at the base layer.

The above chart by Messari shows only the rank of POW coins, and it shows that Ethereum Classic (ETC) is well positioned at number 6. When Ethereum 1.0 moves to Ethereum 2.0, a Proof of Stake (POS) model, then ETC will automatically become the 5th largest POW coin in the world.

However, ETC is programmable digital gold whereas Bitcoin (BTC), Doge Coin, Litecoin, and Bitcoin Cash are not. This means that Ethereum Classic, because it is much more useful, will likely rise, at the minimum, above Doge Coin, Litecoin, and Bitcoin Cash to become the second largest POW coin in the world beside Bitcoin.

This rise above Doge Coin, Litecoin, and Bitcoin Cash is one of my three major driving forces assumed for the rally of ETC to $1,000.

The Layered Blockchain Industry Logic

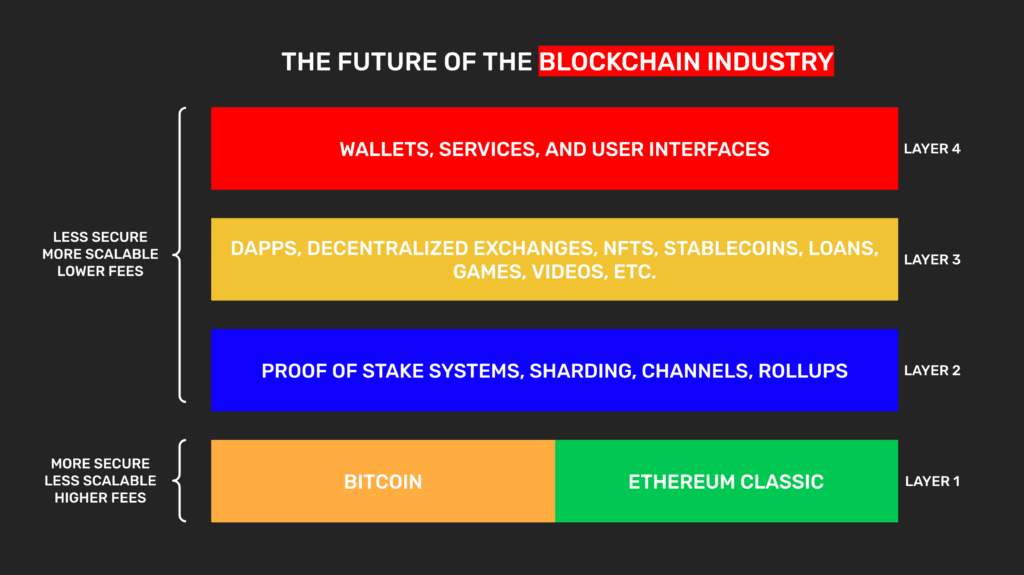

As I have explained many times, the blockchain industry will be layered and divided in components. All the most valuable components together will create the experience of the “blockchain”, just as all the components of the OSI model create the experience of the “internet”, which is a layered and modular decentralized system as well.

Because POW coins are much more secure than POS coins, then Bitcoin and ETC will be at the base layer or layer 1 of the whole industry to provide security and monetary services.

Because POS coins are more scalable than POW coins, then blockchains like Ethereum 2.0, BNB, Solana, and Polkadot, will be at layer 2 to provide high volume transaction services.

Together with the systems, dapps, and wallets in layer 3 and 4, the whole blockchain industry combined will be the complete “blockchain” product and experience. And applications will use the best components in each layer, but not live in one chain as it is today.

