You can listen to or watch this article here:

This article is based on a deal offered on Twitter by Virgil Griffith, Special Projects Manager of the Ethereum Foundation, where he asks Ethereum Classic (ETC) folks for a wishlist of things Ethereum (ETH) could do that would benefit ETC.

Bellow I am posting the wishlist I wrote to him, so I can elaborate on some of the reasons, sources of information, and ideas for such wishlist, which I think is a rational way of approaching a more productive collaboration between the two ecosystems.

Full Thread and Rationale

1. For several reasons I think the base layer blockchain space will end up in the long run with 3 or 4 leading global chains. The share will be distributed something like this:

1st chain: 50%

2nd: 25%

3rd: 12.50%

4th: 6.25%The balance may be an “all the rest” niche residual list.

The reason I stated the above is because blockchains have network effects and, when those externalities kick in, usually it is a “winner takes all” kind of market. This means that when the sector as a whole, and some of the blockchains inside the sector individually, reach a certain critical mass, they will enter a runaway growth phase in total market size and relative market share, where very few chains will be the “winners” and they will likely be very big.

The current period, where there is no defined winner and the general sector is still small relative to the competition and its total addressable market, is called the “standards war” or “format war”. In history, there have been many ways in which standards have been established in the market. Some examples of industries that have gone through intense standards wars with a single or very few resulting winners have been: electricity alternative current vs direct current, railway gauge, Betamax vs VHS video standards, and during this information age, the browsers war and the operating systems war, amongst many other format fights in the past.

I think the most comparable products to blockchains that are sensitive to externalities are operating systems, e.g. Windows, macOS, Android, iOS, Linux, Apache, etc. This is because, in essence, notwithstanding the large efficiency differentials, both blockchains (especially Ethereum and Ethereum Classic) and operating systems serve as multipurpose computing or computing enabling systems across the world, where developers can create and build new applications and use cases on top.

Having said the above, if we see how operating system markets are distributed today we will see that there are always very few, usually 3 to 4, winners and then a residual list of players who either find a niche or become irrelevant.

Some examples of few winners in the consumer operating system market are:

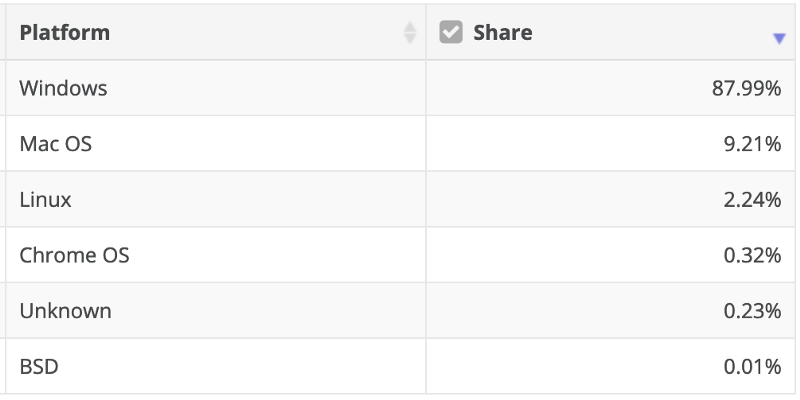

Desktop and Laptop OS Shares

Mobile OS Shares

All Global Consumer Devices Combined (desktop/laptop, mobile, tablet, handheld and TV) OS Shares

As blockchains, especially highly secure base layer chains, may be regarded as non-consumer facing, but backend computing infrastructure, I include below examples of enterprise operating systems, web server systems and super computer market share data.

