A blockchain is a peer-to-peer network of machines or nodes, very much like Napster, LimeWire or BitTorrent, but instead of replicating music or movie files in their nodes, they replicate a distributed ledger with accounts and balances of a cryptocurrency.

Bitcoin (BTC) is the pioneer and largest blockchain and, in search of maximum security, it has a simple design as it serves principally as a cryptocurrency, mimicking digital gold.

Ethereum Classic (ETC) borrows from Bitcoin its basic structure, but adds smart contracts which was the other great goal of blockchains to achieve full decentralized functionality through programmability.

Both networks; with their distinct features, benefits, and tradeoffs; will be complementary base layer systems of the blockchain industry, achieving great value for investors, decentralized application developers, and users alike.

Comparisons

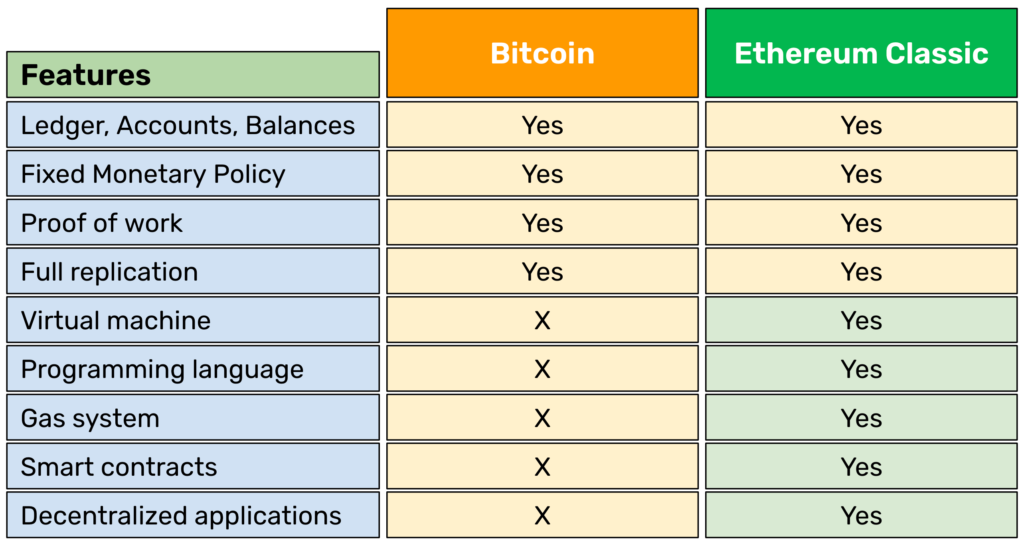

As may be seen in the table below, both BTC and ETC are the same in the first four critical features, but where Ethereum Classic differentiates itself is in the last five, which provide fully generalized programmability for the network.

Each of these features and comparisons are explained in the following sections.

Ledger, Accounts, and Balances

Both Bitcoin and Ethereum Classic host a ledger with accounts and balances of a cryptocurrency. In the case of Bitcoin its cryptocurrency is $BTC and in the case of Ethereum Classic it is called $ETC.

This basic functionality includes the ability to received and process transactions to move $BTC and $ETC from account o account.

The accounting model of BTC is called UTXO (Unspent Transaction Output) which consists of a stream of transactions that together determine the final balance of accounts in the system.

The accounting model in ETC is the “account system” which, instead of using an endless stream of transactions to know what is the balance of accounts, it uses double entry accounting, debiting sending account balances and crediting receiving account balances, enabling what is called “state transition” and, thus, the “state machine“, which is what enables its programmability.

Fixed Monetary Policy

BTC and ETC have very similar monetary policies as both have completely algorithmic and decreasing supplies with eventual supply caps more or less by the years 2130 to 2140.

In the case of Bitcoin, its supply schedule is cut by half (also known as the “halvening”) every four years in a sequence that started paying block rewards at 50 BTC in the first era starting in 2009, then was cut to 25 BTC in the second era, to 12.5 BTC in the third era, 6.25 BTC in the fourth (the current era), will be cut to 3.25 BTC in the next one, and so on.

ETC started with the same supply schedule as Ethereum in 2015, but after the separation of both blockchains in 2016 it began discounting block rewards by 20% (also known as the “fifthening”) every 5 million blocks which is equivalent to every 2.39 years.

Ethereum Classic started paying 5 ETC per block in the first era starting in 2015, then 4 ETC in the second era, 3.2 in the third era (the current era), will pay 2.56 starting in May of 2022, and will continue this schedule until it diminishes eventually, just as Bitcoin.

According to these schedules, Bitcoin will have a total supply of 21,000,000 $BTC and Ethereum Classic 210,000,000 $ETC. This was actually done by design to imitate Bitcoin’s sound money properties.

Proof of Work

The consensus mechanism that both Bitcoin and Ethereum Classic use is called Nakamoto Consensus, also known as “proof of work” because it has that technology at the heart of its functionality.