Crypto Bull Market Cycle Logic

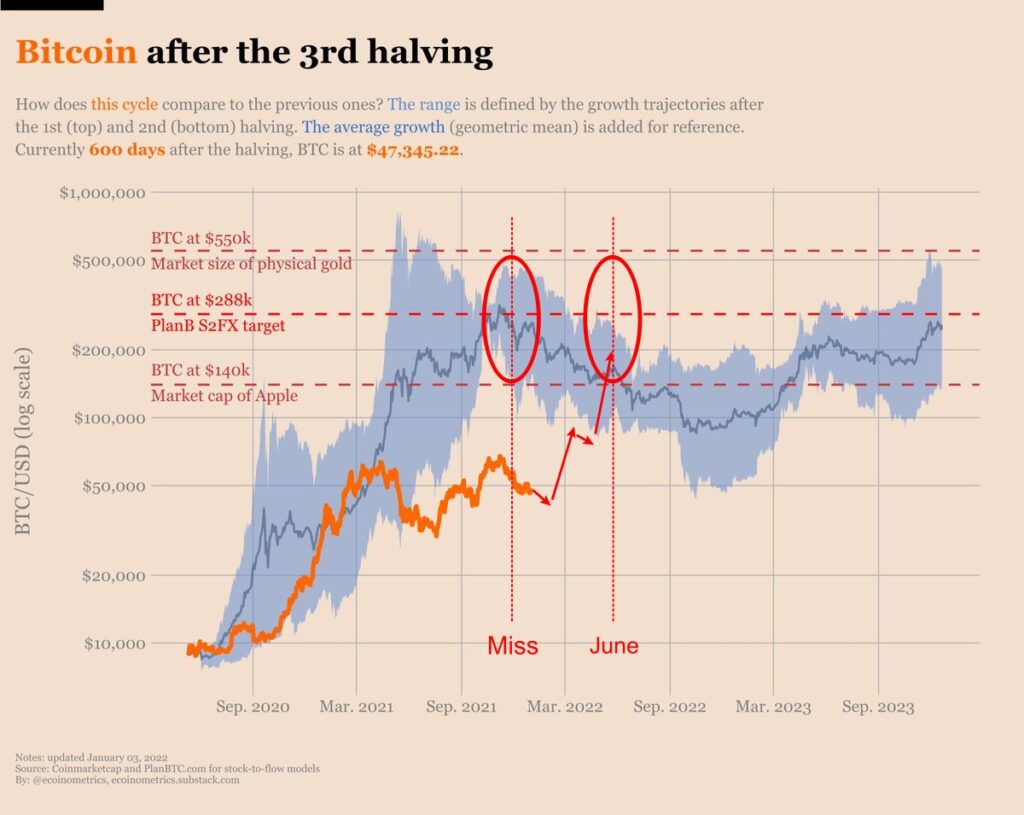

The crypto industry is led by Bitcoin price patterns. Bitcoin had a bull market cycle in 2013 and another one in 2017. This is because every four years it has the “halving“, which is the reduction of its block rewards by 50%.

As may be seen in the chart above, BTC missed the rally that should have happened at the end of 2021. This is why ETC missed the price target of $1,000 I had set for the coin, because the BTC cycle was another of the three driving forces I had predicted. But didn’t happen.

However, because of the macro monetary situation, COVID, and other reasons, I think the second leg of the crypto bull market cycle must have shifted to 2022. So, as I marked on the chart above, I predict that BTC will reach my price target of $125,000 by June of 2022, and ETC will reach $1,000 by the same dates.

