This article is largely a response to Charles Hoskinson’s video titled “More on ETC’s Treasury Idea” posted below:

To the best of my recollection, one way or another, shared by the whole or parts of the ecosystem, Ethereum Classic (ETC) has had four successive and complementary visions up to now:

1. The Code Is Law vision

Code Is Law by means of immutability was the initial vision as a reaction to TheDAO hard fork of 2016 in Ethereum, in which ETC founders made a statement of immutability by not following the Ethereum ecosystem at the time, who instituted an irregular state change of the blockchain, violating its basic principles.

2. The Internet of Things vision

After the initial trauma, the ETC ecosystem got together, reorganized itself, and the first core developer team, called ETCDEV, proposed a general vision of using ETC as a global trust minimized base layer programing system on top of which a system of sidechains would power a large share of the internet of things (IOT). This vision expanded and was an extension of the first vision of immutability and Code Is Law.

3. The Base Layer vision

In 2018, the ETCDEV team was replaced so Etherplan proposed for ETC a vision of being purely a secure base layer for multiple systems to work on top. This view is the same as the internet of things vision, but assumed that, in the end, very few systems would survive at the base layer of the blockchain industry stack; that proof of stake systems will be less secure, so they will operate on a second layer or layer 2; and that ETC could be a highly secure Turing complete system, complementary to Bitcoin, but serving multiple technologies on top, not only IOT. The layer 2 systems operating on Bitcoin and ETC could include ETH 2, Cardano, Tezos, EOS, and many others.

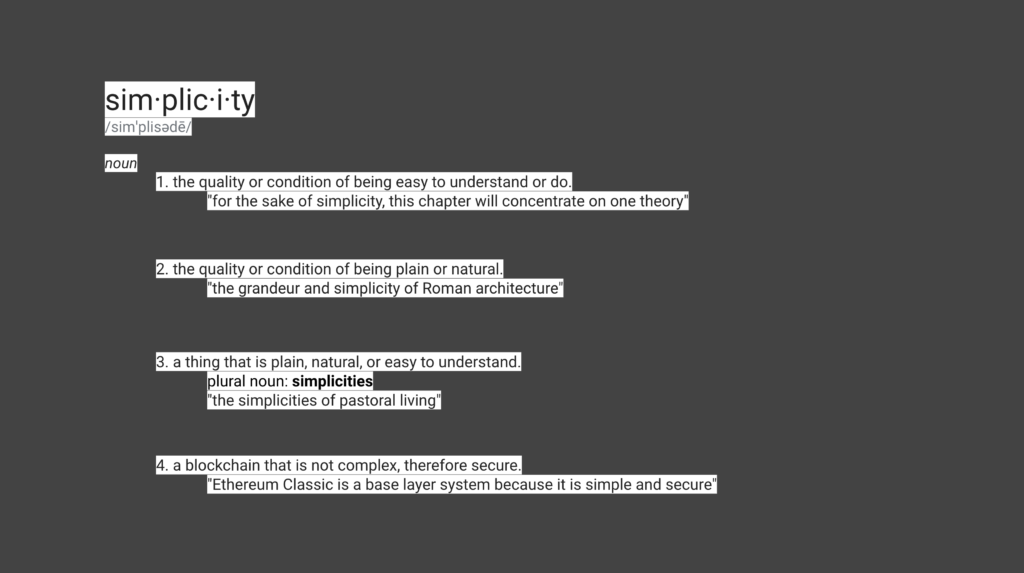

4. The Simplicity vision

After a recent series of reorganization attacks in Ethereum Classic, Charles Hoskinson of IOG, has proposed, including in the video above, a vision where ETC adopts a roadmap favoring the simplicity and security of the system, similar to Bitcoin, but with sufficient functionality, funding, and a professional roadmap, to be minimally competitive in the niche that it chooses. The funding feature proposed is a treasury system integrated into the blockchain protocol that would be used to pay for development, marketing, sponsorship of dapp developers, and other functions. This vision also seems complementary and builds on the previous ones.

Below I am going to comment on Charles’ ideas where I generally agree with the simplicity and security vision, and make some observations about the treasury, and other concepts.

The Simplicity vs Complexity Tradeoff

I completely agree that complexity is the enemy of security. Bitcoin is a deliberately simple system, and that is consistent with a strategy of providing high security with a sound monetary policy.

I agree that Bitcoin is a system that seeks full replication as that is a major component of its security model.

I wrote about the need for full replication, as opposed to sharding, in an article where I responded to Vitalik Buterin’s incorrect statement that replication is centralization and that fragmentation retains the qualities of decentralization.