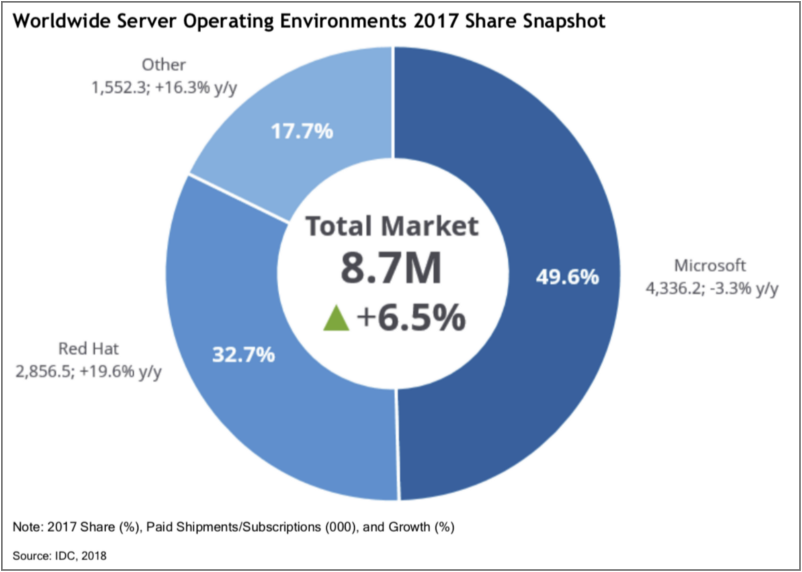

Enterprise Server OS Market

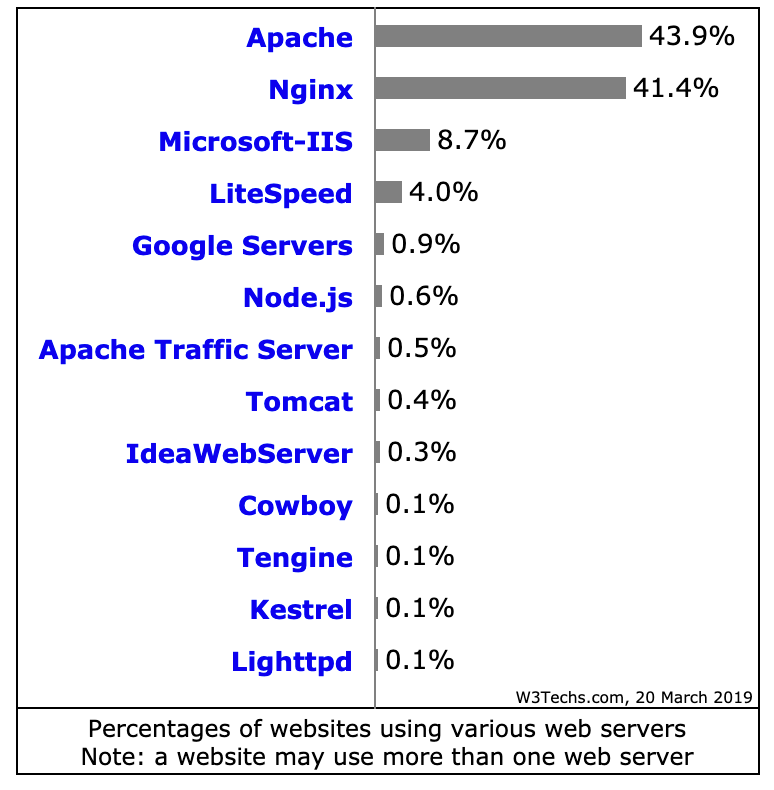

Web Server Market Share

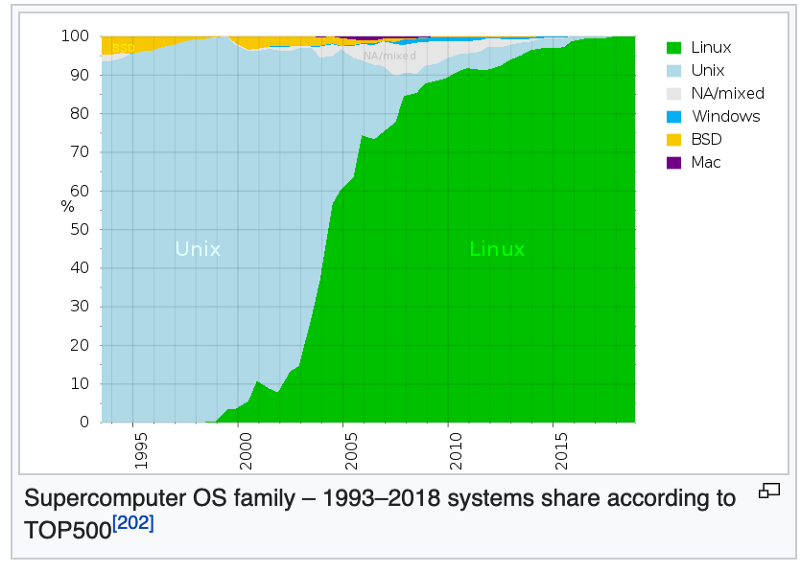

Supercomputer OS Market Share

As can be seen in all operating system segments above, there are usually one or two players at the top who command the largest market shares. Then, the third and fourth players experience a significant lag, and, usually, after the third and fourth players, the market shares of the remaining systems become practically insignificant.