Key Short Term Events

1. Fifthening

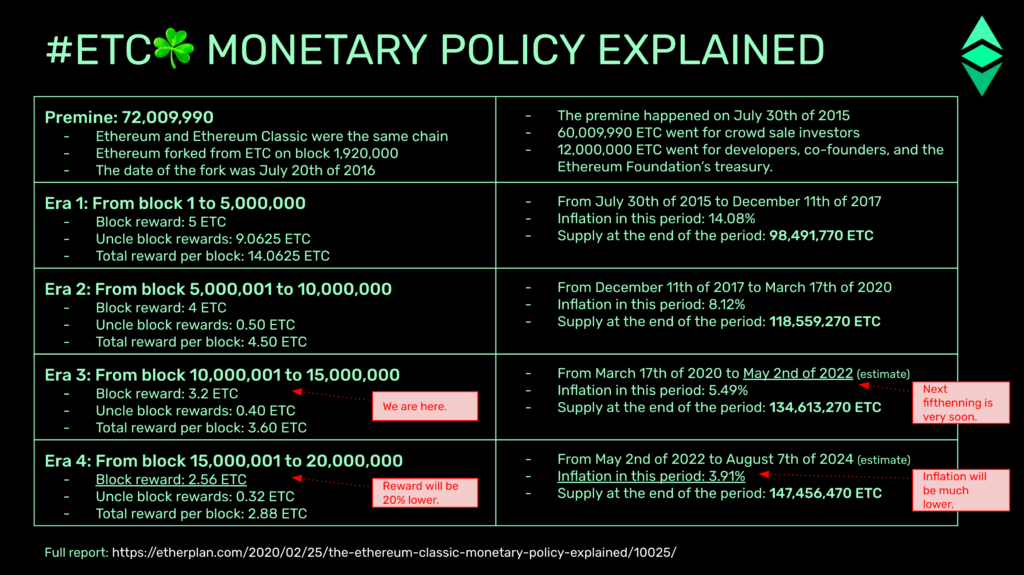

The above chart, which I described in a video, shows that Ethereum Classic will lower its block rewards more or less by May of 2022. This reduction will be from 3.20 ETC per block to 2.56 ETC per block paid out to miners.

As the ETC annual inflation rate will be lowered from 5.49% to 3.91% by this event, and the supply will be 20% lower, hence “fifthening”, then this will be another driver for the likely ETC rally in the first half of 2022.

For a complete description of the Ethereum Classic algorithmic and fixed monetary policy, please read this article.

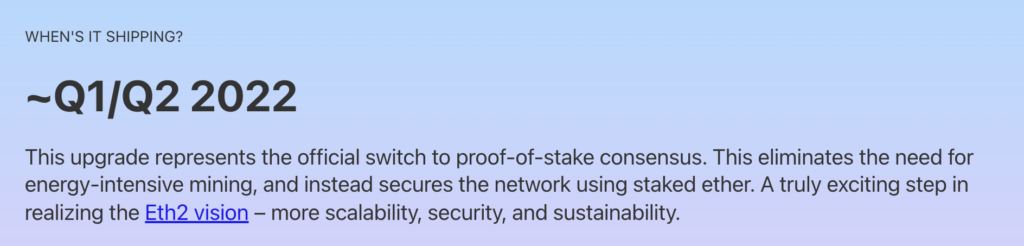

2. Ethereum 2.0 Merger

As mentioned before, the Ethereum 1.0 to Ethereum 2.0 merger is a very important external event in ETC because it will remove Ethereum (ETH) from the POW layer of the blockchain industry as that system seeks more scalability at the expense of security.

As may be seen in the quote above from the Ethereum Foundation, they expect that the merger will occur around the first or second quarter of 2022. This is a major catalyst for the price of ETC, so it is the third major driving force assumed in my price prediction of $1,000 in the first half of 2022.

Macro Situation

1. Fiat Money Printing Is Forever

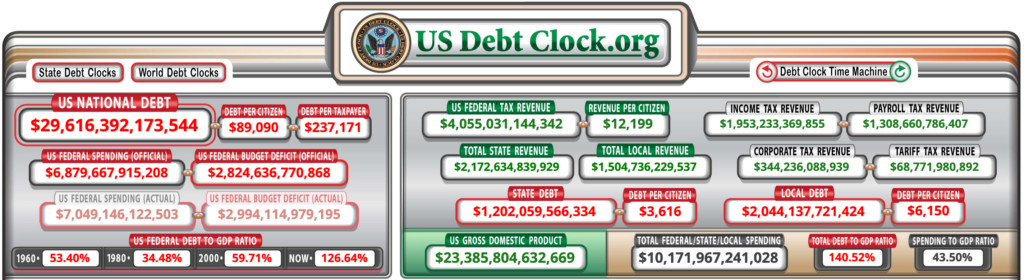

As may be seen in the US national debt levels above, the country has a debt of around $30 trillion and that represents 127% of GDP. This means that when long term rates go back to normal levels of 5%, then interest payments alone will be $1.5 trillion a year.

With a federal spending level of nearly $7 trillion and a deficit of about $3 trillion, this level of debt and interest will be impossible to pay with new taxation.

The above puts the US in a situation of either defaulting or permanently printing money forever. As history shows in many nations, the US Government will opt to print money forever.