My article about this topic:

• Replication is not Fragmentation

Ethereum Classic Should Follow a Simplicity Roadmap

I agree with Charles that simplicity and security are the right strategic goals for Ethereum Classic and its philosophy. I do not agree that ETC would be a sort of “testnet” of Bitcoin as there are many of those, such as Litecoin, Bitcoin Cash, and several others.

I do align with the notion that Ethereum Classic may be very complementary to Bitcoin at the base layer in the sense that they can eventually have similar levels of security, but where ETC could provide programability to Bitcoin as well as high security services to layer 2 systems as ETH 2.0, Cardano, EOS, Tezos, IOT, and traditional business and banking in general.

My articles about this topic:

• Why There Will Only Be 3 or 4 Surviving Blockchains in the Future

• The Format War, Layering, and Systemic Risk will Define the Future Landscape of the Blockchain Industry

• Ethereum Classic Vision

• Bitcoin and Ethereum Classic are Complementary Base Layer Systems

• Model for an Ethereum and Ethereum Classic Collaboration

I agree as well that trying to integrate complexity to compete with ETH 2.0, Cardano, EOS, Tezos, and other proof of stake highly scalable systems would be futile because a) that market segment is saturated, b) it requires large amounts of funding that ETC does not count with, and c) it is contrary to Ethereum Classic’s core values and positioning.

Who Will Take Ethereum Classic There, Funding, and The Treasury

In the topic of funding I agree and disagree with Charles. I agree that ETC has perhaps insufficient funding from diverse players, and that it needs money for development, marketing, and partnerships, but I already wrote about my opposition to the treasury as the funding device (see link below). Not because of the funding, but because of the device!

The opinion that I expressed is that the treasury system is a centralizing mechanism. Charles expressed his belief that blockchains are self evolving infrastructure and that the treasury would migrate from a somewhat centralized state, to naturally become more decentralized with future versions of it.

My disagreement is that I think exactly the opposite. Blockchains are very vulnerable in the beginning, or at least until they “ossify”, and are largely controlled by few people. This means that, due to economic incentives, they will likely not evolve naturally towards decentralization unless very ruthless trust minimization is defended at the social layer since the start. To the contrary, the treasury system will likely become more and more centralized in ETC as time passes by.

My articles about this topic:

• Why Ethereum Classic Should Not Create a Treasury

• Blockchains: What Some See as Toxic Others See as Security

• Public Blockchains are, and will Always be, Under Constant Social Attack

• Ethereum Classic Ungovernance Explained

What Roadmap Aligns With a Simplicity and Security Strategy?

The initial proposals by Charles are the treasury system, a system for checkpointing ETC’s blocks to reduce or eliminate reorganization attacks, and he has also expressed support for the idea of migrating the mining algorithm to SHA3.

As I have written before, I propose a roadmap that has the following general goals or mission:

• Gradually and moderately increasing transaction capacity

• Reducing bloat to increase node count

• Building layer 2 connectivity so other systems can work on top

• Lateral compatibility and interoperability with Bitcoin to serve as a programmable complementary base layer system

• Backward compatibility so new features, fixes, and upgrades don’t break past smart contracts

The above goals are aligned with executing a hard fork in the short term with:

• The SHA3 mining algorithm change (reduce 51% attacks)

• Implementing Flyclient (layer 2 connectivity)

• Implementing account versioning and versionless EVM (backward compatibility)

The reason why I don’t agree with the external checkpointing system, or importing external security in general, is that I think that the strategy of being a simple and secure base layer system requires that Ethereum Classic must be internally secure, and not dependent on third parties.

My articles about these topics:

• The Ethereum Classic Ideal Long Term Roadmap

• Backward Compatibility: What is Account Versioning in Ethereum Classic?

• Why Proof of Work Based Nakamoto Consensus is Secure and Complete

• Proof of Work has Division of Power, Proof of Stake Does Not

• Why Proof of Stake is Less Secure Than Proof of Work

Back to First Principles

I agree with Charles that, treasury or not, ETC must go back or remain in the road of first principles and avoid a long and costly path trying to compete in the complexity space. One thing I would add is that simplicity is compatible with security, and that sometimes those guiding principles also mean slowness!

However, I agree that low interest, which translates into low token prices, and low hash power, leading to frequent 51% attacks, are a clear and present danger, therefore a problem to solve in the very short term.

I also understand that many in the ecosystem are now less fond of following conservative strategies only, and it is reasonable to figure that, in front of the latest attacks, whatever has been done up to now has not worked.

Where Do We Go?

I wish there were simple ways of solving the funding problem, and I don’t have the answers, but I do believe that low time preference and a sound strategy of first principles may be, as I think Charles agrees, the correct path for ETC.