Proof of work based Nakamoto Consensus is the key invention by Satoshi Nakamoto and one of the two critical elements of a secure blockchain; the other being full replication, which is described later in this article.

Proof of work is the most secure consensus engine in a blockchain because it has several key benefits:

– Consensus: The proof of work hash in each block shows that the majority of miners worked on that block. This information is what nodes use to know that each block they receive is the correct and honest block, so they add it to their local database or “blockchain”. Knowing which blocks are the correct ones assures that all nodes in the network globally can share exactly the same state of the blockchain at the same time; even if they are all machines operated by total strangers, in different cultures, continents, and nations; providing the guarantees of decentralization and trust minimization.

– Point of entry and exit: The same information that serves as a consensus mechanism for all nodes globally, serves, for the same reasons, as a way for machines to enter and exit the chain whenever they want, permissionlessly. If a new node wants to join Bitcoin or Ethereum Classic they just have to check with other peers in the network which is the chain with the most proof of work done on it. Once they have this information they can rest assured that they will fully synchronize to the honest network. The same applies if they need to be disconnected, they are down for a while, and then need to reconnect again.

– Security: Proof of work is also a way to protect the current set of transactions as it would take a lot of capital and time for any attacker to falsify blocks or transactions. This feature is cumulative as the sum of all the proofs of work of all the historical blocks in Bitcoin and Ethereum Classic constitute a phenomenal barrier for hackers to reverse or falsify any transactions included in the blocks of the past.

– Scarcity: Just like gold is scarce because it is very costly to produce, BTC and ETC are scarce because they require a lot of work by miners to produce blocks and, hence, issue the rewards to them. This is what gives BTC and ETC their properties of digital gold.

Although Ethereum is migrating to proof of stake, a more scalable but less secure consensus mechanism, Ethereum Classic will remain with proof of work based nakamoto consensus for the foreseeable future or forever, just as Bitcoin.

Full Replication

As mentioned before in this article, full replication of the database, with the accounts and balances, in all nodes of the system is the second most important point of security in a blockchain.

Full transmission of transactions and replication of the database is what ensures that both Bitcoin and Ethereum Classic would, like the internet itself, “survive a nuclear war“.

This is because full replication assures that even if large portions of the network may be attacked or disabled, for any reason, the rest of the nodes could still continue operating, receiving transactions and maintaining the state of the network.

And, because of the properties of proof of work mentioned above, the disabled nodes could eventually rejoin permissionlessly whenever they hopefully recover.

Virtual Machine

This is where Ethereum Classic starts to add features that Bitcoin does not or cannot have.

The virtual machine; also known as the Ethereum Virtual machine, or EVM for short; is a software component of the ETC node client that has many opcodes that, working together, recreate the functionality of a real processor or computing machine. This is why it is called a “virtual” machine.

The benefits of this virtual machine in ETC are that on one side it works with the local machine that is running it; regardless of what is its make, format, or operating system; and on the other side works with all Ethereum Classic smart contracts that are deployed on the network and hosted inside the database or blockchain.

This component is what provides ETC with its unique ability to execute smart contracts, or decentralized programmes, securely on the blockchain, in a distributed manner, across all nodes in the network.

Indeed, in practice, ETC does work as a “world computer”.

Bitcoin cannot have this feature because its UTXO transaction model, the limits of its language, and its tiny memory means it can’t be used for generalized applications.

It is the combination of Ethereum Classic’s account model, the virtual machine, and its rich programming language that enable full programmability.

Programming Language

The programming language of ETC and its EVM is called Solidity.

When decentralized application (dapp) developers want to build dapps on ETC they use this language, which is compatible with the virtual machine.

As said above, the combination of the account model, the EVM, and this programming language is what makes ETC so different than Bitcoin and programmable inside its highly secure environment.

Gas System

Bitcoin uses a direct fee model by transaction. This is that any user sending a transaction may compensate miners for including their transaction on a block by setting a fee for it.

For example, a user sending 1 BTC may include a fee in the transaction form of 0.0001 BTC for a total of 1.0001 BTC, where 1 BTC will be transferred from his account to another account and 0.0001 BTC will be credited to the miner’s account.

Because Ethereum Classic is a more generalized computing system, it may have moments where complex programmes may get stuck, very much like Windows or MacOS machines sometimes get stuck and users have to restart the apps or even turn off and on their machines!

However, because a blockchain like ETC cannot be turned on and off, then the gas system was invented.

The gas system basically enables users to set a specific amount of a computational unit called gas, for each transaction they send to the network. Then, the network knows that they have to spend that gas only to try to compute the transaction or the execution of a smart contract.

If the gas is spent and the execution did not finish, then it is returned to the user with no results. If the execution went through as desired, then then user would have spent that gas and the transaction or smart contract execution would have gone through just fine.

As each opcode in the virtual machine has a specific gas amount to be executed, and gas has a price in the free market, then users pay for this gas, which then miners use to compute and get paid with those gas fees.