Of course the blockchain industry is very unique because secure chains are not only analogous to a computer operating systems, but also contain currencies and smart contracts, which represent property and agreements. However, it is safe to say that currencies in general also have network effects, either locally, in their jurisdictions, or globally, and that the shared internal state of secure blockchains are also environments with strong externalities.

Due to the above, my guess is that after this period of standard wars, there will be very few winning blockchains, say, 3 or 4, and whichever group of chains wins will have market shares roughly as the operating systems I used as examples above. As a gross simplification, my “guesstimate” is that more or less 4 chains will win, with more or less 50%, 25%, 12.5%, 6.25% of market shares respectively, and all the rest the remaining 6.25%.

2. I think the base layer will primarily provide high security in the form of consensus and monetary policy.

As experienced during the block size debates in Bitcoin (BTC), and later seen in Ethereum with the “Cryptokitties” phenom, it is very difficult to scale base layer blockchains securely. This means that layer 1 (L1) blockchains will have to provide basic, high value, low volume security services such as secure transaction processing, smart contracts, and hard money oriented monetary policy; and layer 2 (L2) chains and systems will provide low value, high volume and performance computing, and flexible features and benefits to end users and enterprise.

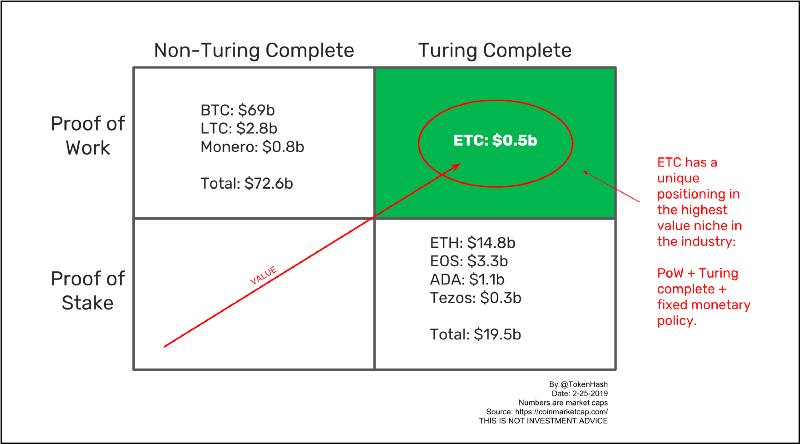

3. I think at least BTC & ETC are well designed and positioned to occupy the value reserve (BTC) and the Turing complete (ETC) base layer roles. I don’t know what the other ones’ roles will be, maybe privacy or just a diversification alternative for people & businesses like LTC (?)

In the context of a few blockchains surviving at the base layer in the future, I think those select chains will have to be the ones with the strongest security features while following the most stringent blockchain principles. This means not only a sound technical design, focused on trust minimization such as the proof of work based Nakamoto consensus mechanism, but also a disciplined monetary policy.

As to which blockchains will be selected in the end by the market based on their security and specific features, it is difficult to say, but I am confident that Bitcoin will be one of those because of its size, safety, history, and significance, and Ethereum Classic as well because it is the only chain that will be proof of work, Turing complete, and have a fixed monetary policy.

4. In the above scenario, a chain like ETH will not be able to compete as a safe base layer chain because “safe enough” is not an option for the use cases that require base layer security: As objective as possible social scalability thru trust minimization.

Ethereum is migrating to proof of stake and sharding. Proof of stake has two problems as it is built on top of two flawed arguments: that proof of work kills trees and doesn’t have finality. And it is based on subjective consensus which is precisely the opposite of what blockchains are seeking to achieve: social scalability by means of trust minimization.

On the other hand, one of the basis of blockchain security is that the database has to be replicated throughout all nodes in the network. Therefore, fragmenting it using sharding, unavoidably goes in the opposite direction.

Due to the above, the Ethereum proof of stake plans have been widely criticized by prominent industry participants and computer scientists. This means that Ethereum does not qualify as a highly secure blockchain, therefore it cannot compete with truly safe base layer chains such as Bitcoin and Ethereum Classic.

5. However, both ETH, with its flawed strategy, and ETC, with its little resources, are signaling to the world that they want to be positioned in the same niche: To be the base layer secure Turing complete chain.

The complementarity that may exist between Ethereum and Ethereum Classic is that Ethereum has huge resources and a larger community, but it is trying to position itself in a segment were it will not be able to compete in the future.

Ethereum Classic, on the other hand, is well positioned and designed for the place it wants to occupy, but has little resources and a much smaller community which may make it lag in the market. This means that there is an opportunity for collaboration in a rational way.