The is the situation in the majority of advanced nations, and emerging nations have been in this situation for decades already.

This permanent inflation of the dollar and major currencies of the world, will guarantee the permanent rise of ETC as it is sound money with a fixed monetary policy.

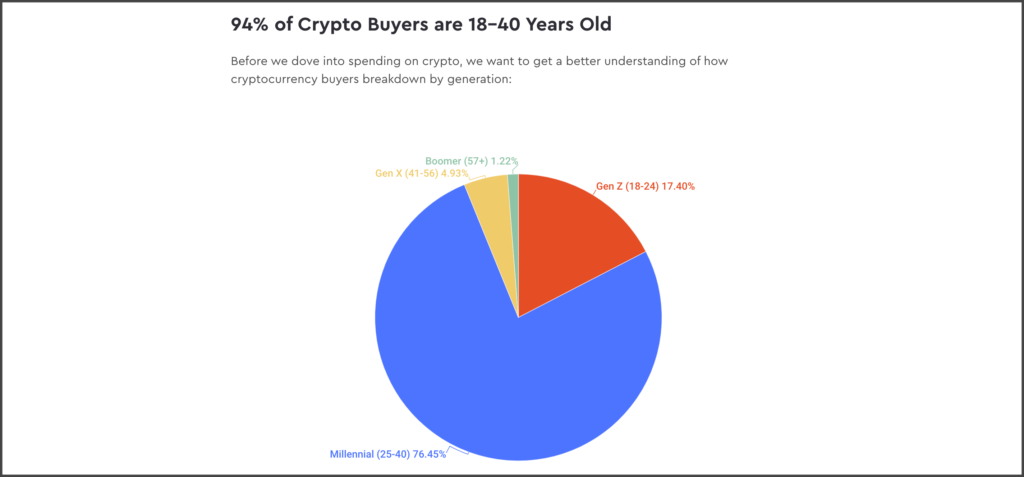

2. Millennials and Zoommers

Millennials (Gen Y) and Zoommers (Gen Z) are becoming what I call “crypto first” generations. This means they invest their savings in Bitcoin and other cryptocurrencies first, rather than in the traditional alternatives like mutual funds, ETFs, stocks, or bonds.

As ETC will be a major cryptocurrency; comparable to Bitcoin as digital gold, but ETC will be programmable digital gold; then Millennials and Zoommers will include ETC in their portfolios as a major holding.

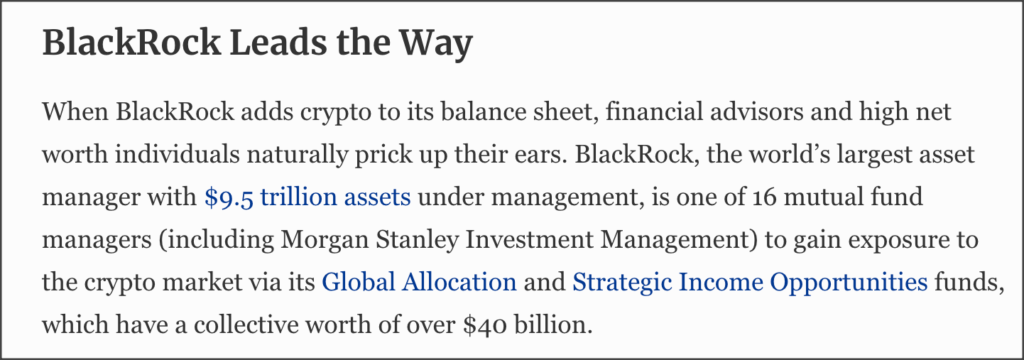

3. Institutional Investors

2021 has seen a major shift by institutional investors, governments, and large corporations who started to invest in Bitcoin. As reported above by Forbes, this trend will accelerate.

For the same reasons as Millennials and Zoommers, ETC will be a major cryptocurrency holding in institutional investor portfolios.

Conclusion

My price prediction for Ethereum Classic is $1,000 by the end of June of 2022.

This is due to that the second leg of the current crypto bull market cycle likely shifted to 2022 and that other very important events for ETC will happen in the first half of 2022.

Code Is Law