All in all, the gas system is what solved the final problem of EVM based blockchains likes ETC and; together with the account model, the EVM, and the programming language; enables smart contracts on Ethereum Classic.

Smart Contracts

For all the reasons said above Bitcoin cannot have smart contracts, but Ethereum Classic can.

Smart contracts are really software programmes that, when they are deployed into the network, as they are replicated in all the nodes of the blockchain globally, they become decentralized programmes.

These programmes can be very simple or as complex as normal applications in PCs, smart phones, or cloud computing systems today.

Not only smart contracts are decentralized software programmes, but because they can hold $ETC, they can make money transfers according to their use cases, rules, and functionality.

All this versatility enables all sorts of decentralized applications.

Decentralized Applications

Decentralized applications, or dapps, are products and services that may be built on EVM blockchains like ETC using smart contracts. Because Bitcoin is not an EVM blockchain it cannot have complex applications inside its highly secure environment, but they have to be built on higher layer components external to it.

Many kinds of dapps may be built, and have been built, on EVM blockchains like ETC. Examples of these are decentralized exchanges, loan and deposit services, insurance products, securities, mutual funds, and NFTs.

In the future, it is very likely that dapps like video services, messaging apps, and even ride share services may be built on EVM blockchains.

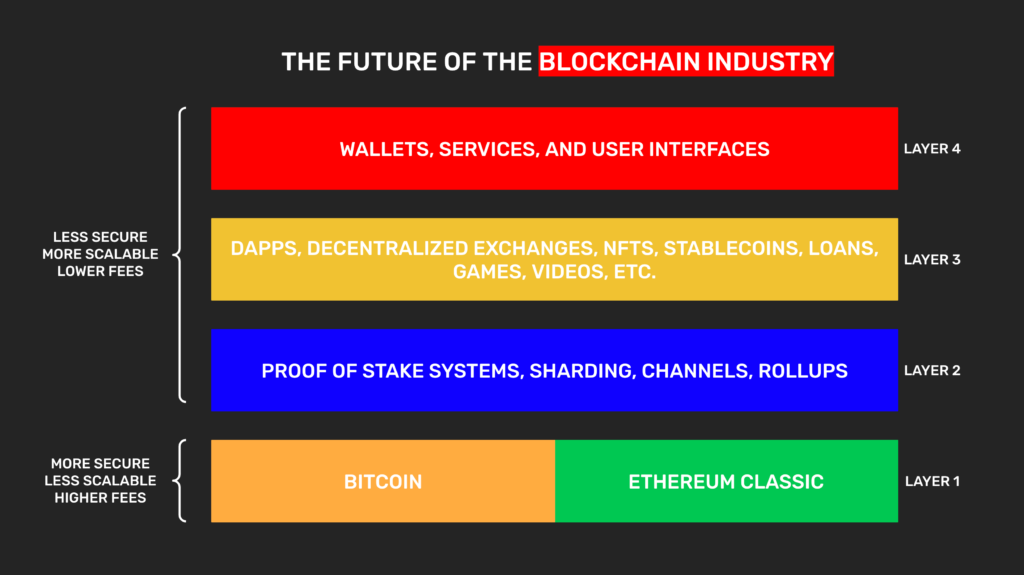

The use cases for ETC in particular, as a proof of work base layer system on par with Bitcoin, is for dapp and systems developers to build the most secure components of their products and services on ETC.

It is very likely that dapps will not be hosted on single chains in the future, but their components will reside in different networks and systems depending on their specialization, focus, features, and security vs scalability tradeoffs.

Examples of use cases and designs that may be applied to ETC, depending on the needs of dapps and user profiles may be:

– Wallets and planning dapps for individuals and families to invest in ETC as a store of value and for long term financial planning.

– Proof of Stake blockchains may use ETC for checkpointing and anchoring their state and for sound monetary policy services.

– Higher layer systems and components may use ETC as a settlements layer.

– Governments may use ETC for treasury reserves and large payments.

– Central banks may use ETC as reserves and for high value real time settlements between regulated financial institutions.

– Supranational organizations may use ETC for their reserves and for managing complex multilateral smart contracts.

– Banks may use ETC for settlements, securities issuance, derivatives, and large value transfers.

– Multinational corporations may use ETC for large value smart contracts with providers and clients with automated payments given certain complex conditions.

– Teams and small businesses may use ETC to manage their capital, shareholder registries, and to use high the value dapps and services mentioned above.

Conclusion

In light of all that has been explained in this article it may be said that Bitcoin is more akin to digital gold and Ethereum Classic is more like programmable digital gold.

Due to their tradeoffs and design choices both networks will be highly complementary at the base layer of the blockchain industry’s technology stack.

Just as Bitcoin is and will further achieve a value that is measured in the trillions of dollars; because of its incredible positioning and versatility, ETC will likely grow to be beside Bitcoin as a highly sought and valuable programmable base layer blockchain, and will thus be worth trillions as well.

Code Is Law