6. I see ETH may have an opportunity to be a user and enterprise facing public chain as an L2, PoS and sharded, scalable option if it uses chains like BTC & ETC as security providers in the back end, e.g. checkpointing and monetary policy thru pegging on BTC & ETC.

If it’s true that PoS and sharding are not the most secure systems for base layer blockchains, but that those systems offer much higher performance, then Ethereum can perfectly be a consumer and enterprise facing blockchain, providing the features and benefits such users need, but at the same time securing their accounts, balances, and smart contracts, by using the services of chains such as Bitcoin and Ethereum Classic for finality and hard money.

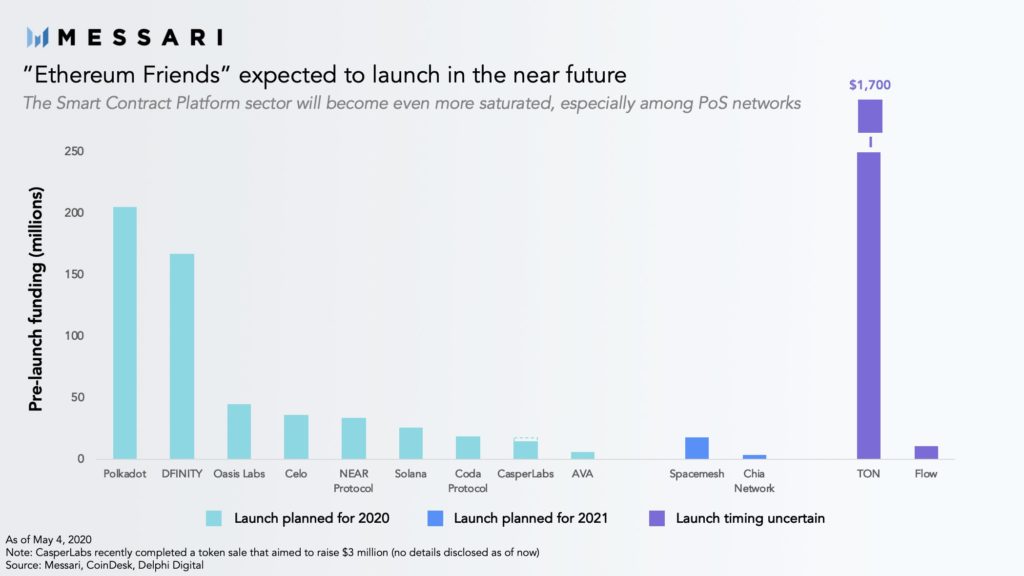

7. There’re like 10 or 15 (I lost count) other ETH compatible PoS + sharded + governance + {invention of the day} chains in the market. If ETH & ETC can formulate and agree on a clear strategy as above and communicate it effectively, then all the other chains would become obsolete.

In the context of standards wars as described in the first part of this article, the market needs to eventually decide on a format to minimize coordination and mental costs. For that, users monitor signals from the potential providers to see if they are meeting the desired requirements to become such standards.

Important signals are: that the technology is correctly designed to satisfy security and performance needs, that liquidity is growing in the form of other users adopting the standard, and that the format has a true chance of becoming the winner.

A clear strategy that would leverage the advantages of both the ETH and ETC chains would go a long way assuring users, while all other competing or substitute alternatives would become much less relevant in front of such advancements.

8. This is b/c currently we are in standards war. However, if ETH & ETC can coordinate to be truly complementary chains (security provider + performance provider) one on top of the other, w/ clear roles and value added, then that would be the definitive winning signal to the market.

