Vision

Etherplan will enable individuals, families, corporations, partnerships, governments, and nonprofits to build smart savings, investment, estate, retirement, and pension plans on the Ethereum network.

Summary

Product

A smart investment plan (SIP) is one that is planned and executed by smart contracts on Ethereum according to customers profiles, needs and set parameters.

Customers may change instructions and parameters when they want to, but if they pass away SIPs will execute their plans on behalf of beneficiaries until funds are depleted.

Plans may be initiated by individuals or groups which facilitates the use of SIPs by organizations for retirement and pension plans.

Etherplan’s front end will be an easy to use web and mobile application. It’s back end will be the Ethereum network open source cryptocurrency, blockchain, consensus mechanism, mining, virtual machine, smart contract, and account system.

Benefits

Since Ethereum is an open source, decentralized peer-to-peer network with a blockchain protected by a cryptographically secure consensus mechanism, SIPs have a series of properties that are not possible in traditional centralized financial markets:

Autonomous

They are governed by algorithmic rules, no need for institutions, lawyers, trustees or administrators.

Transparent

They are visible and auditable at all times.

Trustworthy

Interaction with them does not require trust because their algorithms are hard coded and stored on the blockchain.

Incorruptible

It is impossible to convince them to do anything other than what was instructed by the customer.

Resilient

There are no central points of control or failure, they may span long periods of time irrespective of financial crises, and will soon be recognized legally.

Fiduciary

They have no self interest, therefore they act solely for the benefit of the customer and his/her designated beneficiaries.

Confidential

Customer information is securely (and incorruptibly) protected.

Low cost

They pay for the low Ethereum network computational costs and may pay small fees for services like Etherplan.

Conversation

The purpose of this post is to explain the vision of Etherplan and to present the opportunity to the Ethereum, crypto, and fintech community in general.

The Problem

Millennials are saving more than ever, according to Bloomberg the percentage of 18-to 34-year-olds who saved at least 5% of their income increased to 56% from 50% in 2014. This is great news, but for this generation the majority of solutions are expensive, cumbersome to use, vulnerable to black swan crises, and lack transparency.

Financial Costs

In the current financial system there are a series of cost layers including marketing and sales, investment managers, investment vehicles, trustees, and account administrators that cost, between hidden and transparent fees, from 3% to 4% annually.

Frictional Costs

When they decide to start a savings, investment, or retirement plan, individuals, families, and organizations need to go through a long and cumbersome learning, trust building, comparison, and implementation process. These pain points prevent millennials, small business owners, entrepreneurs, and young professionals from adequately laying out and implementing their savings and investment plans to most efficiently reach their financial goals.

Systemic risks

The 2007-2009 financial crisis showed millennials in their younger years that financial markets are vulnerable to oligopolistic practices, unpredictable systemic risks, and specific institutional vulnerabilities.

Transparency

Honesty is valued more than ever before in this information age, but traditional financial institutions including banks, brokers, and trust companies don’t offer full transparency in their fee structures or even in their full revenue models. Historically, information asymmetry has been key in their business models.

The Solution

Etherplan will be incredibly easy to use, nearly free, and since the logic of the investment plans will reside on the open Ethereum blockchain, it will be fully transparent.

Additionally, through Etherplan, customers will be able to create enforceable financial plans on Ethereum that may span decades and will eliminate lock-in to specific banks, brokers, or trust companies.

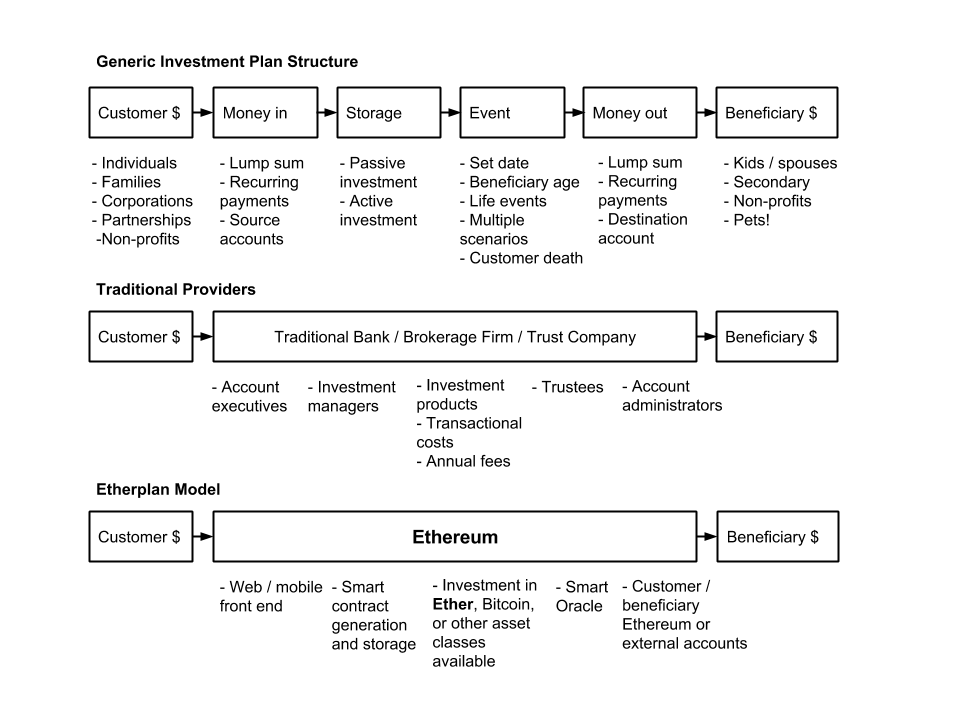

The generic investment plan structure and a comparison of the traditional and the Ethereum based models are shown in the graph below.

