With the rising popularity (and market price) of Bitcoin millions of people around the world are exploring which are the best services to start using the digital currency.

The basic functionality needed is a place to store, send, and receive bitcoins, but after that the question everybody asks is : Where do I buy and sell them?

The two most popular digital currency exchanges in the world for trading bitcoins against US dollars are Mt.Gox and Bitstamp.

Japan based Mt.Gox is the historic leader in Bitcoin exchanges although recently it lost market share due to regulatory and compliance issues in the United States.

However, Mt.Gox’s losses have been Slovenia based Bitstamp’s gains in trading volume. Also accounting for its success Bitstamp has a high focus on customer service and efficient back office operations.

How do they compare?

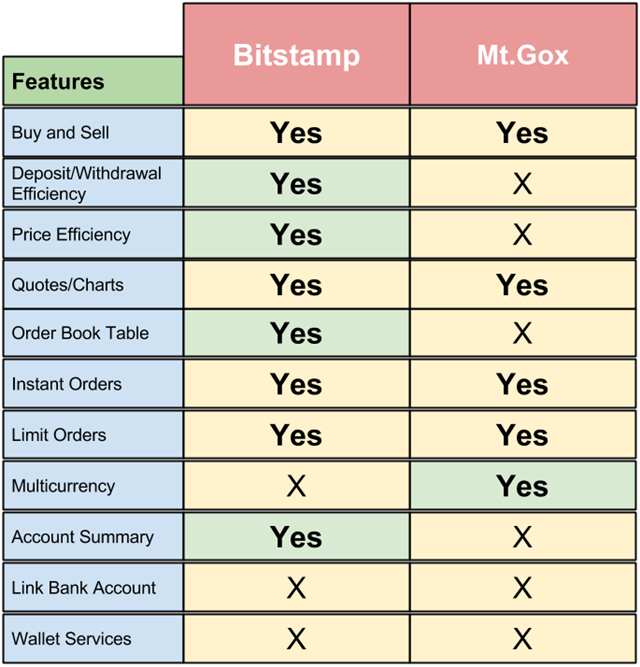

The basic currency exchange functionality is adequately delivered by both companies, but the areas where they differ might be the keys to deciding which one to use.

Buy and Sell: Both services provide a fast execution service when users enter their orders. In both cases adequate speed and liquidity are provided. This is key especially in recent fast moving markets.

Deposit/Withdrawal Efficiency: As mentioned above Mt.Gox has had difficulties with regulators in the US and they even seized funds from their US bank accounts. Due to these issues they haven’t been able to process US dollar deposits and withdrawals within normal time frames in the last few months. Although they have been working diligently to solve these significant delays they are still having some trouble according to customer complaints in different public internet forums. In the case of Bitstamp they have maintained an adequate deposit and withdrawal system with US dollar transfer processing usually taking between 2 to 5 business days.

Price Efficiency: Due to the issues mentioned above Bitcoin pricing against the US dollar has been inefficient on Mt.Gox. This has not affected the normal bid/offer spread, but the absolute price level within the exchange as compared to other markets, including Bitstamp, has been at times significantly higher. This is due to the preference of traders to be able to deposit and withdraw their funds within reasonable time frames in the other markets.

Quotes Charts: Both companies offer their own markets’ current quotes and historical price charts. These tools are important for investors to have a good perspective on Bitcoin price evolution before they trade.

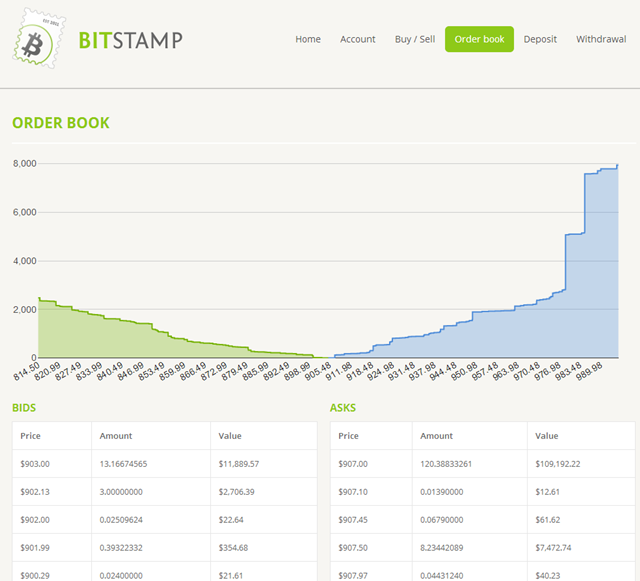

Order Book Table:

This is another important tool for decision making that is provided only by Bitstamp. The first part of the order book table page is a chart that represents all the orders organized by type (bid or offer), price, and volume. It is a very effective way of looking at the market depth and also analyzing the open interest so you can decide how to set and manage your orders. Also, below the chart is their list of all the open orders organized in two columns (bids and offers) with the same data of the chart with respect to volume and price for each order. Mt.Gox doesn’t offer this feature, but like for other relevant exchanges their order book can be seen on independent services like BitcoinWisdom.

Instant Orders: If you want to buy or sell bitcoins at the current market price you can enter what they call instant orders. They will execute your order at the best price on the exchange immediately and both services provide this.

Limit Orders: Also provided by both exchanges, if you want to buy or sell bitcoins at a specific price then you can enter the order at that level and they will publish it on their market and execute it when someone else wants to buy or sell at that price.

Multicurrency: Bitstamp trading is limited to bitcoins against US dollars only. In the case of Mt.Gox it has adequate liquidity for trading between Bitcoin and other currencies including Japanese yens, euros, British pounds, and Australian dollars. They also support other currencies, but with less depth so in general these are better traded on other exchanges.

Account Summary: As with every type of financial institution an account summary page is always useful to be able to check balances, transaction activity, open orders, profile settings, and other details. Bitstamp has a well designed and easy to use “Account” section with all these features and more. In the case of Mt.Gox there is no centralized section within their website that offers this information in a simple and orderly fashion. They provide all the information, but it is separated in different sections and users need to find their data in a rather cumbersome way.

Link Bank Account: This is the functionality of linking your bank account so that money transfers can be made automatically between your bank and your Bitcoin exchange accounts. Both Bitstamp and Mt.Gox operate with wire transfers so this service is not offered by either company. To their credit though, this is a difficult task considering they operate globally with customers in diverse money systems. Within the US the only service that provides this convenient functionality is San Francisco based Coinbase.

(Please read Newfination’s Coinbase Review here)

Wallet Services: A proper wallet service is one that supports storage and simple “send and receive” functionality with Bitcoin addresses and QR codes so users can pay and get paid easily. Bitstamp and Mt.Gox are both set up to provide trading services, but their accounts cannot be considered Bitcoin wallets and it is not advisable to use them as such.

Fees:

Like all exchanges both companies charge trading commissions. In the case of Bitstamp they have a fee schedule that goes from 0.50% to 0.20% depending on the user’s monthly trading volume.

In the case of Mt.Gox their scale is also based on volume, but on a moving 30 day basis that goes from 0.60% to 0.25%.

Which one should I use?

Based on the negative publicity they suffered when US regulators seized their bank accounts and its effect on actual delays in deposits and withdrawals and the subsequent price premium of Bitcoin against the US dollar it seems natural to discard this option for traders and investors who want to base their transactions in this currency. However for traders who need market depth and efficiency in other currencies Mt.Gox may be the better alternative.

For Bitcoin/US dollar trading, good customer service, and normal lead times in US dollar deposits and withdrawals Bitstamp is the place to go.