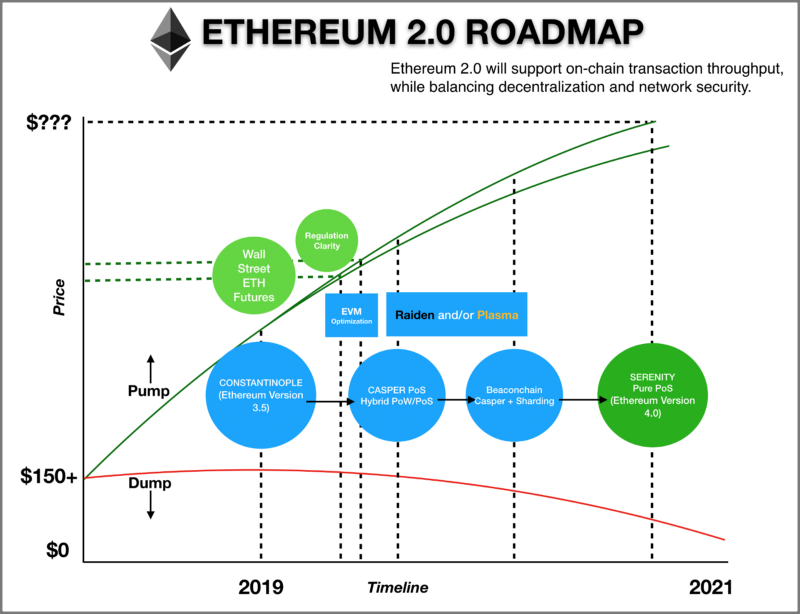

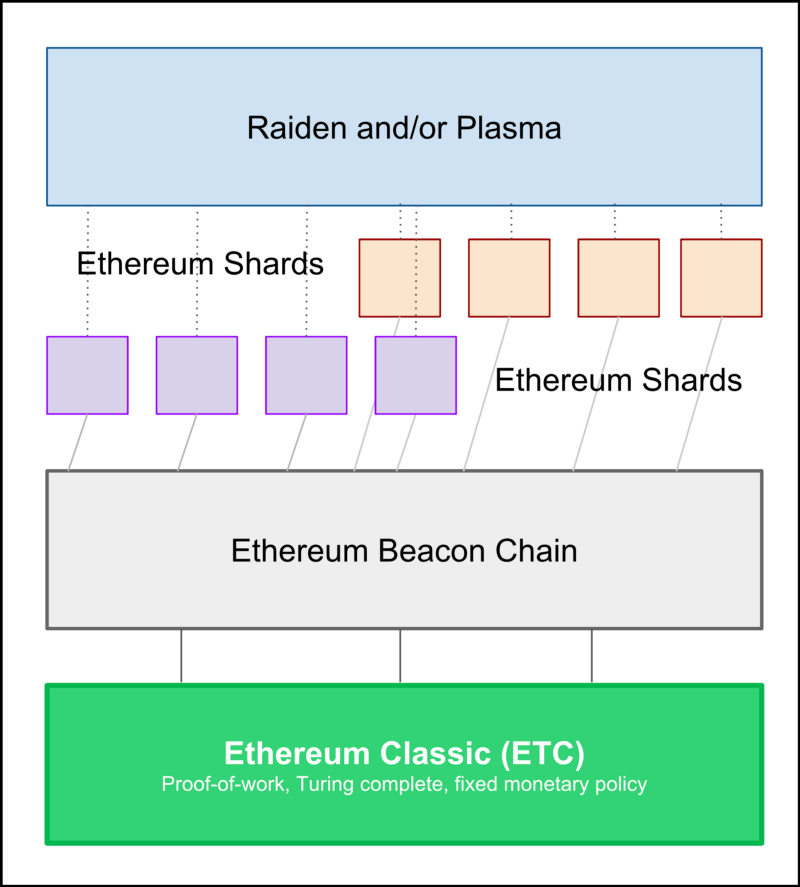

Ethereum’s roadmap already includes a vertical fragmentation of the blockchain into shards and a horizontal subdivision in layers with a beacon chain at the base, shards in the middle, and Raiden and/or Plasma layers on top, where these two last ones are the final solutions to consumer and enterprise scalability in the medium to long term.

Since a proof of stake beacon chain will not be sufficiently secure to support the whole structure above (note it’s a security consideration, not scalability) either it could be replaced with pegging shards directly to Ethereum Classic, or the beacon chain itself could be pegged to ETC to obtain the security services of a proof of work and fixed monetary policy base layer.

That is a smart and rational design choice that ETH engineers can analyze working together with ETC engineers, while truly complementing, therefore benefiting, both networks.

Conclusion

9. PS: If both chains continue to try to be the base layer secure Turing complete chains, then they will continue to compete for their life in this standards war, together with all the other imitators, because very few, if not one or two, in this segment will survive.

The current state of affaires is that there are a lot of gestures and signs of collaboration between Ethereum and Ethereum Classic. However, those interactions don’t seem to have a concrete vision and strategy, other than trying to suck network effects from each another, to reach any specific and constructive goals for both chains.

The truth is that if Ethereum and Ethereum Classic both want to be base layer networks, then one of them will likely die in the effort. Today ETH has a scalability plan that is more adequate for L2 blockchains, money, and community momentum, while ETC has the correct design, security, and monetary policy. A sincere and much more productive plan and future can be envisioned if they leverage their strengths.

Code Is Law