Market

Not only are millennials saving more than ever, are tech savvy, and conscious about honesty and transparency, but in the next few decades they will inherit $30 trillion dollars from their parents and grandparents.

Additionally, according to the Federal Reserve, the total amount of US household financial assets in 2011 was $53.7 trillion. Out of this amount $20 trillion were retirement accounts:

| Household Assets 2011 by Class | |

| Financial Assets: | $ Billions |

| Bank Accounts/ Money Market | 10,000 |

| Treasury Bonds | 700 |

| Municipal Bonds | 1,500 |

| Corporate Bonds | 900 |

| Stocks | 13,000 |

| Mutual Funds | 7,600 |

| Retirement Accounts | 20,000 |

| Source: Federal Reserve | 53,700 |

Business Model

Even though Ethereum is a new platform and many business models are experimental, there are 5 revenue lines that could emerge as a result of Etherplan’s value proposition.

1. Setup fees on money in

As customers setup and fund their investment plans a commission may be charged as a percentage of deposits.

2. Investment fees

As the customer investment funds grow and some customers select actively managed investments, low management fees may be charged.

3. Smart Oracle fees

As technology to track reality becomes more sophisticated, an information fee may be charged on external inputs from smart oracles to activate the payout schedule to beneficiaries of investment plans.

4. Payout fees on money out

When payout schedules are activated, fees may be deducted from payments.

5. Balance sheet business

As the aggregate investment funds from all customers grow, Etherplan may decide to go below the full reserve model to invest customer assets for a profit.

Competition

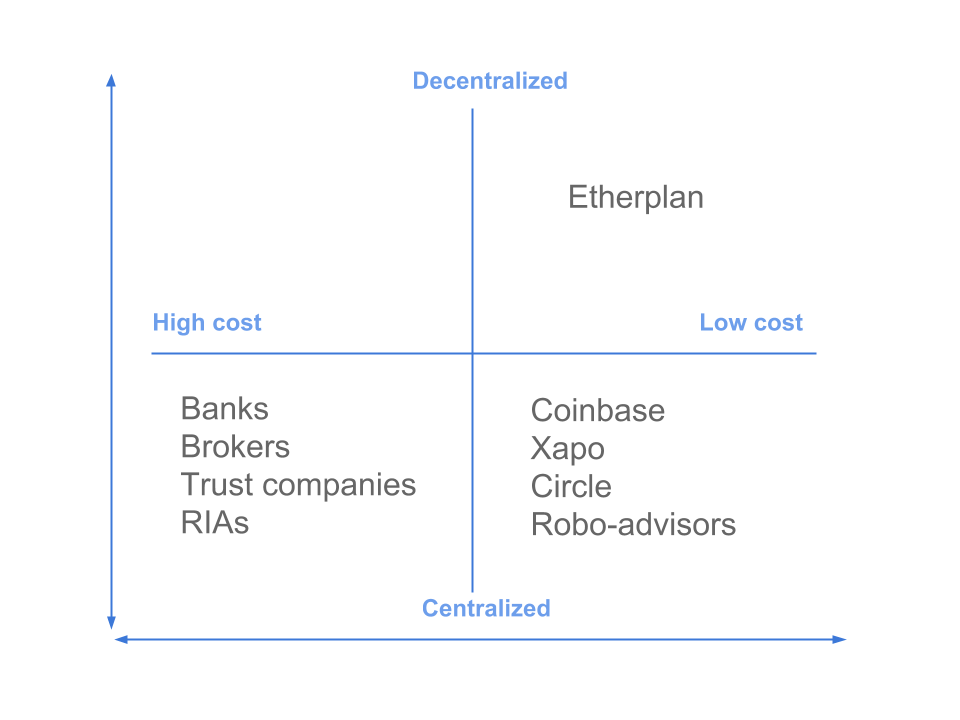

Etherplan will replace the investment planning ecosystem including banks, brokers, trust companies, RIAs, and “robo-advisors“. Only on an Ethereum back-end providers will be able to stay competitive.

Nevertheless, some competitive threats may be:

Traditional players

Even with their high costs and risks, banks, brokers, and trust companies may keep a “human touch” value that may let them retain some customers especially Gen X and Baby Boomers.

Fintech startups

Although they operate on top of the traditional financial services platform, robo-advisors are showing how millennials are willing to use modern solutions to manage their money and they could promote a “race to zero” competitive environment.

Other cryto-startups

Companies like Coinbase, Xapo, or Circle could make their accounts programmable, but, if they keep their current models, those programs would be stored in their private servers which makes them less transparent and risky.

Risk vs Cost Competitor Map – How Will Etherplan Win

Founder

Donald McIntyre is an internet entrepreneur and financial advisor. He has implemented numerous individual, family, and corporate investment and pension plans. At Naation he blogs about the advantages of financial technology, Ethereum, Bitcoin, the blockchain, AI, the IoT, and Rationality in general. Previously Donald started McIntyresa, Dineronet, and was a Senior Vice President at Morgan Stanley and Vice President at UBS Securities.

Among his achievements, Donald directed the design, implementation and management of the pension fund for over 80 Ernst & Young partners in Argentina, Uruguay, Paraguay, Bolivia, and Colombia. He was exclusive advisor to Marco Antonio Slim, President, Grupo Financiero Inbursa. At Dineronet, in 2000, he closed a series A round with Softbank and Carlos Slim for $11 million. Donald was the #1 producer at Morgan Stanley International Private Client Group.

Next Steps

It is important to note that part of the prototype will reside directly on the Ethereum blockchain, which serves as a non-traditional hosting platform for executing code that is unique to the Ethereum technology.

If you have any questions or would like to be involved in this project please email Donald McIntyre at donald@etherplan.com or leave a comment in the comments section below.

Thank you!

Donald McIntyre